Hi everyone.

Marc just dropped me a note telling me that he is having a problems with the internet on the Island and can’t manage to upload his midweek update to the FMP site.

Problem for me too as I had some maintenance scheduled on my lines for today after yet another gail force wind hit our town…..so I had to wait for them to finish the job this morning.

Unfortunately a little later than usual ……but never fear with Forex Mentor Pro that’s near……here is my MID WEEK update for the Earth and Sky.

They joy`s of working in the remote parts of the world…..You just have to love it !!

PS…..Marc gave US some homework.

He said that loads of trades triggered on the one hour system and we need to have a look and see if we can spot them……he will show us later in the webinar the ones that did trigger and why they were good setups.

Let’s have a look at some updates:

1) Euro Dollar on the DAILY chart:

We made highs this week so we had to follow it with the fib to get the adjusted zone for the week.

Currently I have an Earth and Sky long zone between 1.1115 and 1.0977 with areas to keep an eye on at the 38.2 fib at 1.1194 and 1.1142 and 1.1118 as we have the monthly main pivot here, plus a 4 hour 200 EMA and if that breaks look at the 55 EMA at 1.1098 support areas where after I will re look to long this pair again.

If the 55 EMA breaks to the downside, be careful as we can then drop to visit the MS1 pivot and daily 200 EMA at 1.0965 where I will re look to long.

Possible counter shorts at 1.1396 as this is the MR1 pivot !!

If we make new highs here follow price with your fib to get the adjusted trading zone for the week.

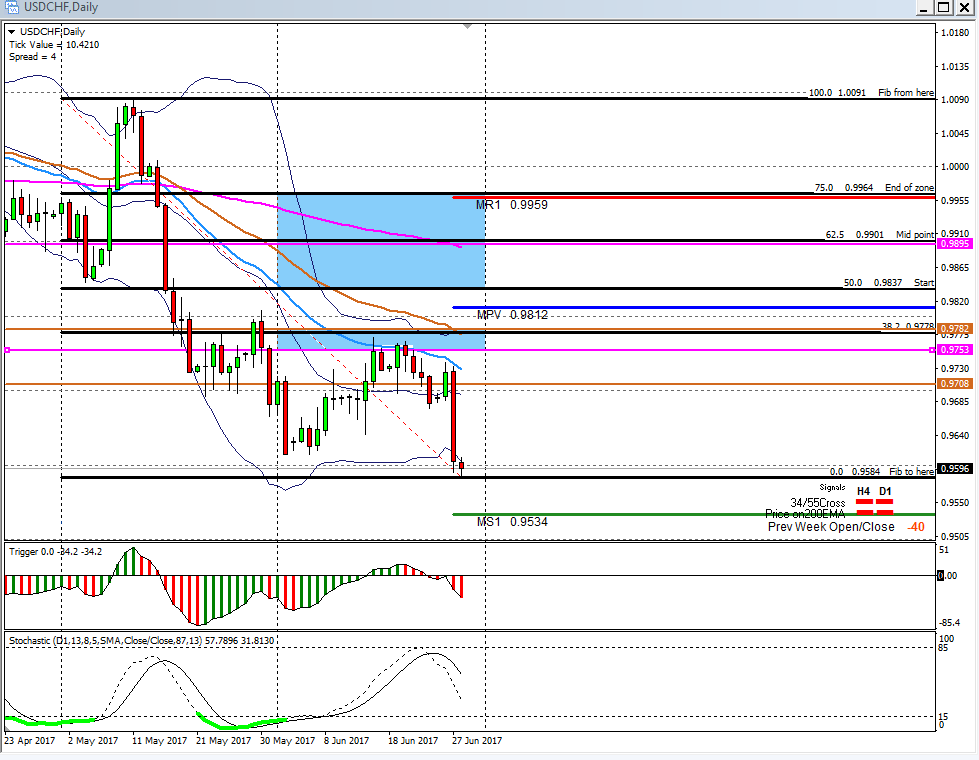

and negative correlated Dollar/CHF on daily chart:

……………………………………………………………….

2) Euro JPY on the 4 hour and DAILY chart:

We made highs this week so we had to follow it with the fib to get the adjusted zone for the week.

Currently I have an Earth and Sky long zone between 125.75 and 124.69 with areas to keep an eye on at the 55 EMA at 124.96 and the WS1 pivot support areas where after I will re look to long this pair again.

If we make new highs here follow price with your fib to get the adjusted trading zone for the week.

……………………………………………………………….

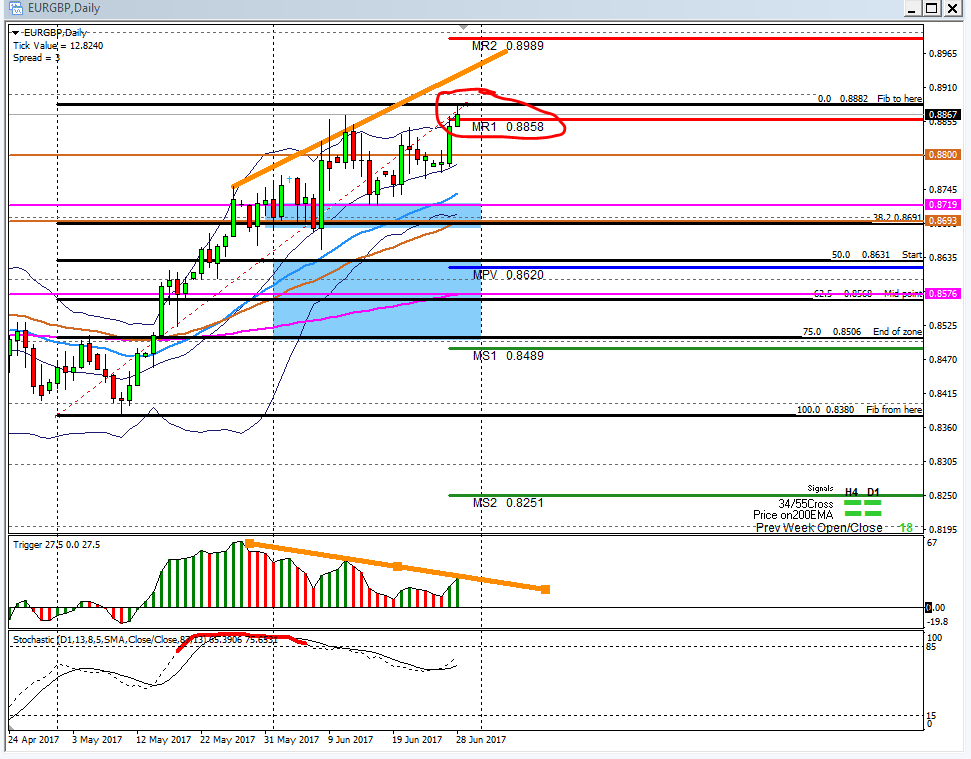

3) Euro GBP on the DAILY chart :

MAIN TREND IS STILL LONG.

However…..The triangle broke to the upside but be careful now with longs. I will look for possible counter trades from the MR1 pivot at 0.8858 and 0.8925 and the MR2 pivot at 0.8989

……………………………………………………………….

4) GBP Dollar on the 4 hour chart:

Price broke to the upside….Sitting on my hands for now.

Keep an eye on the WR1 pivot at 1.2849 as a resistance area but keep in mind we have loads of EMA`S to the downside that can form support if you get a counter trade.

……………………………………………………………….

5) GBP JPY on the 4 hour chart:

Sitting on my hands for now.

Keep an eye on the WR2 pivot at 144.08 as a resistance area but keep in mind we have loads of EMA`S to the downside that can form support if you get a counter trade.

This one however have more room to the downside before we hit support than the correlated GBP/Dollar pair.

………………………………………………………………

6) Aussie Dollar on the DAILY chart:

Last week we closed min 47 pips lower than the opening but the main trend is up. That is why I had to fib the daily chart for the long zone.

Currently I have an Earth and Sky long zone between 0.7482 and 0.7406 with areas to keep an eye on at the 38.2 fib at 0.7518 areas where after I will re look to long this pair again.

Possible counter shorts at 0.7635 and 0.7664 levels

………………………………………………………………

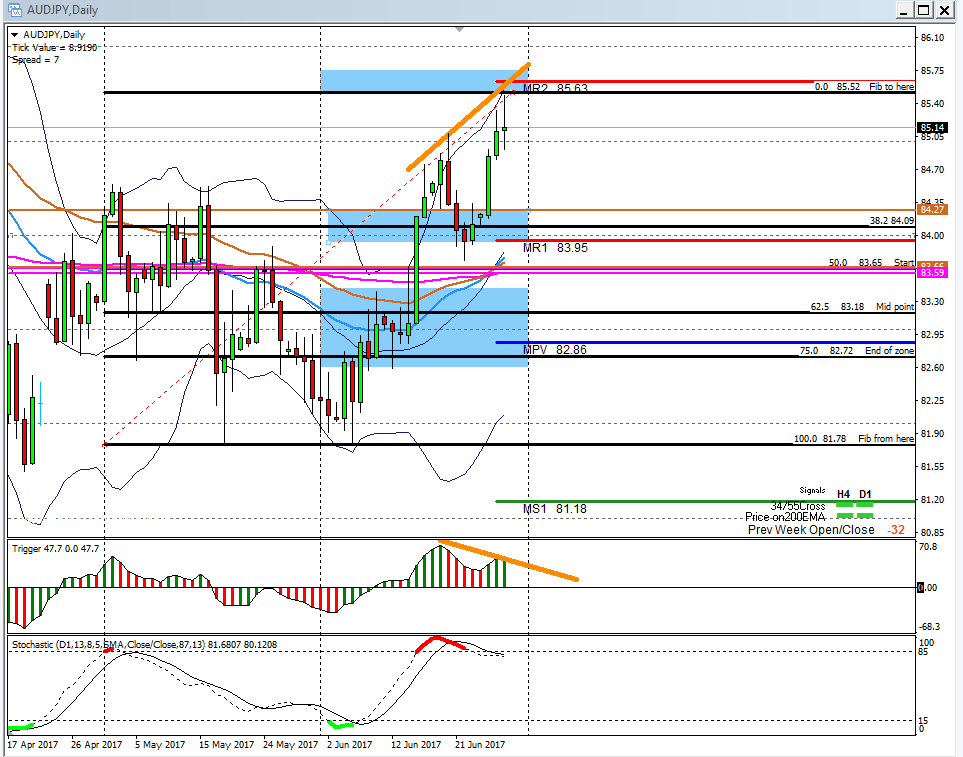

7) Aussie JPY on the DAILY chart:

This one made new highs so we had to follow it with the fib to get the adjusted zone.

Currently I have an Earth and Sky long zone between 83.65 and 82.72 with areas to keep an eye on at the cluster EMA`S at 84.27/09 and 83.59 areas where after I will re look to long this pair again.

Possible counter shorts at 85.08 and 85.63 levels

………………………………………………………………

8) Dollar JPY on the DAILY chart:

Sitting on my hands. This one is just camping out at the cluster EMA`S at 111.12. If we look at the Dollar Index then the bias is still to look for shorts……so this one can follow….BUT then we first need to close under the cluster EMA`S followed by a M2 set up for a short.

………………………………………………………………

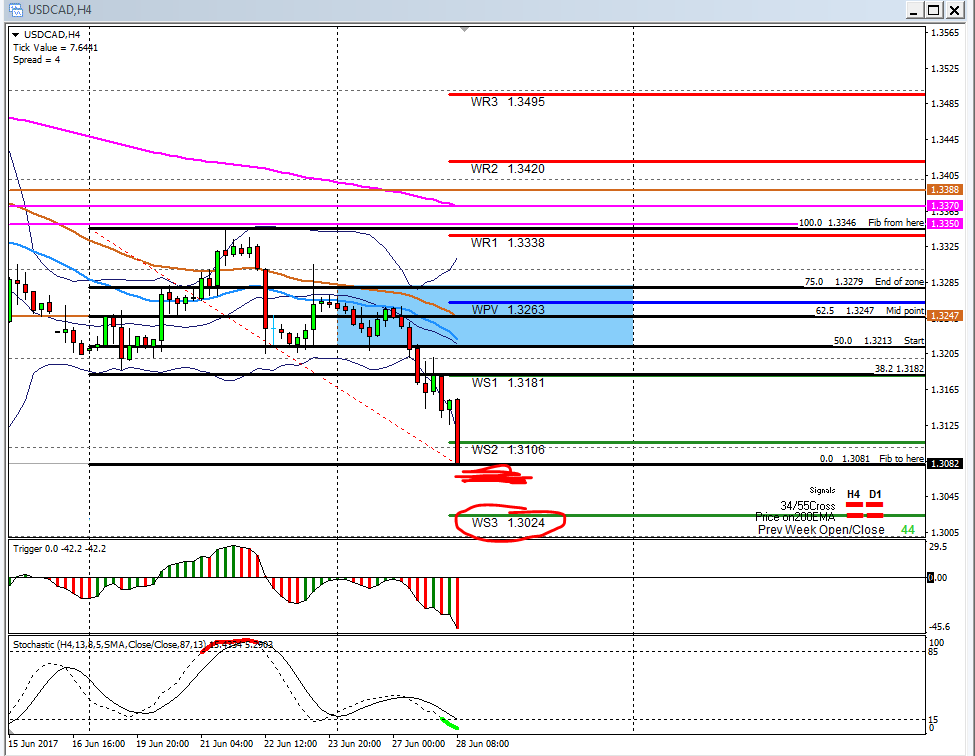

9) Dollar CAD on the 4 hour chart:

This one made new lows so we had to follow it with the fib to get the adjusted zone.

Currently I have an Earth and Sky short zone between 1.3222 and 1.3283 with areas to keep an eye on at the WS1 pivot at 1.3181 and 1.3247 as we also have the 55 there – I will re look to short from here.

Possible counter longs at 1.3064 and 1.3024 area.

If we make new lows here follow price with your fib to get the adjusted trading zone for the week.

………………………………………………………………

10) Dollar Index on the Daily chart :

This one made new lows so we had to follow it with the fib to get the adjusted zone.

Currently I have an Earth and Sky short zone between 98.00 and 98.94 with areas to keep an eye on at the 97.56 (38.2 fib and the 4 hour 200 EMA and monthly main pivot slightly higher) and 97.86 resistance areas where after I will re look to short this index again.

Possible counter longs at 95.87.

………………………………………………………………

Regards

Pierre

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below