This article should help you see why it is very important to never assume anything in Forex.

Good morning everyone.

How you all doing this morning?

I hope you are all well and that you didnt burn like I did yesterday!!

A lesson I have learned a very long time ago (but unfortunately I put it in file 13 way back in the draw) is never to assume in forex!!

Why?

Well…………….

Yesterday I assumed the Euro/Dollar will find resistance at that roadblock area we showed you in the webinar and just took the short straight after it.

I did not wait for confirmation and oh boy did I pay for that mistake. 🙁

Price shot up like a kite in a hurricane and broke the weekly pivots like there was no tomorrow………..

This move took some of the correlated Euro pairs with it and pairs that comes to mind here are………….

Euro/GBP

Euro/NZD

Euro/Aussie

Did we miss the bus?

No way!!

Why not?

Look at this and read my notes for the specific pairs. We are hitting super hot areas now, for super hot trades that can set up later today or later this week.

All we need to do is never assume anything in Forex and wait for confirmation and take the ride!

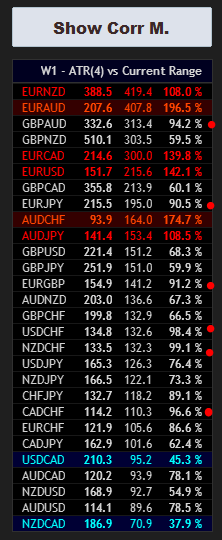

Here we have a table with pairs where the weekly ranges are way way way over. We are hitting key resistance areas here now – Especially on the Euro’s!!!!

……………………………………………………………….

1) Euro Dollar on the 4 hour chart:

Notes:

The direction indicator is mixed on the daily and short on the 4 hour chart…however last week we closed plus 50 pips higher than the opening so we can’t fib the 4 hour to get an Earth and Sky short zone.

We however have a roadblock area between 1.1700 and 1.1718 where we have a WR1 pivot and a 4 hour 200 EMA and a daily 55 EMA that can give resistance where we can have short set ups that can follow from this roadblock area.

Wednesdays notes:

Currently hitting key resistance here at 1.1830 and 1.1850 areas.

If we look to the left of the chart we can see previous resistance plus we are at the WR3 pivot PLUS we way past the weekly range so all warning signs we might be hitting a top area here.

Lesson learned…..I will first wait for confirmation to short again back to 1.1751 and 1.1711.

……………………………………………………………….

2) Euro JPY on the DAILY chart:

Notes:

Sitting on my hands with this pair. The direction Indi is long on the daily and short on the 4 hour chart……and last week we only closed min 1 pip lower than the opening so we formed a doji on the weekly chart. We already were at last month’s low area so we can’t fib last month to get a Earth and Sky long zone.

My plan for this one is to wait and see.

I have 3 areas where we can find support where after I will look for a long set up. The first one is at the MS1 pivot at 131.00 and the second one at 130.00 and then lastly the 129.62 resistance roadblock.

Possible shorts only once we get to last month’s high areas and MR1 pivot at 134.20.

Looks like we are currently also trapped in a triangle so take note of it as we might have possible M2 set ups on the cards if we have a nice clean breakout.

Wednesdays notes:

Triangle broke to the upside yesterday but my plan is to look for shorts from the double top area we have at the MR1 pivot at 134.20 and 134.50 areas.

……………………………………………………………….

3) Euro GBP on the 4 hour chart :

Notes:

The direction indicator is long on the 4 hour chart and mixed on the daily chart……plus we closed only 6 pips higher than the opening……..so we can’t really fib it.

We are however at a key resistance area on this one. We have a short area between 0.8886 and 0.8921 so I will be looking for trades to set up within this area.

I will keep an eye on the 4 hour 200 EMA at 0.8887 and the daily 55 EMA at 0.8902 and the WR1 pivot at 0.8921 for possible entry points.

Wednesdays notes:

This one gave my levels the middle finger too yesterday and followed the Euro/Dollar…..however we also now once again hitting a possible roadblock if you look to the left of the chart.

We have previous resistance at 0.8970/80 areas and we have MACD divergence on the 60 min chart so a possible short will be on the cards back to 0.8921 and 0.8892 areas……but lesson learned…..wait for confirmation.

……………………………………………………………….

4) GBP Dollar on the 4 hour chart:

Notes:

We opened with a GAP on Monday and this gap is still open.

This gap broke to the downside and with this move we broke a 200 EMA and a daily plus 4 hour 55 EMA`s to the downside……this is significant and we need to take note if it as we might have M2 shorts set up from these EMA`S again.

Looking at the daily chart – then it looks like we trapped in a triangle on this one too – so take note.

Wednesdays notes:

This one broke bullish and took the previous resistance EMA`S out where I said to look for possible M2 shorts. Price did however now closed the GAP we had on Monday morning.

Possible roadblock at last week’s high at 1.3220 area as we also have the WR1 pivot here too.

……………………………………………………………….

5) GBP JPY on the WEEKLY chart:

Notes:

Sitting on my hands with this pair. If we look at the weekly chart we spot MACD divergence plus we are sitting at a cluster of EMA’S too. The stochastic is also rolling over PLUS we are trapped in a triangle on this pair……so all warning signs to be careful.

Wednesdays notes:

Still trapped in the weekly triangle going nowhere.

………………………………………………………………

6) Aussie Dollar on the 4 hour chart:

Currently I have an Earth and Sky short zone between 0.7656 and 0.7679 – areas to keep an eye on 0.7659 and 0.7669 resistance areas where after I will re look to short this pair again.

Possible counter longs at 0.7617 and 0.7586

Notes:

If the 55 EMA at 0.7669 breaks to the upside for some reason be careful as we might fly to the WR1 pivot at 0.7690 and last week’s high at 0.7700 where I will re look to short this pair again.

Wednesdays notes:

This one made new lows so we had to follow price with our fib to get the adjusted trading zone. Currently we have a short zone between 0.7639 and 0,7670 with areas to keep an eye on 0.7624 and 0.7656 for possible short areas again

Possible counter long at the WR2 pivot at 0.7586.

………………………………………………………………

7) Aussie JPY on the DAILY chart:

Notes:

The direction Indi shows we short on the 4 hour and mixed on the daily chart. You can fib the 4 hour chart but I am expecting a bigger bullish move up that will break the earth and sky short zone to the upside……….

So my plan for this pair this week is to stick to the daily chart. I will look for resistance between 87.29 and 88.00 where after I will look for short set ups

Otherwise I will look for support between 86.34 and 86.14 and 86.00 where we have the daily 200 EMA, a MS1 pivot and a psychological level.

Wednesdays notes:

Naughty boy !!!

We broke to the downside and took the support out at the MS1 pivot and daily 200 EMA at 86.14. Looks like we on our way to the MS2 pivot at 85.22 and 85.00 level so possible support there.

Otherwise I will re look to short from the 86.34 and 87.10 areas again if we find resistance there.

………………………………………………………………

8) Dollar JPY on the DAILY chart:

The direction Indi is all mixed up on the 4 hour and long on the daily. We also closed min 43 pips lower than the opening of last week so we can’t find the 4 hour to get a long zone. So we had to fib the daily chart.

Currently I have an Earth and Sky long zone between 113.19 and 112.44 with areas to keep an eye on the 113.07 and 112.72 support areas where after I will look to long this pair.

Possible counter shorts at 114.71 and 114.84 resistance levels.

Notes:

If the 55 EMA support at 112.72 breaks to the downside…..be careful as we might drop to the mother in law dining room table (daily 200 EMA) at 111.68 where I will re look for support to go long again.

Wednesdays notes:

We breaking now into the long zone but be careful as we have volume/momentum behind this move so we can drop past it and go visits last month’s low and daily 200 EMA at 111.68 where I will re look for support to long again.

………………………………………………………………

9) Dollar CAD on the DAILY chart:

Notes:

The direction indicator is mixed on the 4 hour and mixed on the daily chart plus we closed min 68 pips lower than the opening so it’s really totally mixed up !!

Looking at the daily chart then my only plan I can put together is to look for shorts at the daily 200 EMA at 1.2823 and psychological level and previous highs at 1.2900.

Otherwise I will re look to long from 1.2654 and 1.2632 and the 1.2577 areas ( 200 EMA, 55 EMA and the MS1 pivot areas )

Wednesdays notes:

Still trapped between the support and resistance areas I called above…..so plan stays the same.

………………………………………………………………

10) Dollar Index on the DAILY chart:

Notes:

The direction indicator is long on the 4 hour chart and mixed on the daily chart and last week we closed min 41 pips lower than the opening so it’s really totally mixed up !!

Looking at the daily chart then my only plan I can put together is to look for shorts between 95.30 and 95.53 areas as we have some roadblocks here (200 EMA and MR1 pivot) that can give resistance.

Otherwise if we break to the downside I will re look to long from 94.00 and 93.90 again where we had the inverse head and shoulder neckline and some EMA`S that can give support again.

Wednesdays notes:

This one broke the support at 93.92 to the downside……and by the looks of it we on our way to the MS1 pivot and last month’s low area at 93.00 where it might find possible support.

I will re look for a M2 short from 93.92 and 94.07 areas again.

………………………………………………………………

11) Euro NZD on the 4 hour chart:

Notes:

The direction Indi is long on the 4 hour and the daily chart on this pair. However we are highly overbought so possible counter shorts can set up from 1.7000 and 1.7046 back down to 1.6870 and 1.6823 support areas.

NB !!!! AFTER MY WRITE UP WE JUMPED NOW PAST THE WR2 PIVOT AT 1.7046 MAKING THIS HIGHLY OVERBOUGHT so I will be looking for short set ups ……follow price with your fib to get the adjusted LONG zone.

Wednesdays notes:

This one just kept going in the strong wind as it broke ALL the weekly pivot to the upside this week.

We are however very close to the WR3 pivot at 1.7204 and if you look left we can see we had previous resistance here too.

This pair is also way past the weekly range so all warning signs we might run out of steam so I will be looking to short from 1.7204 and 1.7300 areas back to 1.7046 and 1.6942 areas where I will re look to long again..

………………………………………………………………

12) Euro Aussie on the 4 hour chart:

Notes:

The direction Indi is long on the 4 hour and the daily chart on this pair. However we are highly overbought so possible counter shorts can set up from 1.5306 and 1.5327 back down to 1.5232 and 1.5203 support areas.

NB !!!! AFTER MY WRITE UP WE JUMPED NOW TO THE WR2 PIVOT AT 1.5363 MAKING THIS HIGHLY OVERBOUGHT so I will be looking for short set ups ……follow price with your fib to get the adjusted LONG zone.

Wednesdays notes:

This one just kept going in the strong wind as it broke ALL the weekly pivot to the upside this week.

We are however very close to the MR2 pivot at 1.5627 and I will look for resistance here. This pair is also way past the weekly range so all warning signs we might run out of steam so I will be looking to short from 1.5600 and 1.5627 areas back to 1.5419 and 1.5252 areas.

………………………………………………………………

13) Aussie NZD on the 4 hour chart:

Notes:

The direction Indi is long on the daily but mixed on the 4 hour chart. We broke the WR1 pivot to the upside yesterday so in my book we a little overbought. Possible roadblocks at 1.1138 and at the WR2 pivot at 1.1174.

Wednesdays notes:

Price found the resistance at 1.1138 I called and dropped like a stone there after break all the EMA`S to the downside…….currently we on our way to the WS1 pivot at 1.0991 where we might find support…..but be careful before you just jump in with a long again.

………………………………………………………………

14) NZD JPY on the 4 hour chart:

The direction Indi is short on the 4 hour and daily chart.

Currently I have an Earth and Sky short zone between 78.68 and 79.06 with areas to keep an eye on the 38.2 fib at 78.50 and 78.63 and 78.80 resistance areas where after I will look to short this pair.

Possible counter longs at 77.85 where we have the WS2 pivot and monthly 200 EMA waiting to give support.

Wednesdays notes:

Price broke the support at the WS2 pivot and 200 EMA at 77.85 so follow price with your fib so that the earth and sky trading zone can adjust.

By the looks of it we on our way to the WR3 pivot at 77.26…..if we look to the left we can also see previous support here so possible longs might set up here back to at least 77.85.

………………………………………………………………

See you all Friday with a catch up.

Regards

Pierre

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below