The countdown has started !!

This will be my last week where I will be actively looking for trade set ups for 2017.

Next week we have Christmas day on the Monday…..Boxing day on the Tuesday……leaving us only 3 days of trading……and then the 1st of January 2018 on the Monday !!

Looking at the above holidays………..my feeling is that there is a very very big risk that we can get stuck in the market over the 3 day period and one thing I have learned over the years is…….

NOT TO BE IN ANY OPEN TRADES OVER A NEW YEAR !!!

I have seen the market open on the 2nd of January with HUGE HUGE HUGE gaps !!!

If you do for some reason think its a good idea……..let me phone and organise your ride to take you to the nearest psychiatric ward !!!

……………………………………………………………….

The last webinar for 2017 !!!!!!

TRY to get to the live training sessions, we are able to explain our plans in much greater detail and those who can attend have a better chance of having a profitable week. If you can’t make it then make sure to check out the recording and the notes. As ever some of the trades that we showed in the last session fired and gave pips once more so don’t miss out!

Please register for this week’s Forex Mentor Pro Live Training on Tuesday, 19th December 2017 at 11:00 AM GMT (London Time) at:

https://attendee.gotowebinar.com/register/3402120261241249283

Live training session with Marc Walton. Pierre du Plessis & Judith Waker. The team will assess fundamentals, M2 Earth & Sky & the trigger system for potential trades. Followed by a Q & A session

After registering, you will receive a confirmation email containing information about joining the webinar.

……………………………………………………………….

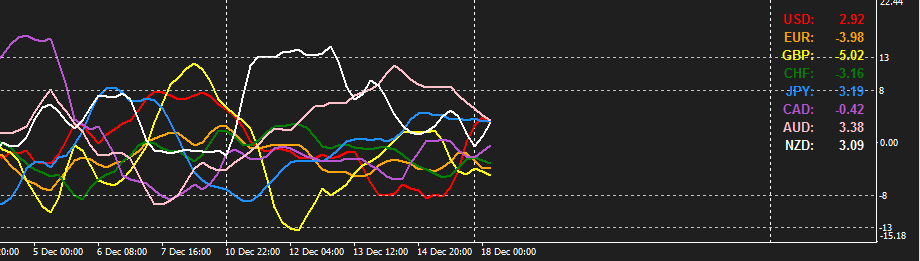

The Spaghetti Indicator:

The 4 hour chart :

The Spaghetti Indi is flat on all the currencies.

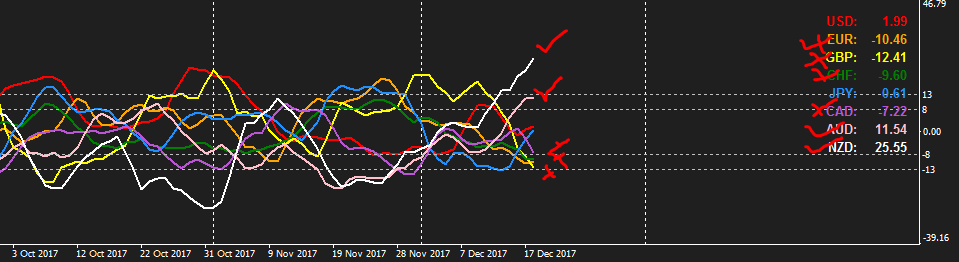

The Daily chart :

The Spaghetti Indi is overbought on the Aussie and NZD currencies and oversold on the Euro,GBP, CHF and CAD currencies this morning.

So let’s keep an eye on them for possible trade set ups from areas of interest (multiple reasons levels areas)

- If you want to add the overbought and oversold areas to this Indi…..right click on the RS all Indi……then go to the RS All properties…….here we go to the levels tab…..then add the 8 and 13 and min 8 and min 13 line and click on OK.

- Remember then to save a new template.

……………………………………………………………….

Not too much scheduled red flag news this week. I am looking to trade the Gbp but need to be careful around Carneys speech on Wednesday. The main problem with the the Gbp is of course, Brexit and what politicians from all sides in both camps say on any given day.

I use Forex Factory’s Calendar

……………………………………………………………….

Let’s have a look what’s cooking in the Forex kitchen this morning:

1) Euro Dollar on the DAILY chart:

Notes:

The direction Indi is short on the 4 hour and long on the daily……last week we only closed min 25pips lower than the opening so we very flat at the moment.

What I don’t like is the way how price don’t respect the cluster EMA`S we have at 1.1786. We broke it to the downside….just to break it to the upside again and now we broke it to the downside again.

Being the last week of trading for me this year – I will be sitting on my hands and only re look to long once we get to the daily 200 EMA at 1.1565

……………………………………………………………….

2) Euro JPY on the DAILY chart:

Notes:

Sitting on my hands with this pair. I don’t like the way how it doesn’t respect the EMA`s at 132.60/78 at the moment.

Also looks like we might be trapped in a triangle on this one.

……………………………………………………………….

3) Euro GBP on the DAILY chart :

The direction Indi on the 4 hour shows short and on the daily chart short too. However last week we only closed min 34 pips lower than the opening so we very flat and I will prefer to fib the daily chart this week to get a short earth and sky zone.

Currently I have an Earth and Sky short zone between 0.8849 and 0.8933 with areas to keep an eye on at the 0.8831 and 0.8849 resistance areas where after I will re look to short this pair again.

Possible counter longs at 0.8678 areas.

Notes:

If we look at the daily chart we can see how price didn’t managed to break the 0.8850 level to the upside this month…..so while that level holds….I will look for short set ups.

……………………………………………………………….

4) GBP Dollar on the DAILY chart:

The direction Indi on the 4 hour shows its mixed and long on the daily chart. However last week we closed min 76 pips lower than the opening. We can’t fib the 4 hour to get a long zone…..so we have to fib the daily chart for the earth and sky long zone this week.

Currently I have an Earth and Sky long zone between 1.3296 and 1.3168 with areas to keep an eye on at the 1.3296 support areas where after I will re look to long this pair again.

Possible counter shorts at 1.3552 and 1.3640 areas.

Notes:

While the 55 EMA holds at 1.3294 my bias will be to look for longs. If this support level for some reason breaks to the downside……be careful as we can then go visits the MS1 pivot at 1.3198 and even the daily 200 EMA at 1.3096 where I will re look for support to long again.

……………………………………………………………….

5) GBP JPY on the WEEKLY chart:

Notes:

The triangle broke to the upside and we closed above the bear trend line. Problem now is that we have the weekly 200 EMA at 153.63 that can kick this move right in its teeth again so I will have a look what price will do once we hit this level.

……………………………………………………………..

6) Aussie Dollar on the DAILY chart:

The direction Indi is long on the 4 hour and short on the daily chart. Last week we closed plus 139 pips higher than the opening. My bias is still to look for shorts however…..so I will fib the daily chart to get a short zone.

Currently I have an Earth and Sky short zone between 0.7616 and 0.7673 with areas to keep an eye on the 0.7684 and 0.7697 resistance areas where after I will re look to short this pair again.

Possible counter longs at 0.7500 and 0.7486 support areas.

Notes:

While the 200 EMA at 0.7697 holds my bias will be to look for short set ups.

………………………………………………………………

7) Aussie JPY on the 4 hour chart:

The direction Indi is long on the 4 hour and mixed on the daily chart. Last week we closed plus 109 pips higher than the opening. My bias is still to look for shorts however…..so I will fib the daily chart to get a short zone.

Currently I have an Earth and Sky short zone between 86.22 and 87.16 with areas to keep an eye on 86.22 resistance areas where after I will re look to short this pair again.

Possible counter longs at 84.35 and 83.63 support areas.

Notes:

My bias will be still to look for shorts. I will prefer if price can break back under the cluster EMA`S we have at 86.00 before I will re look for my short set up.

………………………………………………………………

8) Dollar JPY on the DAILY chart:

The direction Indi is mixed on the 4 hour but still long on the daily chart so we will have to fib the daily chart for the earth and sky long zone here.

Currently I have an Earth and Sky long zone between 112.27 and 111.56 with areas to keep an eye on 112.60 (38.2fib) and 111.86 support areas where after I will re look to long this pair again.

Possible counter shorts at 113.69 and 114.00 and 114.60

Notes:

Currently we sitting on top of the cluster EMA`s and by the looks also a little triangle. I will prefer a break to the upside.

………………………………………………………………

9) Dollar CAD on the DAILY chart:

Notes:

Sitting on my hands for now. Looking at the chart we can see how price ranges between last month’s high at 1.2900 and this month’s low at 1.2600.

While these levels holds as resistance and support I will be looking to trade the range.

………………………………………………………………

10) Dollar SGD on the DAILY chart :

The direction Indi is short on the 4 hour and daily chart…..however last week we only closed min 14 pips lower than the opening so I will prefer to fib the daily chart for the earth and sky short zone.

Currently I have an Earth and Sky short zone between 1.3540 and 1.3600 with areas to keep an eye on at the 38.2 fib at 1.3512 and 1.3526 and 1.3540 resistance areas where after I will re look to short this pair again.

Possible counter longs at 1.3420 and 1.3392 support areas.

Notes:

Keep an eye on the dollar index as these two are correlated and it can help you with extra confirmation.

………………………………………………………………

11) Dollar Index on the DAILY chart :

Notes:

The direction Indi is short on the 4 hour and long on the daily……last week we only closed plus 11 pips higher than the opening so we very flat at the moment.

What I don’t like is the way how price don’t respect the cluster EMA`S we have at 93.66. We broke it to the upside….just to break it to the downside again and now we broke it to the upside again.

Being the last week of trading for me this year I will be sitting on my hands and only re look to short once we get to the MR1 pivot and daily 200 EMA at 94.64 and 94.86.

……………………………………………………………..

I will be back tomorrow with a comprehensive Earth and Sky analysis plus a video clip for you !!

Regards

Pierre