Good morning everyone.

Yesterday I showed you that the spaghetti indicator was telling us to keep an eye on the Aussie and the GBP currencies AS THEY BOTH WERE OVERBOUGHT.

This morning when I opened my charts, I was surprised to see that the Aussie had another big bullish move. Strange but true – well we had to follow price with the fibs and we have now an adjusted Earth and Sky long zone in place.

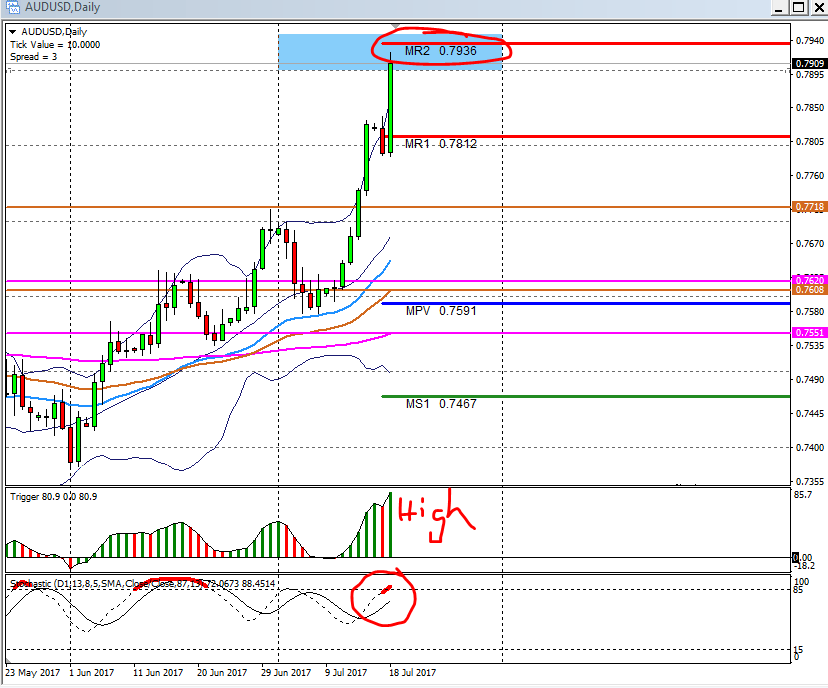

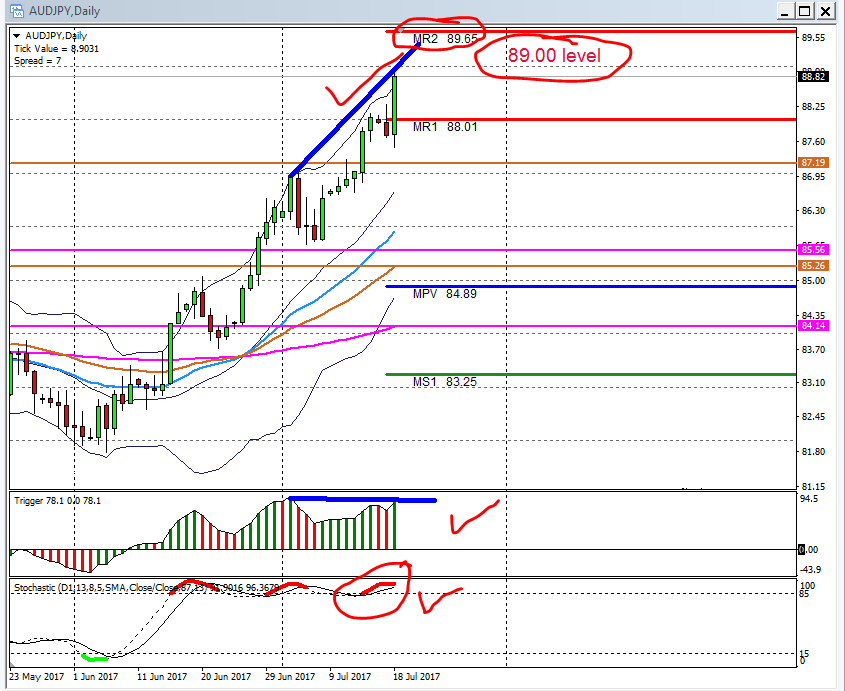

HOWEVER…..we highly overbought on the Aussie/Dollar as we now getting closer and closer to the MR2 pivot at 0.7936 and on the Aussie/JPY we now getting closer and closer to the MR2 pivot at 89.00/07.

We have high MACD`S on the daily charts with overbought stochastic and MACD divergence on the Aussie/JPY daily chart PLUS ……if we drop to the 4 hour charts we can spot MACD divergence`s on both pairs…….so surely a warning sign that a correction is on its way.

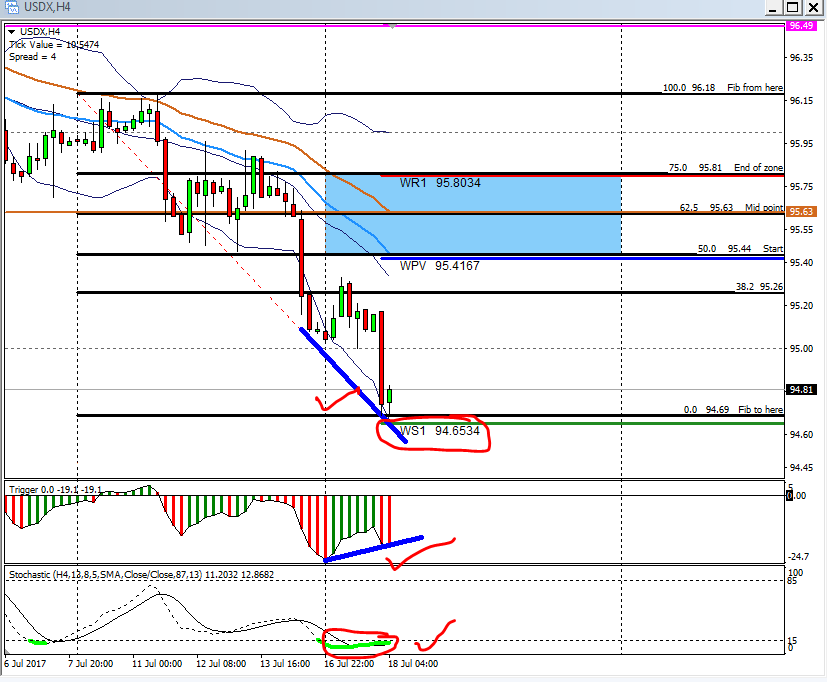

What also support a possible correction on the above is the fact that the Dollar Index is hitting the WS1 pivot this morning at 94.65 with also MACD divergence on the 4 hour so if the Dollar finds the support and pull back….then the Aussies will have that correction we want for that counter trade.

So I will be keeping an eye on it.

Get into your play pin and build the puzzle my friends. 🙂

……………………………………………………………….

Let’s have a look as we have some adjusted Earth and Sky trading zones this morning:

……………………………………………………………….

1) Euro Dollar on the 4 hour chart:

Currently I have an Earth and Sky long zone between 1.1456 and 1.1413 with areas to keep an eye on 1.1476 ( 38.2 fib) and 1.1447 and 1.1427 support areas where after I will re look to long this pair again.

Possible counter shorts at 1.1523 and 1.1541 and 1.1568 levels.

Notes:

*If we make new highs here follow price with your fib to get the adjusted trading zone for the week*

While the 55 EMA at 1.1427 holds my bias will be to look for longs. If it breaks be careful as we can drop to last week`s low at 1.1370.

……………………………………………………………….

2) Euro JPY on the DAILY chart:

*The main trend is still long……however….last week we close min 104 pips lower than the opening so we can’t fib the 4 hour for the trading zone, we need to fib the daily chart for the Earth and Sky long zone*

Currently I have an Earth and Sky long zone between 126.63 and 124.52 with areas to keep an eye on at the 38.2 fib at 127.63 and 126.96 and 126.16 support areas where after I will re look to long this pair again.

Possible counter shorts at 130.27 and 130.63 and 130.74

Notes:

Currently we just under the 4 hour 55 EMA at 129.11 so be careful as we might drop fast from here. Bollinger bands closing up starting to make tweezers.

……………………………………………………………….

3) Euro GBP on the DAILY chart :

*The main trend is still long……however……last week we close min 94 pips lower than the opening so we can’t fib the 4 hour for the trading zone, we need to fib the daily chart for the Earth and Sky long zone*

Currently I have an Earth and Sky long zone between 0.8000 and 0.8725 with areas to keep an eye on at 0.8744 support areas where after I will re look to long this pair again.

Possible counter shorts at 0.8887 and 0.8949 levels.

Notes:

Yesterday we found support at the 55 EMA at 0.8740 and we had some pips with a long but we bumping now the daily 55 EMA at 0.8810 so be careful as this can be a roadblock for this pair today.

If the 55 EMA at 0.8744 breaks to the downside….be careful as we can drop to last week’s low at 0.8652 where I will re look to long this pair again.

……………………………………………………………….

4) GBP Dollar on the 4 hour chart:

Currently I have an Earth and Sky long zone between 1.2962 and 1.2886 with areas to keep an eye on at 1.2997 (38.2 fib) and 1.2968 and 1.2924 and 1.2900 support areas where after I will re look to long this pair again.

Possible counter shorts at 1.3100 and 1.3150 and 1.3200 levels.

Notes:

*If we make new highs here follow price with your fib to get the adjusted trading zone for the week*

……………………………………………………………….

5) GBP JPY on the 4 hour chart:

Currently I have an Earth and Sky long zone between 146.53 and 145.90 with areas to keep an eye on at 146.80 and 146.54 support areas where after I will re look to long this pair again.

Possible counter shorts at 147.77 and 148.34 levels.

If we break the 146.54 at the 4 hour 55 EMA level to the downside be careful as we can drop to 145.84 where we have the 75% fib and WS1 pivot waiting as support……..If that breaks for some reason….then sit on your hands as we might drop to last week’s low at 145.28 and even lower to go visits the mother in laws dining room table at the 200 EMA at 144.71 where I will re look to long again.

Notes:

If we break the 146.54 at the 4 hour 55 EMA level to the downside be careful as we can drop to 145.84 where we have the 75% fib and WS1 pivot waiting as support……..If that breaks for some reason….then sit on your hands as we might drop to last week’s low at 145.28 and even lower to go visit the mother in laws dining room table at the 200 EMA at 144.71 where I will re look to long again.

………………………………………………………………

6) Aussie Dollar on the 4 hour chart:

Currently I have an Earth and Sky long zone between 0.7758 and 0.7657 with areas to keep an eye on at the 38.2 fib at 0.7797 and 0.7750 and 0.7718 support areas where after I will re look to long this pair again.

Possible counter shorts at 0.7907 and 0.7950 levels

Notes:

*If we make new highs here follow price with your fib to get the adjusted trading zone for the week*

*Looking at the daily chart then we hitting the MR2 pivot at 0.7936 with MACD that high and stochastic that is overbought so I am expecting a correction*

………………………………………………………………

7) Aussie JPY on the 4 hour chart:

Currently I have an Earth and Sky long zone between 87.70 and 87.15 with areas to keep an eye on at 87.97( 38.2 fib) and 87.56 and 87.19 support areas where after I will re look to long this pair again.

Possible counter shorts at 88.52 and 89.07 levels

Notes:

*If we make new highs here follow price with your fib to get the adjusted trading zone for the week*

*Looking at the daily chart then we hitting the MR1 pivot at 88.01 with MACD that high and stochastic that is overbought so I am expecting a correction*

………………………………………………………………

8) Dollar JPY on the DAILY chart:

The main trend is still long……however……last week we close min 161 pips lower than the opening so we can’t fib the 4 hour for the trading zone, we need to fib the daily chart for the Earth and Sky long zone.

Currently I have an Earth and Sky long zone between 111.70 and 110.25 with areas to keep an eye on at the 38.2 fib at 112.38/32/09 and 111.70 and 111.45 support areas where after I will re look to long this pair again.

Possible counter shorts at 113.16 and 113.90 and 114.59 levels

Notes:

If we break the 55 EMA at 112.09 to the downside, be careful as we can then drop to the 200 EMA at 111.45 where I will then re look to long this pair.

………………………………………………………………

9) Dollar CAD on the 4 hour chart:

Currently I have an Earth and Sky short zone between 1.2785 and 1.2864 with areas to keep an eye on at the 38.2 fib at 1.2737 and 1.2800 and 1.2806 resistance areas where after I will look to short this pair.

Possible counter longs at 1.2600 and 1.2531 area.

Notes:

*If we make new lows here follow price with your fib to get the adjusted trading zone for the week*

* This one looks like it’s on its way to the MS2 pivot at 1.2545 if we look at the daily chart*

………………………………………………………………

10) Dollar Index on the 4 hour chart :

Currently I have an Earth and Sky short zone between 95.44 and 95.81 with areas to keep an eye on at 95.26 (38.2 fib) and 95.4 and 95.63 resistance areas where after I will re look to short this index again.

Possible counter longs at 94.65

Notes:

*If we make new lows here follow price with your fib to get the adjusted trading zone for the week*

We have MACD divergence here on the 4 hour chart and we getting closer to the WS1 pivot at 94.65 – so if it holds as support, a possible counter long can set up.

………………………………………………………………

See you all during the webinar today !!!

Regards

Pierre

Learn from yesterday- Live for today – Hope for tomorrow.

Remember to make the video clip bigger to see the levels more clearly.

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below