Impact of China Downturn

Hi everyone,

This week let’s have a look at how a Chinese economic downturn could impact the rest of the world. The full article is available here but I’ll show some selected extracts.

Across many of the largest economies, consumers are enduring high prices and high interest rates. While the U.S. Federal Reserve, Bank of Canada, European Central Bank, and Bank of England have been raising interest rates and signalling they will stay high for some time, one central bank cut interest rates in August: The People’s Bank of China lowered its one-year loan prime rate to 3.45%.

There’s a good reason. China doesn’t have an overheated economy and thus is charting its own macroeconomic policy path. Policymakers in Beijing are confronted with deflationary pressures, yuan depreciation, and a struggling property sector. Given the size and wide influence of China’s economy, economists and market observers suggest that these challenges could potentially have broader implications beyond China’s borders, such as:

-A negative effect on global metal exporters.

-New trade partnerships.

-Cheaper goods for developing markets.

China’s Impact on Global Commodities Companies

The downturn of the property sector, which used to be a primary economic growth driver, is an example of the impact of China’s campaign to deleverage its economy and reduce its reliance on debt- and investment-led growth. This downturn has had wider-reaching effects, as amid weak Chinese domestic investment and sluggish sales of new homes, commodities-exporting countries that are exposed to China as an end market have taken an immediate hit. Economists think this environment will continue to depress global commodities demand and commodities prices.

A China Slowdown Could Reshape Trade Deals

Equally, investors should not forget that the trading pattern isn’t static, and subdued demand from China can be offset by other economies and sectors that are in need of raw materials and commodities inputs. Chris Kushlis, chief of China and emerging-markets macro strategy at T. Rowe Price, agrees that producers of metals solely tied to housing construction could face pressure from China’s slowing property development. However, a shift toward green energy infrastructure may provide support to metals-intensive exporters in South America, Indonesia, and South Africa.

Cheaper Chinese Goods Could Help Global Inflation Outlook

Exports to China could be under pressure, but cheaper products are a boon to importers of Chinese manufactures. This holds especially true for economies struck by stubbornly high inflation, which welcome lower prices from the world’s manufacturing hub. Tiffany Wilding, economist and managing director at Pimco, says: “While disruptions and changes to post pandemic economies have raised questions about the extent to which the Chinese economy still dominates global trade and industrial cycles, we see several reasons to expect spillovers to intensify in developed markets.”

Awaiting Stimulus From China

As the backdrop remains deflationary for China, economists think the next catalyst that is pertinent to kick-starting the economy is policy stimulus. BNY Mellon’s Mitra is among the market watchers who worry that China could see a worse year ahead if the right amount of policy support isn’t in place. “[The property sector] is indeed the biggest driver of the downturn in the Chinese economy,” Mitra says. “It accounts for around one quarter of Chinese GDP and its slump has clearly hurt growth. But the erosion of private-sector confidence has, likely, limited the scope for any offsetting upturn and fueled the deflationary spiral.”

The full article is available here

…………………….

DXY chart:

I think we will see some further upside in the $

Gold;

Strong $ hitting gold this week.

Oil;

I think oil might challenge the $100 a barrel level.

Bitcoin;

Holding out against a strong $. I’m keenly watching the 30k level.

+++++++++++++++++++++++++++++

You can also follow us on Twitter https://twitter.com/marcwalton

+++++++++++++++++++++++++++++

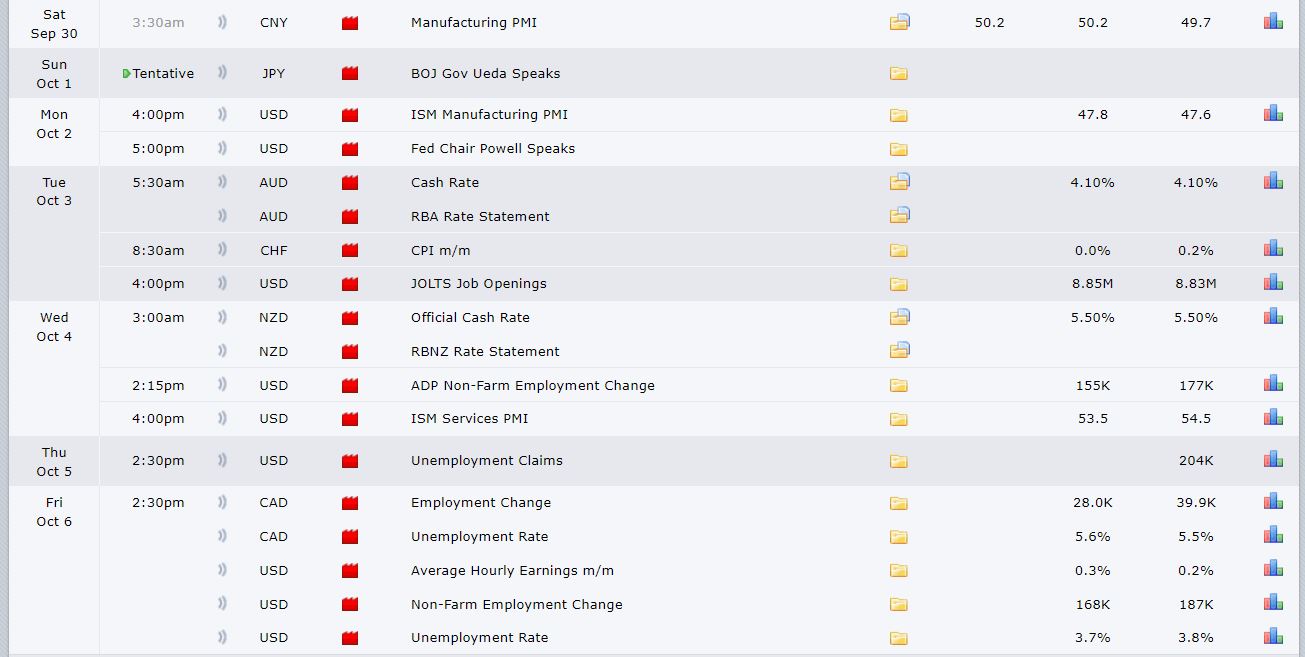

Red flag news:

First week of a new month means a lot of news.

++++++++++++++

MAJORS

EUR/USD: Looking to short from 1.0760

USD/CHF: Looking to long form 0.9080

GBP/USD: Short from 1.2400

AUD/USD: Short from 0.66500

NZD/USD: Short from 0.61200

USD/CAD: Long from 1.34600 -I’m looking at the shorter timeframes with this one.

USD/JPY: Still leaving alone for now.

CROSSES

EUR/GBP: Long from 0.86500

EUR/CAD: Negative Canadian $ news on Friday, but I’m keeping an eye on 1.44500

AUD/CAD: See video.

GBP/AUD: 1.9250 is key. Look for a break above or below.

GBP/CAD: 1.685 to short.

GBP/CHF: See video for an update on the pattern we have been following.

AUD/NZD: Short from 1.0780

As always, remember correlation! -Especially when taking more than one JPY trade!

M3 -Shorter timeframes.

I do my analysis on daily and weekly charts first and make a note of the MAJOR areas of support and resistance. Then copy them onto Pierre’s Earth and sky template. Then I make a note of the weekly & monthly pivots points and add them to the charts. You will see lots of opportunities line up during the week. The important thing then is to select a bias for the next few days and do NOT take trades if the price is too near a trend line or pivot. Ideally, you want to buy when the price is near a major support and or pivot point line and has the potential to make at least 40 pips. Vice versa for a short.

New members, please note: If I am looking to take a trade long, for example, 1.5000, I place my order 10 pips above & 10 pips below for a short. This is because price often does not quite reach a major line and you need to allow for spreads.

We are NOT a “tipping service” our aim is to teach you how to trade for yourself.

Watch the video below for more detailed explanations of this week’s analysis and trade plan (click the 4 arrows bottom right to view full-screen):

Regards

Thinus