The Most Volatile Currency Pairs 2023

It’s coming to the end of the year and reflecting on it I thought why not write a post on the most volatile currency pairs for this year. I also get the question asked by members which pairs would I recommend to trade. But this is like asking someone why do you drive a Toyota and not a BMW? They might have some personal reasons to not trade certain pairs.

Don’t worry it is not that deep. What I mean is it depends on someone’s personality. A person might not perform the same way as you on a particular pair, this could be for various reasons. Not traded the pair enough to know how it moves, it moves when they are at work or sleeping, or just that you never had success with it after trading it for several months.

This is why I don’t trade the AUDNZD and the CHF cross pairs. Never had success with AUDNZD because it never respects the EMAS and is very unpredictable. CHF pairs are usually quite slow and don’t do over 60 pips a day so it’s not for me. I want a mix of both, volatile and something stable. Hence I trade the majors and a few other cross pairs that are volatile.

Now for the Main course, I would recommend grabbing a coffee or a drink. Got it? Okay, let’s begin.

Most Volatile currency pairs

Back to the topic, The best Forex pairs often depend on market volatility, economic events, liquidity, and your personal risk tolerance. It’s important to consider factors like the pair’s average daily range, trading times, and costs. By understanding these elements, you can identify pairs that offer the best opportunities for your trading style. Whether you’re a day trader, swing trader, or long-term investor, focusing on the right Forex pairs can enhance your trading success and help you avoid unnecessary risks.

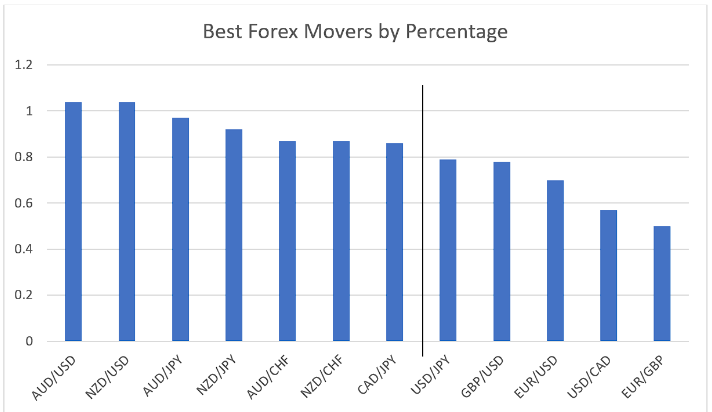

I was doing some research and saw some interesting charts. The first one I want to share with you is Best forex pairs by percentage movement. The results are actually quite the opposite of what I was predicting. The graphic below shows that the AUD/USD and the NZD/USD have been the best movers on average over the last 40 weeks when looking at their percentage range. Other AUD and NZD crosses such as the AUD/JPY, NZD/JPY, or the AUD/CHF also show high levels of volatility.

Source: Tradeciety.com

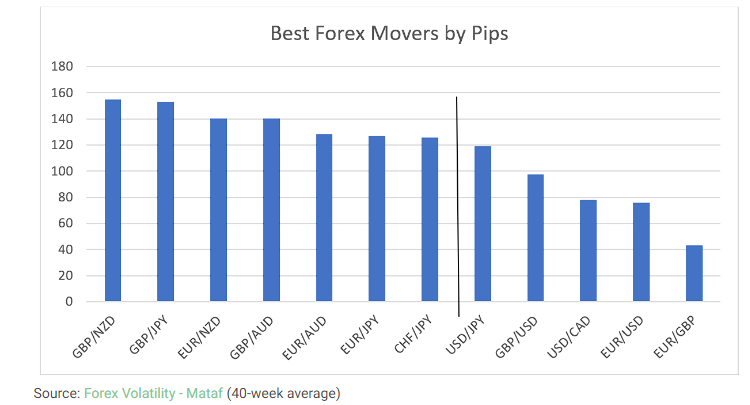

Best movers by PIPs range

This one was quite predictable and most of you should know the pairs that are shown below, so it’s no surprise. When looking at just the pip range, GBP pairs besides the previously mentioned AUD and NZD Forex crosses are among the best movers. The same applies to EUR with AUD and NZD. The majors EUR/USD, EUR/GBP, and USD/CAD fall well behind the most volatile. USD/JPY is the best mover by pips among the majors. However, the recent circumstances of the pair have made it a little tough to trade.

However, this can change over time especially when geopolitical or macroeconomic conditions change in the market. There used to be a time when USD/CHF moved 40 pips a day and then when the market crashed in 2020 it was doing average around 100 pips a day.

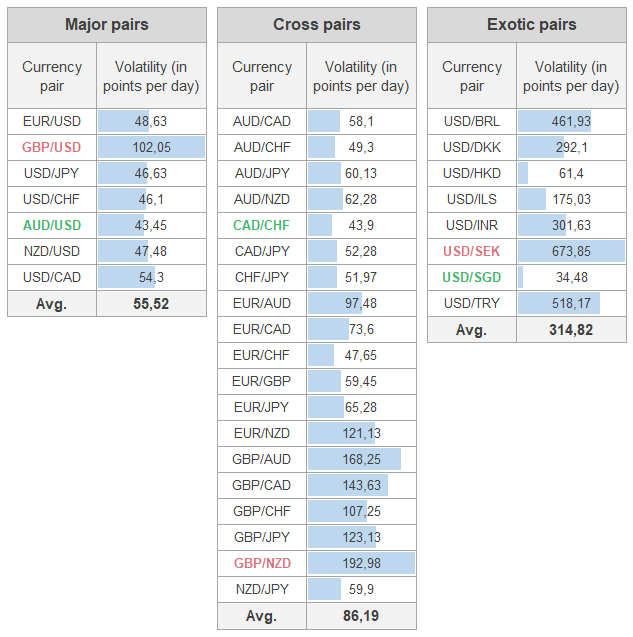

Here is another Table giving an overall view of the most volatile Forex pairs

Source: FXSSI

You might have realized why haven’t I spoken about the Exotic pairs if they are the most volatile. Well, its not that simple. Indeed, the range of exotic pairs’ movements is much broader than that of the major ones. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader.

The fact is that various methods of technical analysis might not work in such situations. If you decide to trade, say, USD/SEK or GBP/NZD, your analysis may not work as effectively as, for example, when trading EUR/USD. Also, technical analysis patterns might generate false signals.

This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question. The Exotic pairs are also more affected by political tensions and economic conditions. Also, a common characteristic you will find among these pairs is the high-interest rate. Currently, as I type this article Turkey increased their interest rate by another 500 basis points to 40%!

Turkey’s central bank hikes interest rate by 500 basis points to 40%, well above expectations

The second problem a trader can face when trading volatile financial instruments is widespread (additional trading expenses).

Best time to trade

This is the last piece of the puzzle. Just trading the most volatile pairs is not the most important thing. It is equally important to identify the Forex pairs that move during your active trading hours. It doesn’t help if you want to trade a specific Forex pair because the graphics above confirmed that it is a significant mover, but then the most active times fall outside of your active trading hours when you are busy at work or sleeping. This applies more to Day trading strategies of people who like trading shorter timeframes.

Most day traders will pick one session to trade and usually focus on a few pairs. If the pair gives a trade signal they will take it otherwise not trade that day.

Although it is important to know when the most active trading hours are, different currency pairs respond differently to the market hours. Typically, you can say that a specific currency is the most active when its domestic stock market is open as well. This means that EUR crosses are most active during the London session, while the USD is most active during the New York Session.

Pairs such as the AUD, NZD, and JPY tend to move more during the Asia session because the news comes in their local time. For Western traders, this is usually when we sleep in the night so its not ideal to trade those at that time. However, the New York session can cause some volatility on them as the stock market opens and also U.S.-related news. Since their base pair is USD it will move the pair.

The same applies to EUR and GBP. They are more active during the London session and also during the overlap between London and New York. This is the time when there is a lot of economic news releases and plenty of traders active.

You can use the below tool on Baby Pips to analyze the different trading sessions.

I have also added a link to another tool that helps with calculating forex volatility over a number of weeks.

Most traded Pairs

We can see right away that EUR/USD is the most traded currency pair in the world. But although it’s the most traded pair it’s not among the best movers in terms of pips. EUR/USD, USD/CAD rank lower on the volatility scale but are the first and 4th most traded forex pairs.

New traders often rush to the most popular traded currency pairs thinking they will make money. But they don’t research further. The most popular Forex pairs are not necessarily going to be the best fit for all traders. As we have seen, the overall volatility and the level of activity during one’s trading hours are significant factors when it comes to market selection.

Conclusion

When it comes to selecting which pairs to trade, keep it simple. If you are a day trader on the lower timeframes, the most important factors are your active trading times and finding a Forex pair that aligns with your time availability. Avoid trading Forex pairs that are most active outside of your trading times. When you are a trader on higher timeframes, selecting Forex pairs that show a high level of volatility might be the right approach because it allows you to trade markets that have a higher likelihood of showing trending movements. Avoid low-volatility Forex pairs because you won’t get those high-risk reward ratio trades very easily.

Kind regards,

Ashley

References:

The top 10 most volatile currency pairs in 2023