We had loads of GAPS yesterday with market opening…..and by the looks of it most GAPS closed already.

We know by now that 90% of the time the market do close these GAPS…..so when we see GAPS we know that we have possible trading opportunities coming up.

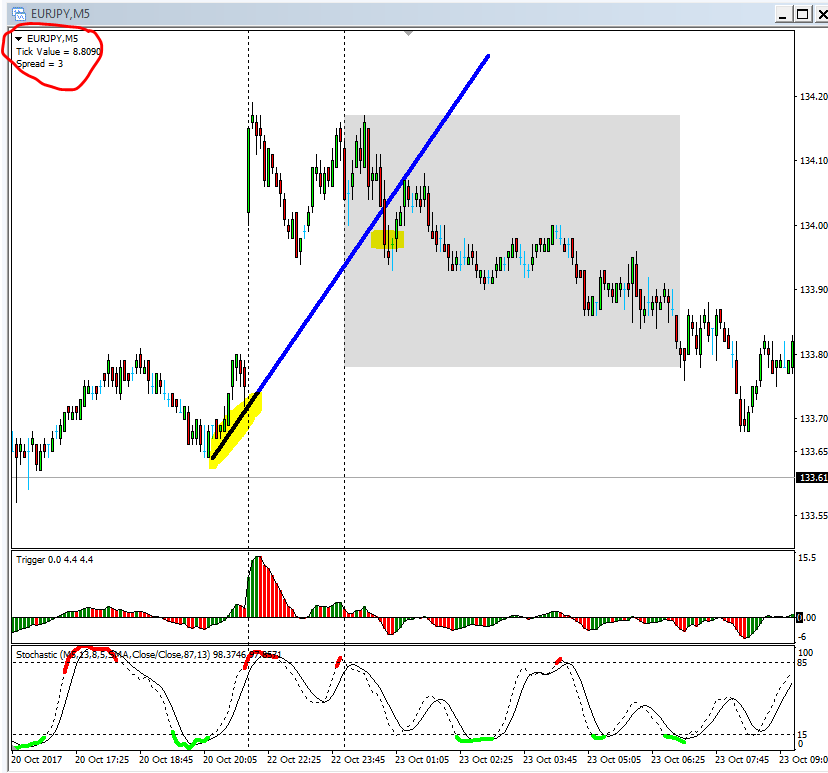

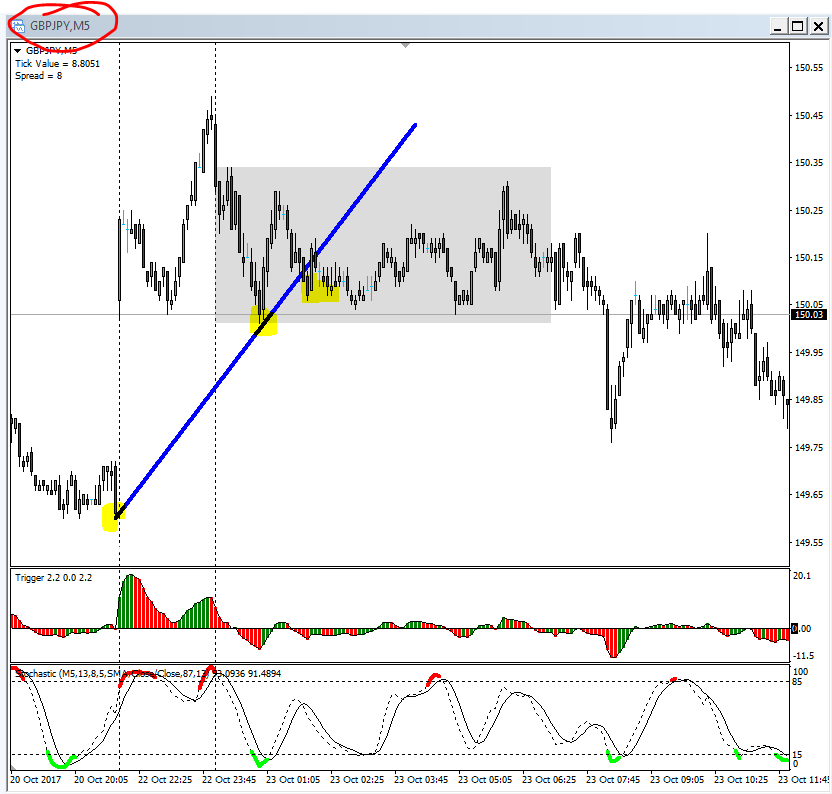

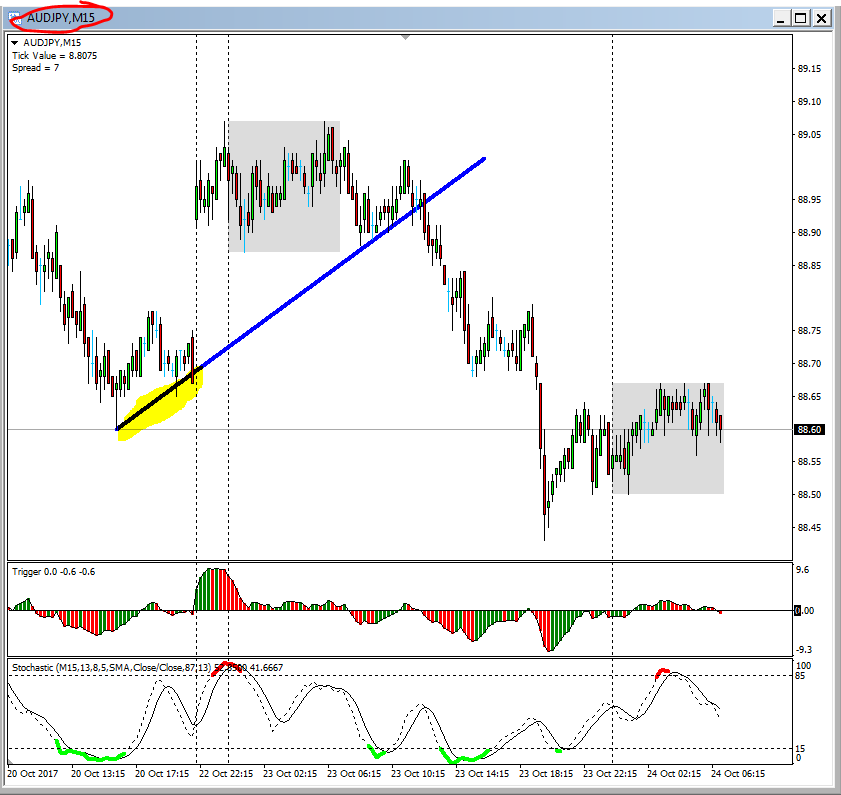

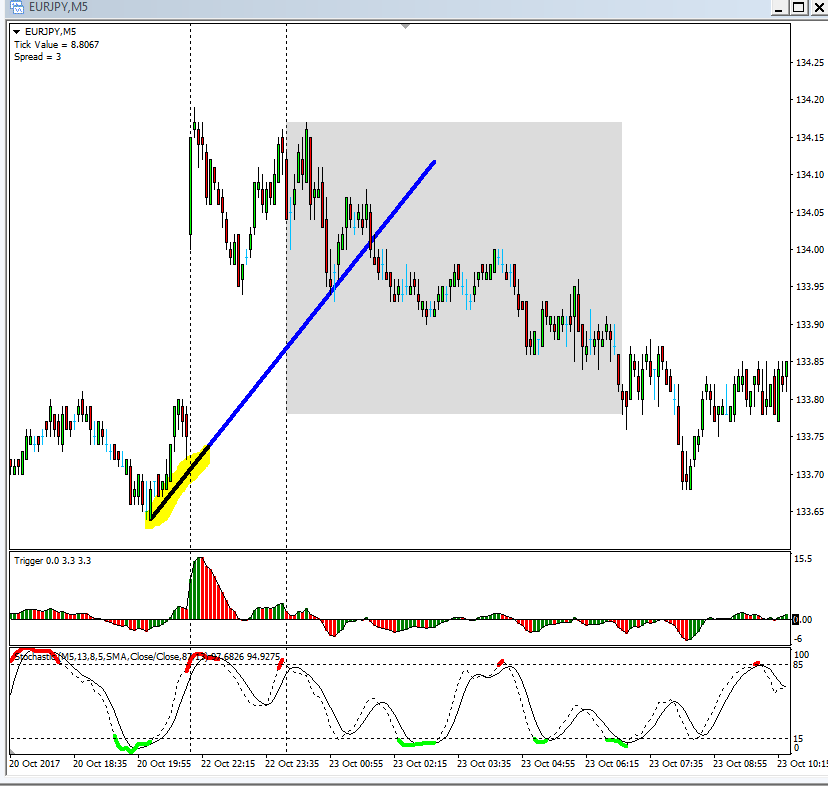

One easy way to trade them is just a normal simple stupid trend line break on the smaller time frames – that is now if you are awake that time !!! 🙁

What ??

Just a trend line break Pierre??

It can’t be that simple can it ??

Well let’s have a look………..

For starters -see if you can find a trend line on the 5 min or 15 min chart………dont go to far back with your trend line…….we only want to use the last bit of Friday afternoon/evenings candles (marked in yellow)

The following pairs are all pairs that gave GAPS on Monday morning – that closed already and gave some pips !!!

I took the Euro/JPY yesterday that gave me already 1/2 of my weekly target.

………………………………………………………………………….

1) `Red Flag News` that can make you lose your pants if you are not careful. 💡

You can use the following web site for `SCHEDULED NEWS` for the week @ http://www.dailyfx.com/calendar

Don`t take any trades just before `Red Flag News` If you are already in a trade, protect your entry. I don’t want to meet up with you at Little Beach, Maui, Hawaii. Did you know this is a nudist beach?

For reference if you don’t want to believe me, have a look at the 4th of April 2013 at all the JPY pairs what happened with price after `Red Flag News` came out. ALWAYS TRADE WITH A STOP!

Still don’t believe me? Then you must be new to Forex Trading

Have a look at what the Swiss did to the market on the 15th of January 2015!!

You would have lost the shirt on your back, your house, your car, your personality and your virginity for a 2nd time if you didn’t have a stop in place!!! 👿

………………………………………………………………………….

2) Where is the `Forum Hang out Spot` that everyone is talking about?

On the top of this main page, go to the ` Forum` Tab and click on it…….once in there, look for `Main forum and Current weeks trades` and click on it………Once in there look for `Pierre`s Earth and Sky Trading week `and click on it……..once in there, look for the Current week`s Thread Tab and click on it………..easy as pips! 😉

……………………………………………………………………………

3) This week`s Analysis:

This is my current `Earth and Sky Trading Zones` – Please take note of the time frames I am looking at.

Sometimes I will refer to `The mother in law` in my video`s or in my write up. The mother in law represents the 200 EMA (the pink line) on that specific time frame.

If you new to the `Earth and Sky` please make sure to read the supporting notes for this system – Look for unit in the education area under Earth and Sky System.

Go to the `Education Tab` here in the main blog and look for the `Earth and Sky Trading System` where you will find helpful videos using this system.

Remember to have a look at some of the other methods we teach here at Forex Mentor Pro too.

………………………………………………………………………….

Ok…..let’s have a look what is cooking in the kitchen for the week

………………………………………………………………………….

1) Euro/Dollar on the DAILY chart:

Difference between last week’s open/close: Min 57 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/JPY and the Euro/GBP. Be careful; don’t take the same trades on these four pairs at the same time!

Also remember: This pair is `NEGATIVE CORRELATED` (moving in the opposite direction) as the Dollar/CHF pair. Be careful; DO NOT OVER EXPOSE YOUR ACCOUNT BY PLACING OPPOSITE TRADES ON THESE TWO PAIRS.

Notes:

Currently sitting just under the cluster of EMA`S at 1.1805.

The Head and Shoulder pattern I showed you two weeks ago is still in play……also looks like we trapped in a triangle on the daily too.

If we break the triangle to the downside I will look to short to the MS1 pivot at 1.1656 where after I will re look for support to long again.

The neckline for the head and shoulder pattern is at 1.1700/1656 so that need to break first if we want to trade the pattern to the upside.

If that is the case price can go visit the daily 200 EMA at 1.1455 where I will re look for support to go long again.

……………………………………………………………………………….……..

2) USD/CHF on the 4 hour chart:

Difference between last week’s open/close: Plus 112 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is above the 55 EMA (earth)

Direction: Long

Potential trading zone: Between the 0.9806 and 0.9768 levels

Potential area to look for reaction: At the 0.9806 and 0.9799 and 0.9786 levels.

Potential Profit take areas: At the 0.9882 and 0.9906 levels

MACDEE Divergence: No

Stochastic: Overbought

Counter Trades:

Potential Counter Trades: At the 0.9882 and 0.9906 levels

Potential Profit take areas: At the 0.9818 level.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is `NEGATIVE CORRELATED` (moving in the opposite direction) as the Dollar/CHF pair. Be careful; DO NOT OVER EXPOSE YOUR ACCOUNT BY PLACING OPPOSITE TRADES ON THESE TWO PAIRS

Notes:

We currently in no man’s land so wait for price to come to you.

……………………………………………………………………………….……..

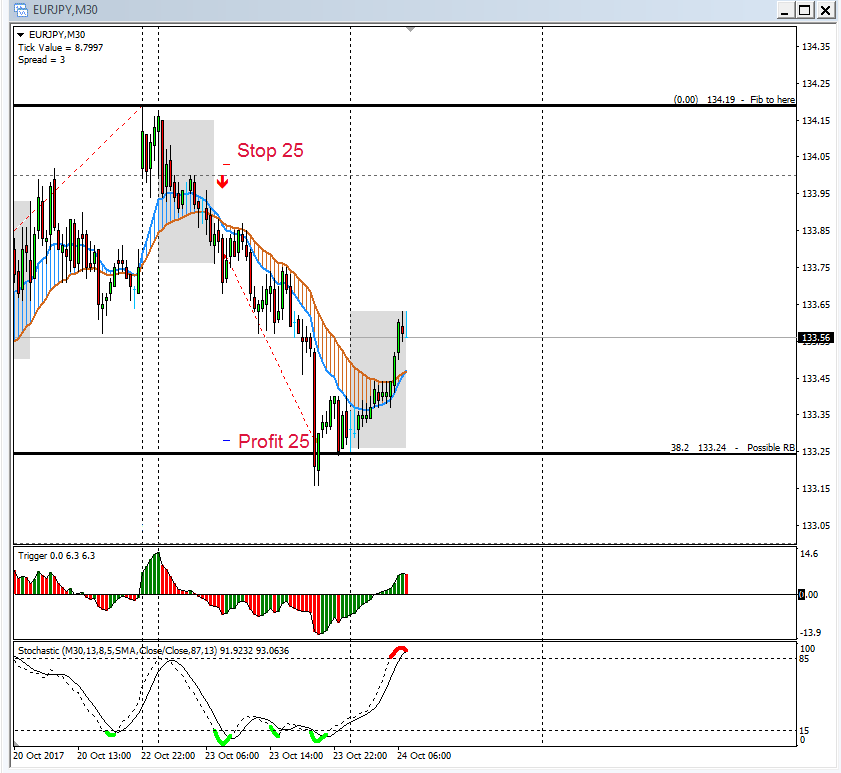

3) Euro/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 191 pips

GAP TRADING:

Did we open with a gap this week? YES !!!!!!!!!!!!!!!!

Did the gap close? YES !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is above the 55 EMA (earth)

Direction: Long

Potential trading zone: Between the 132.96 and 132.34 levels

Potential area to look for reaction: At the 133.25 (38.2 fib) and 133.00 and 132.96 and 132.51 levels.

Potential Profit take areas: At the 134.19 and 134.97 levels

MACDEE Divergence: No

Stochastic: No man`s land

Counter Trades:

Potential Counter Trades: At the 134.19 and 134.97 levels

Potential Profit take areas: At the 133.35 level.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/USD and the Euro/GBP. Be careful; don’t take the same trades on these four pairs at the same time!

Notes:

We opened with a GAP on Monday -This GAP already closed yesterday. I got in a little late but took it after I had a ribbon cross on the 30 min chart yesterday.

Key support for me this week will have to be at the 4 hour 55 and psychological level at 133.00 this week.

…………………………………………………………………………………..…..

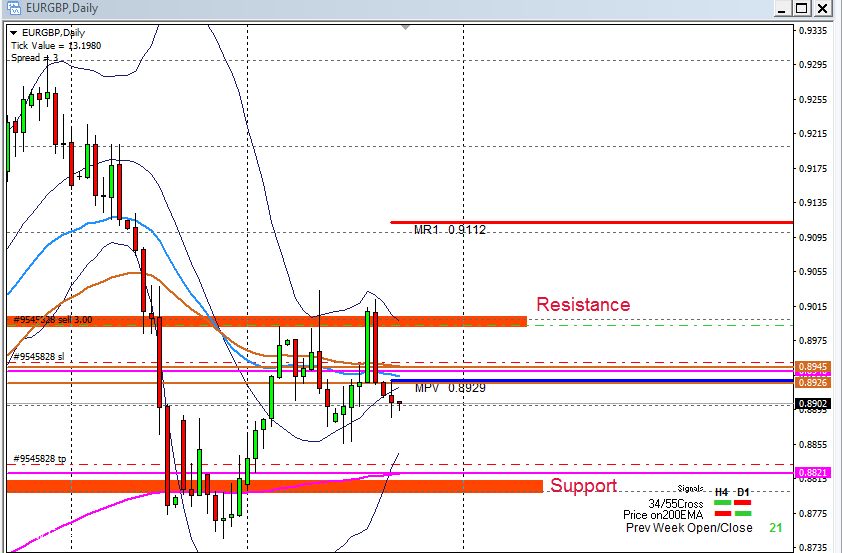

4) Euro/GBP on the 4 hour chart:

Difference between last week’s open/close: Plus 21 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/Dollar and the Euro/JPY. Be careful; don’t take the same trades on these four pairs at the same time

Notes:

The 4 hour direction Indi is all mixed up……the daily direction Indi is also all mixed up with the directions this morning.

I will however look for possible short set ups from the 0.9000 resistance level and possible long set ups from the daily 200 EMA at 0.8820 level again this week.

I am still in my short I took last week and waiting for possible profit take at 0.8820 area.

……………………………………………………………………………………….

5) GBP/Dollar on the 4 hour and DAILY chart:

Difference between last week’s open/close: Min 97 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is UNDER the 55 EMA (earth)

Direction: Mixed

Potential trading zone: Between the 1.3201 and 1.3258 levels

Potential area to look for reaction: At the 1.3208 levels.

Potential Profit take areas: At the 1.3100 levels

MACDEE Divergence: No

Stochastic: Overbought

Counter Trades:

Potential Counter Trades: At the 1.3083 levels

Potential Profit take areas: At 1.3180 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the GBP/JPY pair. Be careful; don’t take the same trades on both pairs at the same time!

Notes:

The 4 hour is mixed with the direction Indi and still long on the daily chart – However the fundamentals tells us to look for shorts that is why I fib the 4 hour this week to get a short zone. Price needs to close first under the EMA`S we have at 1.3200 before I will re look for a short set up.

On the daily chart it looks like we might be trapped in a triangle.

……………………………………………………………………………………….

6) GBP/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 176 pips

GAP TRADING:

Did we open with a gap this week? YES !!!!!!!!!!!!!!!!

Did the gap close? YES !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is above the 55 EMA (earth)

Direction: Long

Potential trading zone: Between the 149.13 and 148.45 levels

Potential area to look for reaction: At the 149.04 and 148.65 levels.

Potential Profit take areas: At the 150.49 and 151.00 levels.

MACDEE Divergence: No

Stochastic: Overbought

Counter Trades:

Potential Counter Trades: At the 150.49 and 151.00 and 151.36 levels

Potential Profit take areas: At the 149.57 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the GBP/Dollar pair. Be careful; don’t take the same trades on both pairs at the same time!

Notes:

We opened with a GAP on Monday. This GAP did close already yesterday. Currently in no man’s land so wait for price to come to you.

……………………………………………………………………………………….

7) Aussie/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 79 pips.

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.7834 and 0.7862 levels

Potential area to look for reaction: At the 0.7832 (38.2 fib) and 0.7842 and 0.7854 and 0.7861 levels

Potential Profit take areas: At the 0.7796 and 0.7777 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 0.7777 and 0.7745 levels.

Potential Profit take areas: At the 0.7832 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the AUD/JPY pair. Be careful; don’t take the same trades on both pairs at the same time!

Notes:

If the WR1 pivot at 0.7777 breaks to the downside then we will go visit the mother in law 200 EMA at the WS2 pivot were I will re look to long this pair again.

……………………………………………………………………………………….

8) Aussie/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 82 pips

GAP TRADING:

Did we open with a gap this week? YES !!!!!!!!!!!!!!!!

Did the gap close? YES!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is above the 55 EMA (earth)

Direction: Long

Potential trading zone: Between the 88.42 and 88.10 levels

Potential area to look for reaction: At the 8.41 and 88.18 levels.

Potential Profit take areas: At the 89.00 and 89.47 levels

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 89.00 and 89.47 levels.

Potential Profit take areas: At the 88.63 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the AUD/USD pair. Be careful; don’t take the same trades on both pairs at the same time!

Notes:

If price breaks the 55 EMA at 88.41 for some reason to the downside….. be careful as we might go visit the mother in law at 88.10 where I will re look to long again.

………………………………………………………………………………………

9) USD/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 216 pips

GAP TRADING:

Did we open with a gap this week? YES !!!!!!!!!!!!!!!!

Did the gap close? YES !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is above the 55 EMA (earth)

Direction: Long

Potential trading zone: Between the 112.89 and 112.29 levels

Potential area to look for reaction: At the 112.87 and 112.46 levels.

Potential Profit take areas: At the 114.10 and 114.87 levels

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 114.10 and 114.87 levels.

Potential Profit take areas: At the 113.28 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

Currently in no man’s land so wait for price to come to you.

……………………………………………………………………………………….

10) USD/CAD on the DAILY chart:

Difference between last week’s open/close: Plus 159 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Dollar Index. Be careful; don’t take the same trades on both pairs at the same time!

Notes:

We had a triangle on this one that broke to the upside on Thursday – it’s also an inverse head and shoulder pattern with the neckline at 1.2550 so possible pullback followed by a M2 long set up from this level if we find support here again.

The Dollar Index still didn’t break to the upside so take note.

……………………………………………………………………………………..

11) USD Index on the 4 hour chart:

Difference between last week’s open/close: Min 75 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Correlation: Remember that the Dollar Index is negative correlated with the Euro Index (They move in opposite direction) so only take one trade at a time as you will double your risk if you took trades on both index`s.

If you don’t have the index on your platform…..download a demo account with Forex LTD at http://www.forexltd.co.uk/

Notes:

The inverse Head and Shoulder pattern I showed you over the last 2 weeks is still in play……also looks like we trapped in a triangle on the daily too.

If we break the triangle to the downside I will look to short to the MS1 pivot at 91.48 where after I will re look for support to long again.

The neckline for the inverse head and shoulder pattern is at 94.00/14 so that needs to break first if we want to trade the pattern to the upside.

……………………………………………………………………………………..

13) NZD/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 238 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.7059 and 0.7129 levels

Potential area to look for reaction: At the (38.2 fib) at 0.7026 and 0.7059 levels.

Potential Profit take areas: At the 0.6926 and 0.6852 levels

MACDEE Divergence: YES !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 0.6900 and 0.6852 levels

Potential Profit take areas: At the 0.7026 level.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

If price makes new lows without the correction….follow price with he fib so that the earth and sky short zone can adjust.

……………………………………………………………………………………..

Please remember we are NOT a “tipping service.” What we aim to teach you here at fxmentorpro is how to look for trade set ups using different methods, taking you’re trading to the next level.

Have a good one mates

Pierre 😛

`Learn from yesterday, Live for today and hope for tomorrow`

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below