Good morning everyone.

I totally forgot to do Marcs comprehensive mid week update for him as they are still slowly but surely making their way back to the Canary Islands after a super holiday down under, so he only had time for a little one. 🙂

…………………………………………………………………………..

This Weeks Live Training Session Webinar:

Please register for This Weeks Live Session:

Marc gets back next week so we will review the schedule, This week Judith & myself (Pierre) will be co- hosting a joint session with fund manager Fotis Papatheofanous MBA & his students ON FRIDAY

https://attendee.gotowebinar.

Your invitation to attend the Forex Mentor pro AND Fotis Trading Academy

Live Training on Friday 16th June at 11.00am LONDON TIME (BST)

Fotis & ourselves share our detailed global macro and technical analysis & tuition followed by a Q & A session. Your chance to ask anything you like of full time traders & a fund manager.

After registering, you will receive a confirmation email containing information about joining the webinar.

Let’s have a look at his Sunday analysis with some current notes:

…………………………………………………………………………..

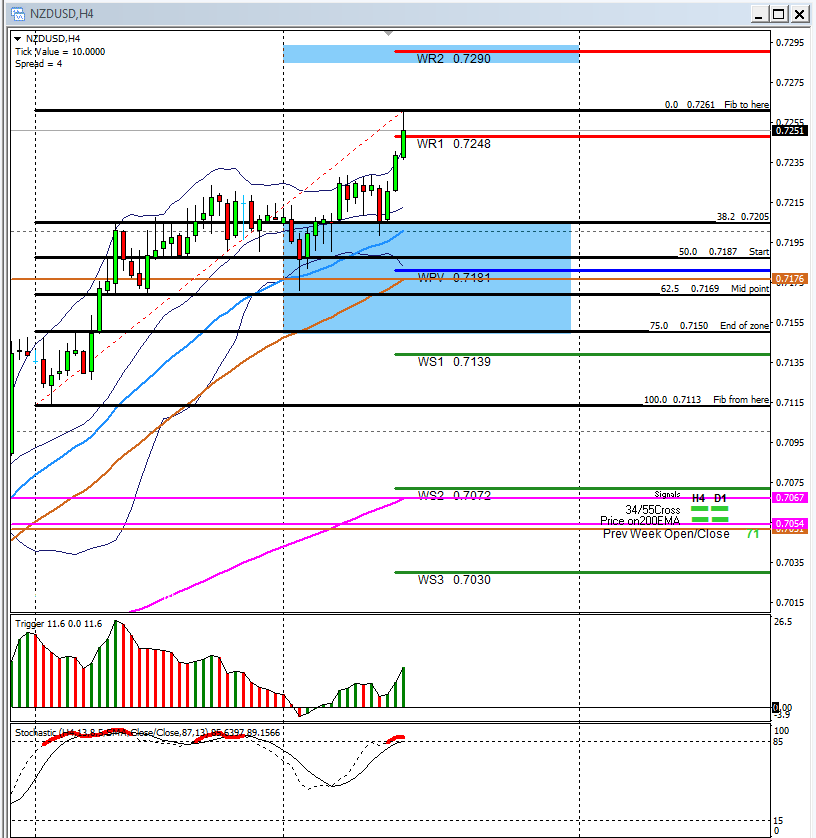

1) NZD/Dollar on the 4 hour chart:

Still interested to short at 0.7300 BUT keep your eye on Nzd news. There has been a lot of positives out of NZ recently, but 7300 is key. If that breaks we start to think of longs, but for now my bias is still short

Wednesdays notes:

Currently hitting the WR1 pivot at 0.7240. Stochastic is overbought so possible roadblock at this level and possible COUNTER short back down to the weekly main pivot at 0.7181.

If this level however breaks to the upside…..then re look for shorts from 0.7290.

…………………………………………………………………………..

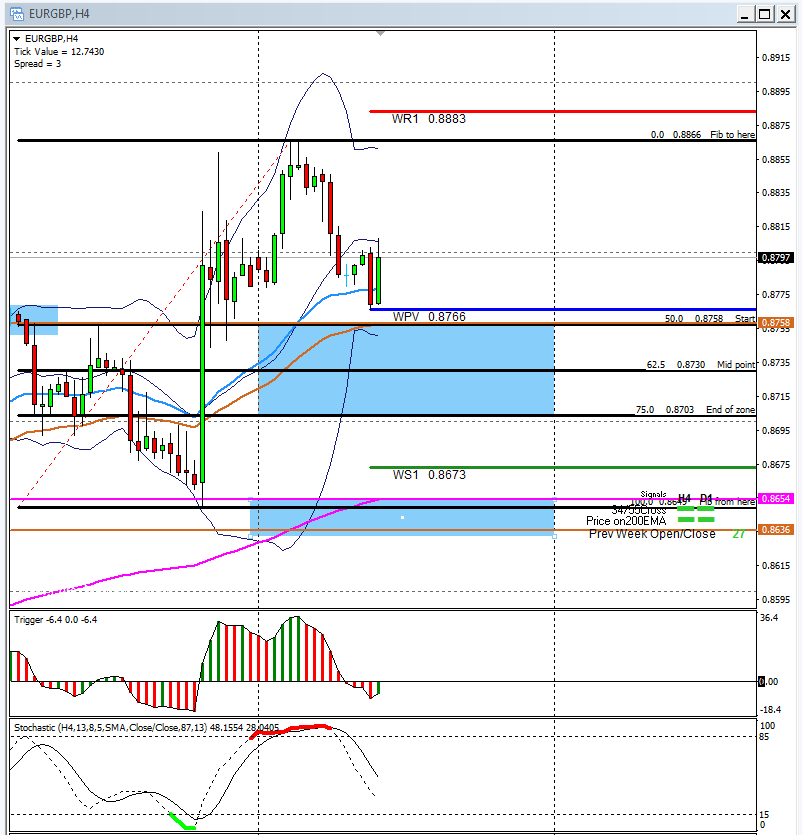

2) Euro/GBP on the 4 hour chart:

Too messy next few days – see Sundays video clip.

Wednesdays notes:

Currently we have an Earth and Sky long zone between 0.8758 and 0.8703 with support levels at 0.8758. While this level holds the bias will be to look for long set ups.

If we break to the downside for some reason, be careful as we can drop back to the WS1 pivot and EMA`S waiting at 0.8674 where I will re look to long again.

…………………………………………………………………………..

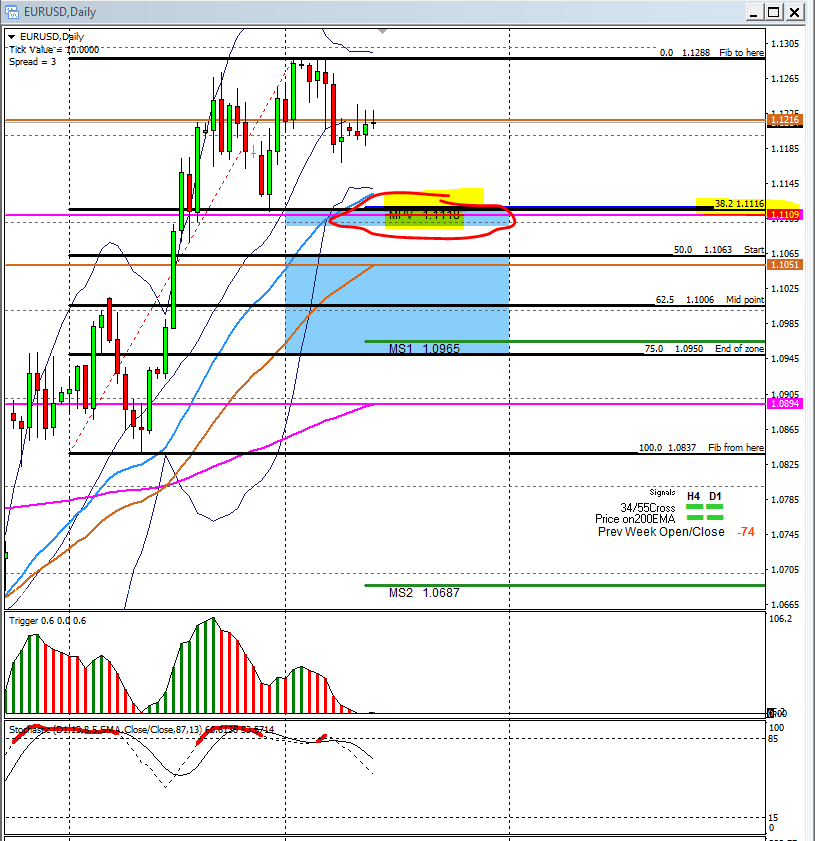

3) Euro/Dollar on the daily chart:

If this continues its move upwards I am interested to short at 1.1600 (see the video) If it pulls back then 1.1000 is obviously the area but it may not go that far, so watch on smaller time frames. 1.1050 is a weekly trend line. Also watch the 1 hour trigger again

Wednesdays notes:

Still camping out at the 4 hour 55 EMA at 1.1217 and we need a correction to at least 1.1116 where we have the 38.2 fib, monthly main pivot and 4 hour 200 EMA and psychological level of 1.1100.

If we find good solid support here longs can set up again. If we break to the downside….keep an eye on the daily 55 EMA at 1.1045 for support.

…………………………………………………………………………..

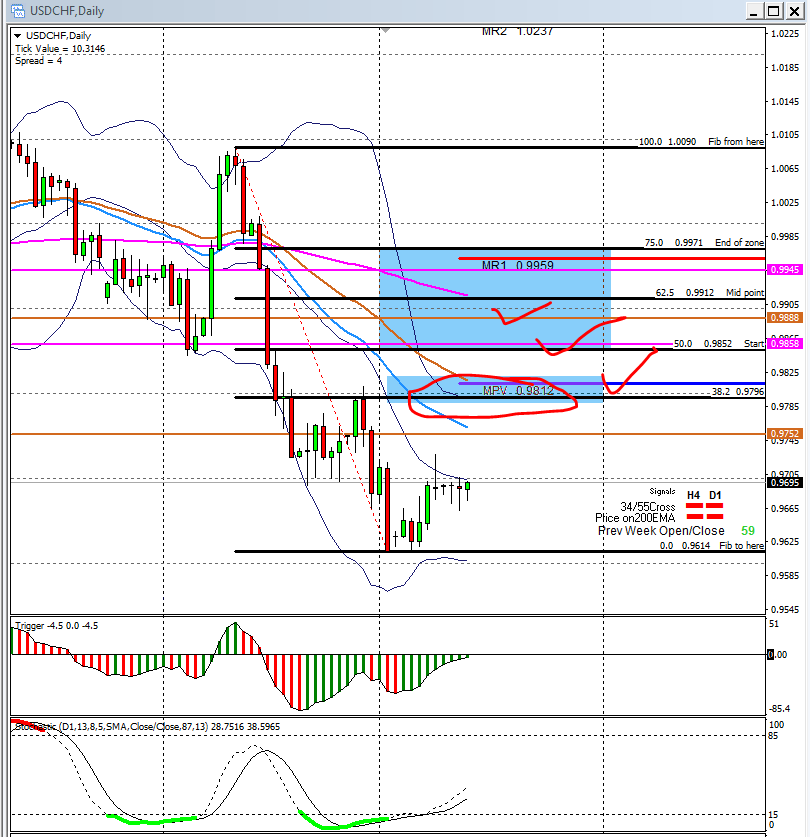

4) Dollar/CHF on the daily chart:

Still bouncing off 0.9600, unless that breaks, expect the Euro to wander back down. If it does break the Euro should go on a run higher in which case I am still looking to short at 1.1600

Wednesdays notes:

Still in no man’s land. We need a correction to at least 0.9800 where we also have the monthly main pivot,38.2 fib, psychological level and if we look to the left of the chart….Previous support/resistance.

Possible short can set up from there…..or if that breaks to the upside, keep an eye on the 200 EMMA and 55 EMA in the Earth and Sky short zone at 0.9858 and 0.9888.

…………………………………………………………………………..

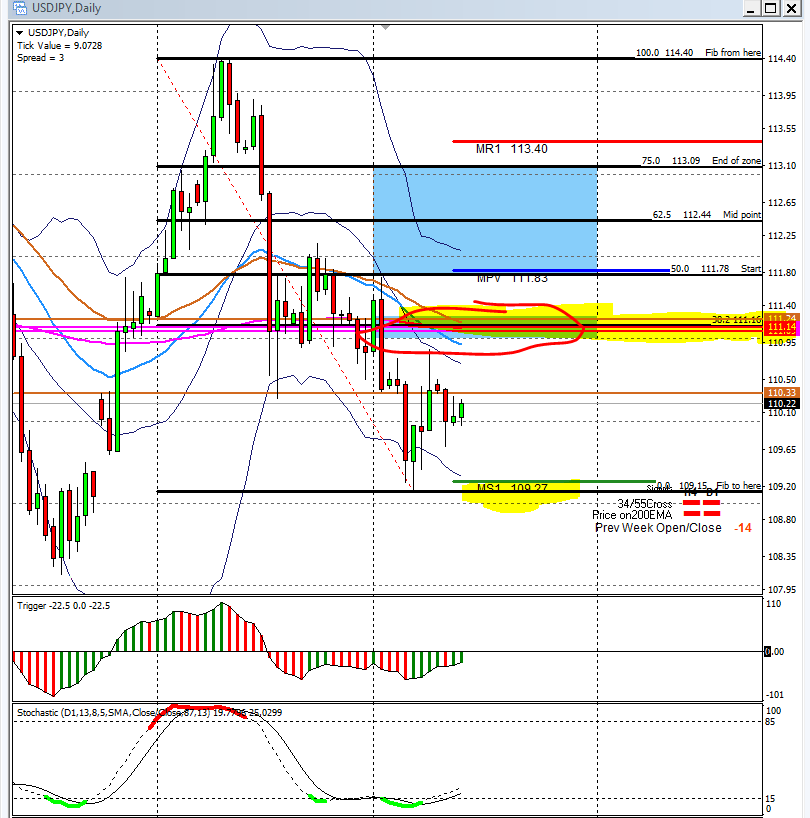

5) Dollar/JPY on the 4 hour chart:

Leaving alone until after FOMC at least

Wednesdays notes:

Camping out at the 4 hour 55 EMA at 110.33 but we need a correction to at least the 38.2 fib at 111.18 where we have also loads of EMA`S waiting to give the resistance we need followed by a possible short set up

…………………………………………………………………………..

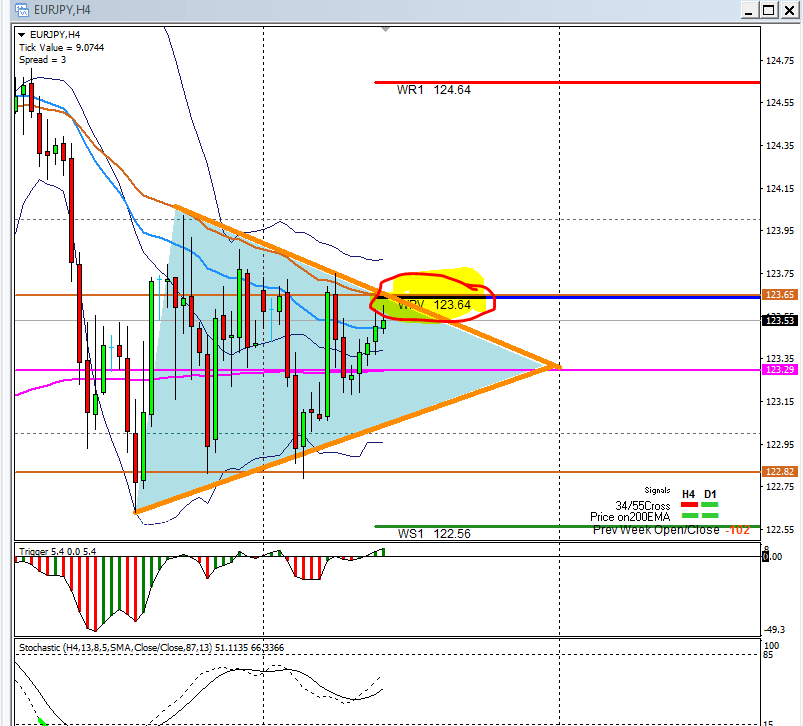

6) Euro/JPY on the 4 hour chart:

The 125.50 has been MAJOR resistance now for the last few weeks so it’s the place to short again If it breaks and closes above there I will wait for a daily candle close before thinking about a long

Wednesdays notes:

We trapped in a triangle on this one. The main trend is still long so I will prefer if we can break to the upside and clear the 55 EMA and weekly main pivot at 123.64 before I will re look for possible longs.

…………………………………………………………………………..

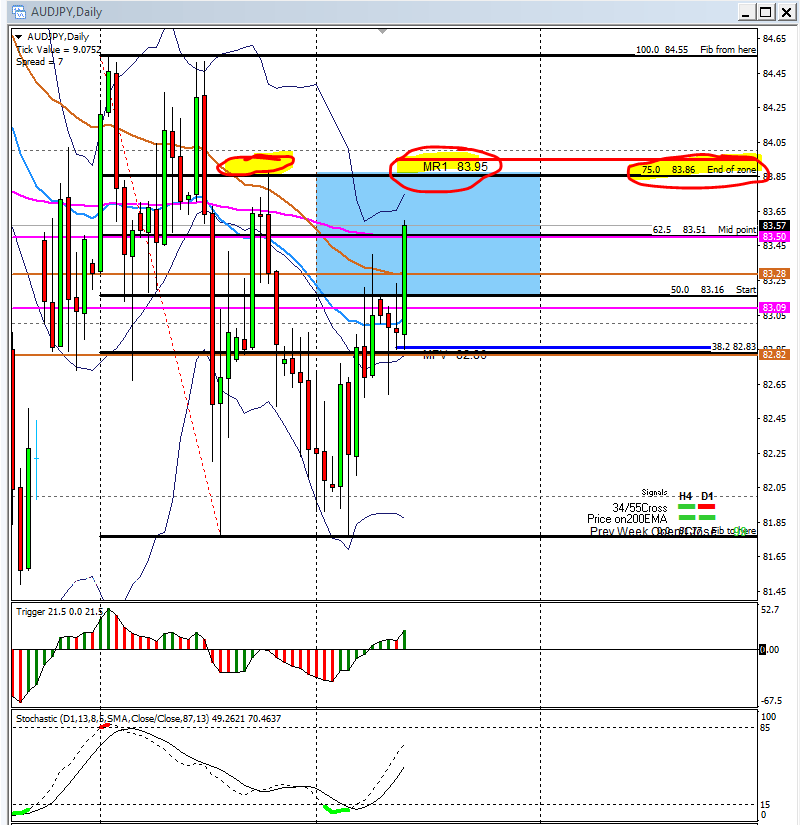

7) Aussie/JPY on the daily chart:

Worked last week, if you missed it then still looking to short at 83.40 for multiple reasons (see Sundays video clip)

Wednesdays notes:

Currently hitting the daily 200 EMA in the short zone at 83.50 so possible roadblock here. If we break to the upside however……keep an eye on the 75% fib and MR1 pivot at 83.95 for possible short set ups.

…………………………………………………………………………..

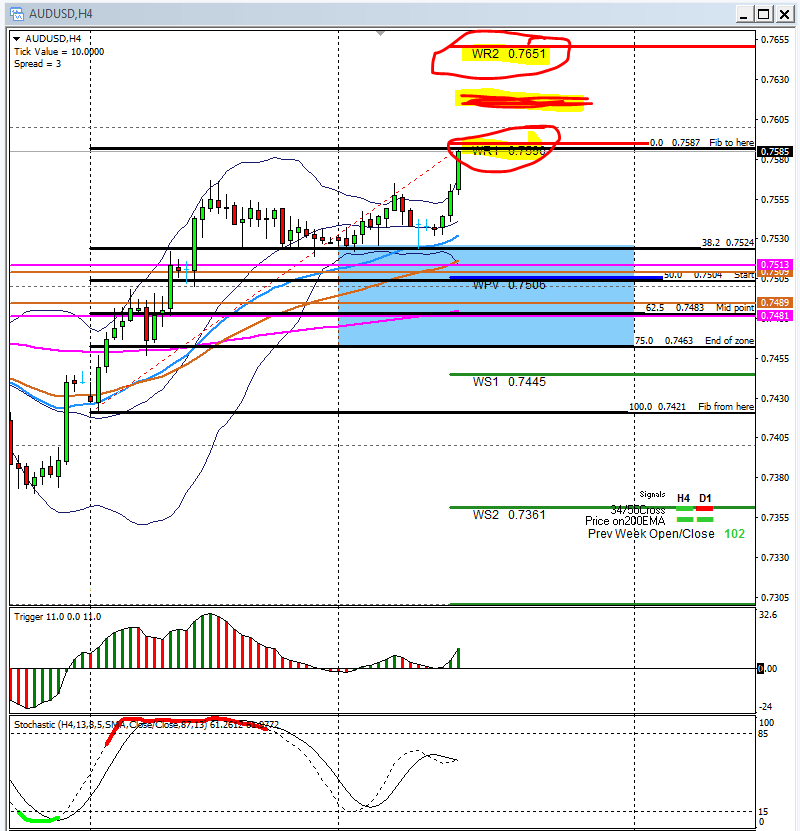

8) Aussie/Dollar on the 4hour chart:

Failed last week, I shorted at 0.7500 for multiple reasons which is key on this pair. Now not sure, but that area is still key to long or short. My bias is still too short but not in current place

Wednesdays notes:

Making new highs this morning so follow it with your fib so that the Earth and Sky zone can adjust.

Possible roadblock at 0.7590 and 0.7620 and 0.7651 where counter shorts can set up.

…………………………………………………………………………..

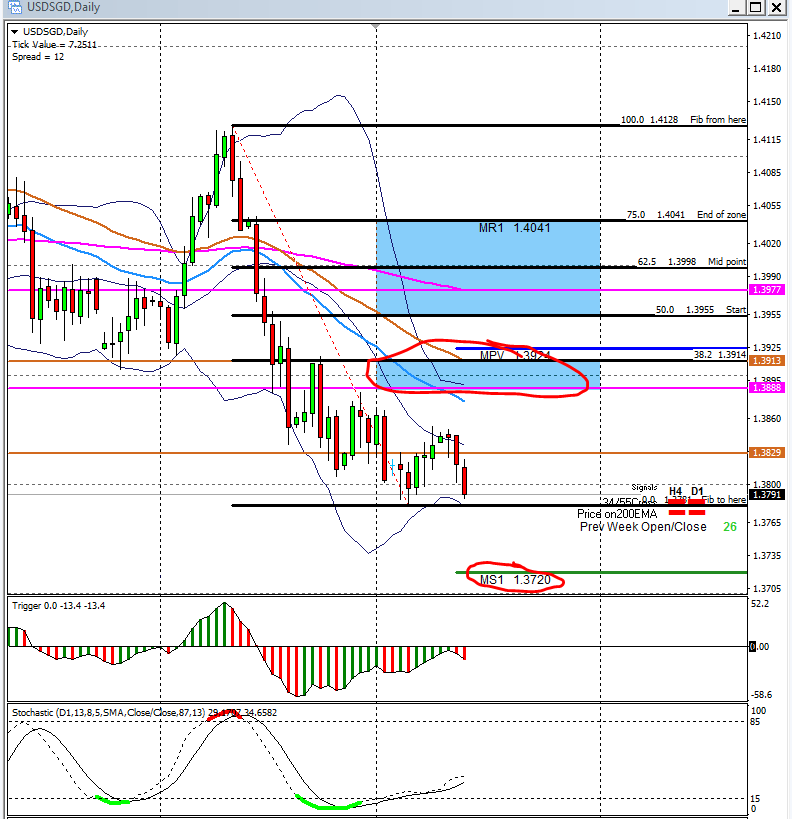

9) Dollar/SGD on the daily chart:

I am interested to long at 1.3500

Wednesdays notes:

Still a long way from Marc support level at 1.3500.

Closer to price now…….we in a down trend and I will prefer a correction back up to 1.3888 and 1.3900 and 1.3924 where I will re look to short this one.

…………………………………………………………………………..

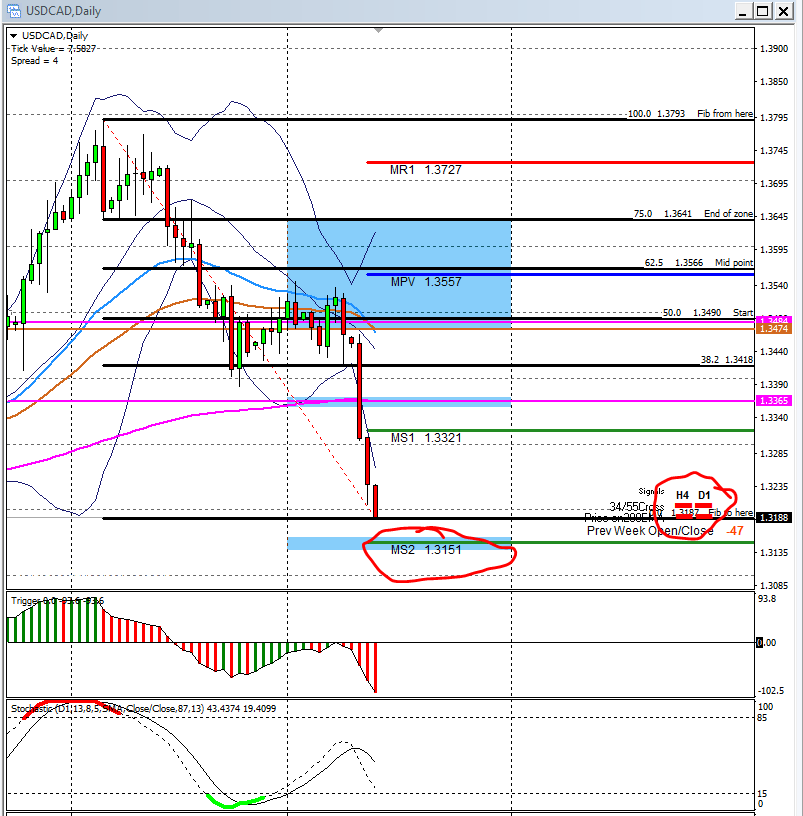

10) Dollar/CAD on the daily chart:

I am interested to long the Cad and 1.3340 will again be my favoured area.

Wednesdays notes:

This one had one big mother of a tumble this week already. Price broke the daily 200 EMA, the WS2 pivot, the WS3 pivot, the MS1 pivot and by the looks of it we are on its way to the MS2 pivot at 1.3151 where I will re look to long again f we find good solid support.

…………………………………………………………………………..

Note from Marc:

New members please note: If I am looking to take a trade long, at for example 1.5000 , I place my order 10 pips above & 10 pips below for a short. This is because price often does not quite reach a major line and you need to allow for spreads. We are NOT a “tipping service” our aim is to teach you how to trade for yourself.

For more up to the minute updates do not forget to drop by the forum in Pierre’s corner.

Regards

Pierre

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below