Hi everyone.

What’s up and what’s down this morning?

Well Marc is still `down under` on a trip of a life time enjoying his time with his lovely happy wife.

Why is she so happy?

She is carrying his wallet !! 🙂

Mmmmmm…….It sounds you need some good set ups again Marc to boost the cash flow but before you get to exited take note that its today the FOMC`s release and tomorrow we have a lot of major news events, all of which could cause some serious swings, so best advice maybe is to take ownership of your wallet again till the dust have settled !!!

Let’s have a look at Marc`s Sunday analysis with some notes I made today:

………………………………………………………………………………………………..

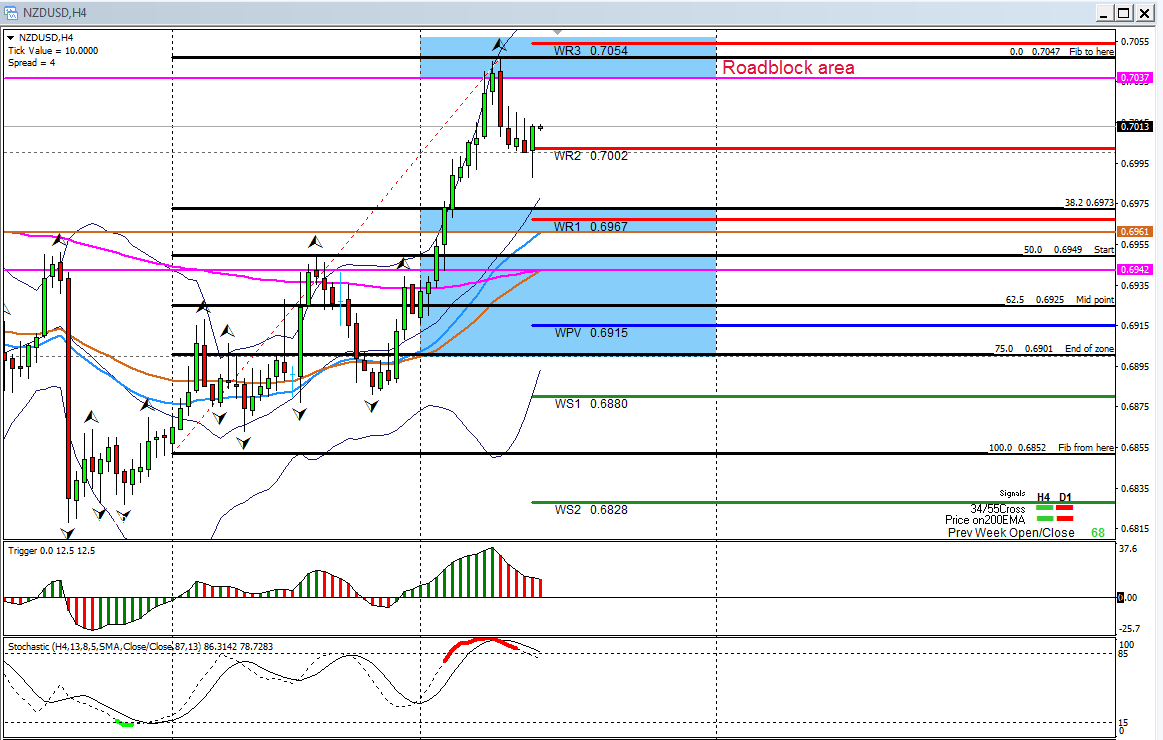

1) Dollar/NZD :

My analysis from a month ago saw a decent M2 break out pull back entry on a weekly chart, but unfortunately it only went 100 pips. There has been a recent flurry of Nzd news so look out for any more this week, at the moment I am still only interested to short and 0.6950/0.7000 is the area for me. If it breaks higher I will leave for now.

Wednesdays notes :

This one had a nice bullish run for the early part of the week even breaking Marc`s psychological level at 0.7000 to the upside. However this run was stopped dead in its tracks at the daily 200 EMA just under the WR3 pivot point at 0.7035/ 0.7055.

This will be a key resistance area for us again so look for possible shorts from here.

Currently we dropped back but sitting on the WR2 pivot that can give support for now……but be careful if it breaks we will can drop to the WR1 pivot and 4 hour 55 EMA at 0.6968 and even lower to 0.6940 where we have the 4 hour 200 EMA and 55 EMA waiting to give support.

Re look for possible longs from here again.

………………………………………………………………………………………………..

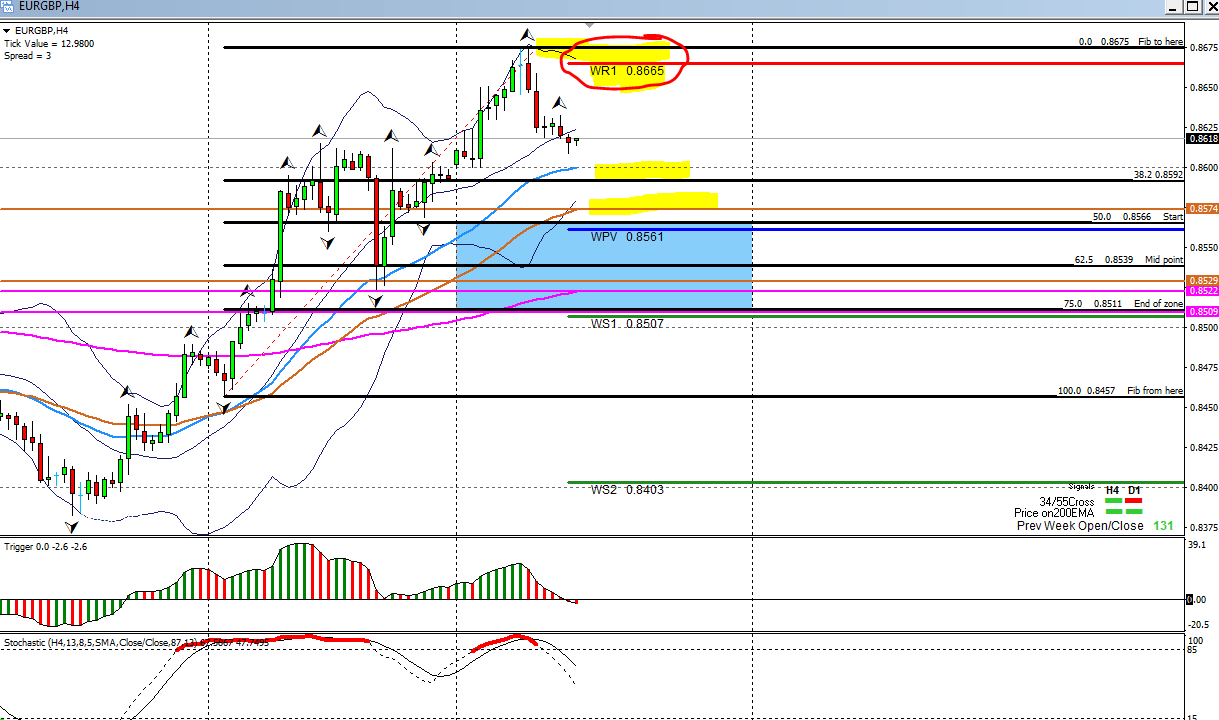

2) Euro/GBP :

I have explained on numerous occasions how this pair usually stops at whole numbers. Last time I posted I explained that a break of 0.8500 would be good for a long, where did it stop? 0.8600! It was a bit tricky to catch on a daily chart BUT the 1 hour trigger worked perfectly again for the entry and the obvious target came from the daily/weekly

0.8600 is now key. If it breaks back down you ALL know the target! If it breaks up then see if you catch it on the 1 hour if not look for M2 pull backs on longer time frames.

Wednesdays notes :

This one broke Marc`s psychological level at 0.8600 to the upside this week but yesterday morning I showed you we had MACD divergence on the 4 hour and 60 min chart as price got closer to the WR1 pivot at 0.8665 where I said to look for a possible short set up.

Price did find the resistance and dropped back for the counter trade. This short is currently 50 pips up and I hope to get to the 0.8600 psychological level as profit take one…….profit take two will have to be at the 55 EMA at 0.8572.

………………………………………………………………………………………………..

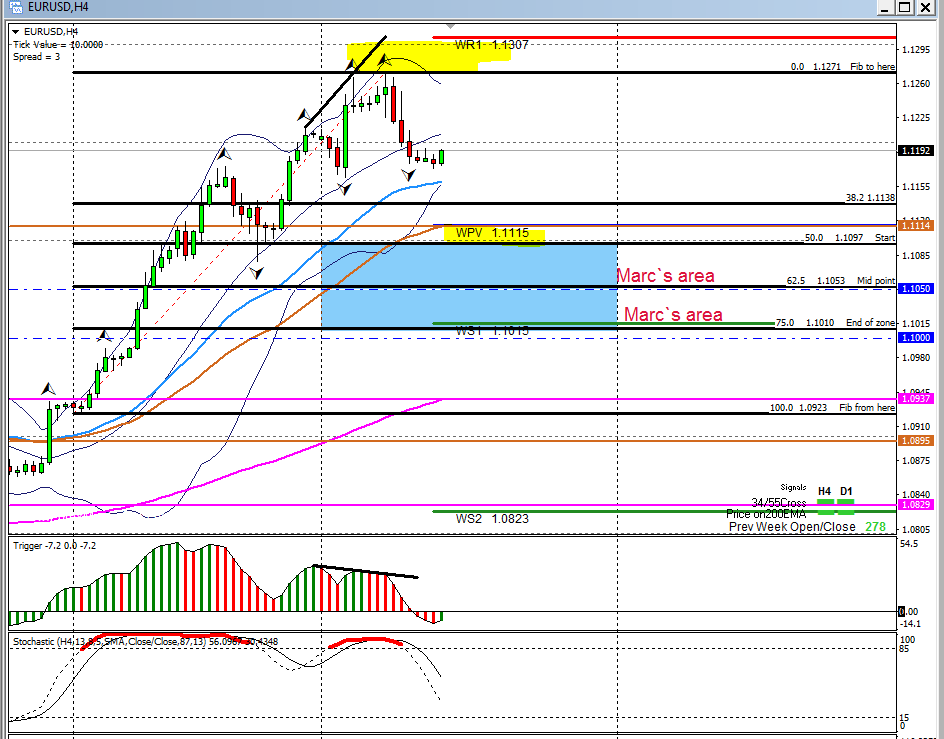

3) Euro/Dollar :

Very similar. I explained pre the French election result how 1.100 was THE major area. Price hung around there for a while before finally surging upwards, once again the 1 hour trigger system gave an excellent entry.

On the daily I want a pull back to long 1.1000 is obviously the better area but it may not go that far, so watch on smaller time frames. 1.1050 is a weekly trend line. Also watch the 1 hour trigger again.

Wednesdays notes :

On Monday we broke the psychological level at 1.1200 to the upside. I warned however that we have MACD divergence on the 4 hour chart Tuesday morning and also showed you that we highly overbought as we already past the MR2 pivot at 1.1191.

Price started to break to the down side yesterday and we sitting just under that MR2 pivot.

Marc`s areas for possible long set ups are at 1.1050 and 1.1000 but also keep an eye on the 1.1115 level as a possible support as we have the weekly main pivot and 4 hour 55 EMA camping out here that can give support….followed by a possible long again.

……………………………………………………………………………………………….

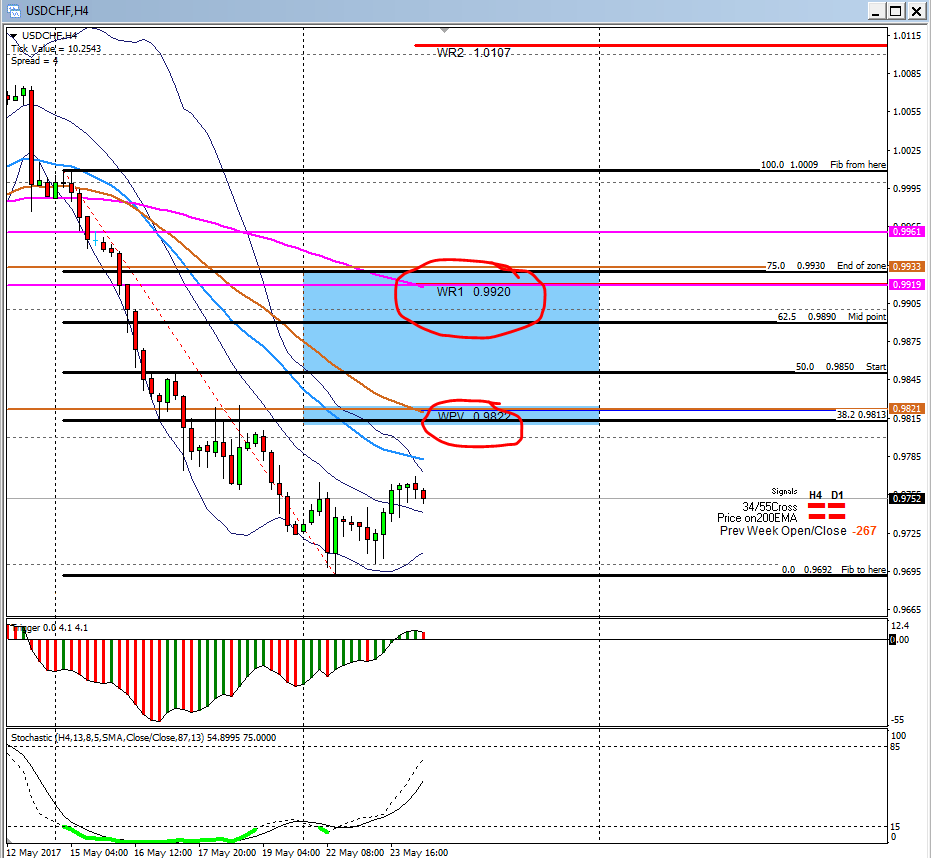

4) Dollar/CHF :

When trading the Euro/$ you MUST watch this pair for correlation. It has stopped to the pip at major EMA`Ss and may well bounce back up, at least temporarily. If it does then it will give more confidence that the Euro is going to pull back down.

Wednesdays notes :

This one is a naughty pair at the moment and I got burned last week with a counter long. If we look at the daily chart we can see price already broke last month’s low, the MS1 pivot and the MS2 pivot to the downside.

I took my long from the MS2 pivot at 0.9756 but price broke this level another 70 pips to the downside before we found support at the psychological level at 0.9700.

I will sit on my hands for now……and only trade with he trend. Possible first roadblock this week will be at the 38.2 fib on the 4 hour chart, the weekly main pivot and 4 hour 55 EMA at 0.9822……if that break to the upside, look at previous support, now resistance at 0.9849 ( this is the 50% fib too on the 4 hour)

If that break to the upside……..huge area at 0.9920 where we have loads of EMA`S waiting to give resistance.

………………………………………………………………………………………………..

5) The Yens are all at major weekly areas:

The $/Yen and Aud/Yen already made their moves, but the Euro Yen is there now. The Aud is also at a major trend line. See the video on how I am looking to play them.

Wednesdays notes :

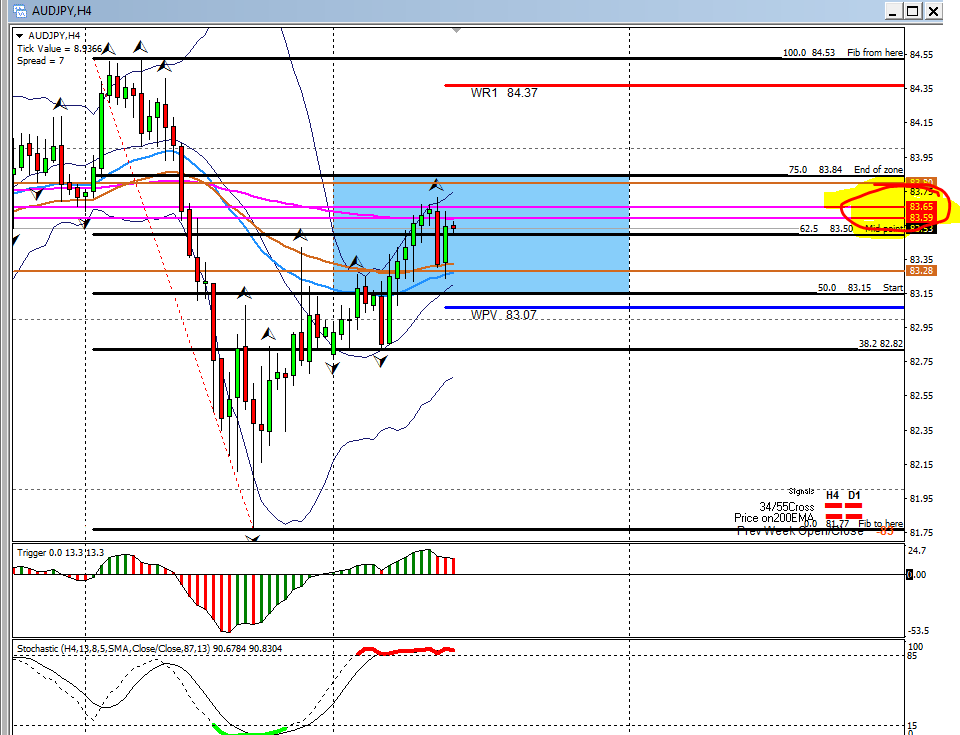

1) Aussie/JPY:

Slammed right into the 200 EMA`S in my trading zone this week and burned fingers at the 83.59 and 83.65 levels. This will be key resistance areas again this week so keep your eyes on it. If it holds – great bit if we break to the upside for some reason then I will only re look to short from the WR1 pivot and last week’s high at 84.37 again.

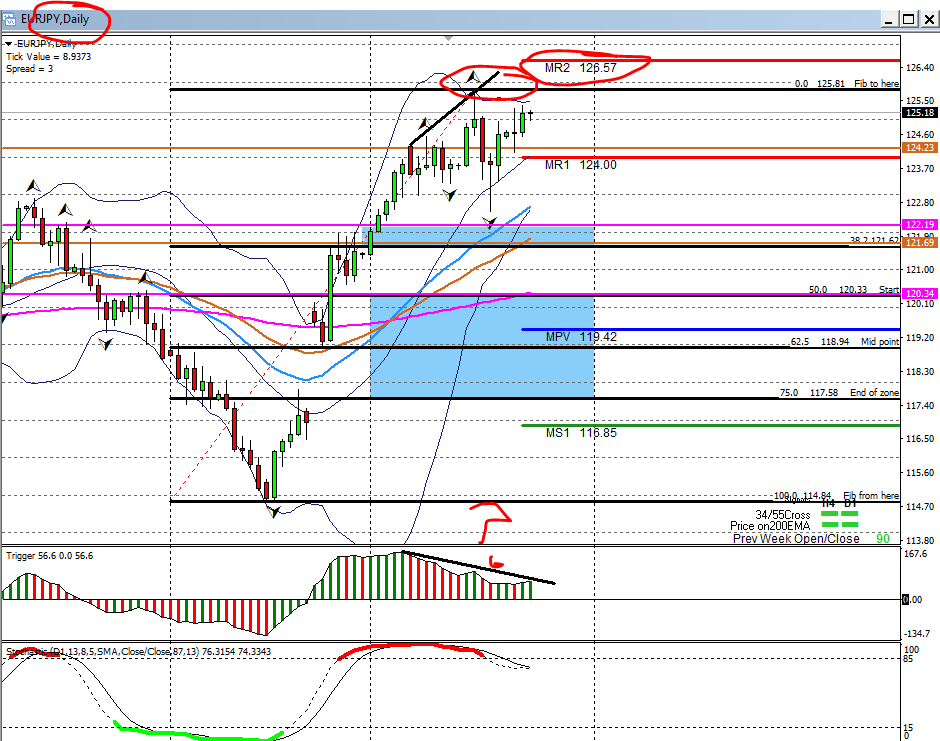

2) Euro/JPY:

I don’t trust at the moment. We highly overbought and we sit on the other side of the MR1 pivot. We have MACD divergence warning us that a correction is coming up so be careful…..if that 4 hour 55 EMA and MR1 pivot at 124.00 breaks to the downside….we can drop fast.

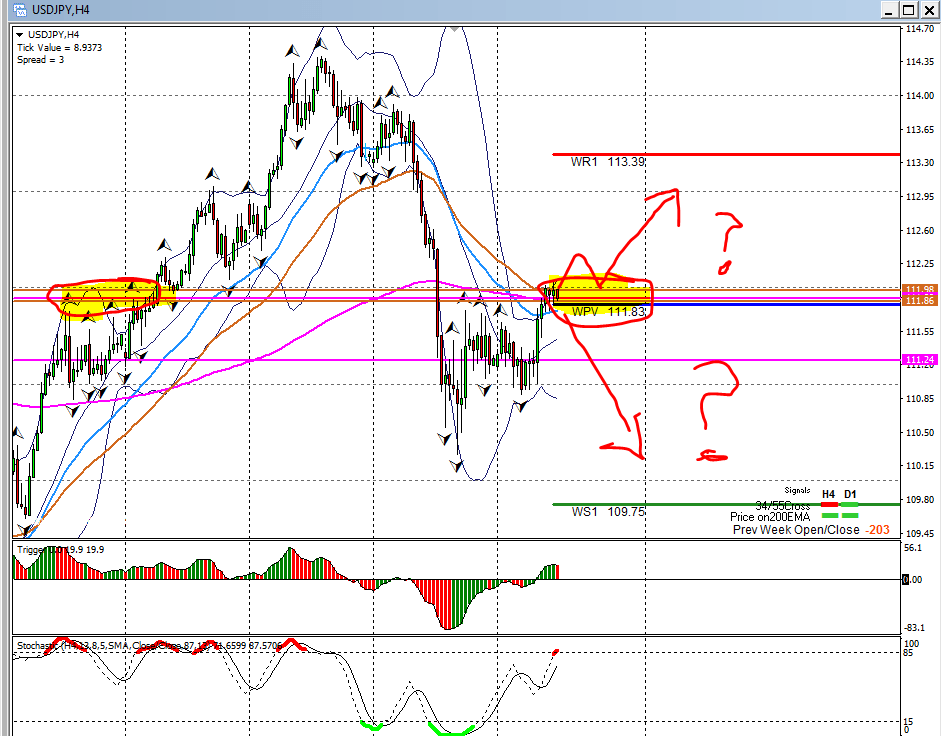

3) Dollar/JPY :

On the 4 hour chart is currently at a key resistance level as we sitting at the weekly main pivot, the 55 and 200 four hour EMA`S plus previous support/resistance if we look to the left of the chart…..so it’s make up your mind time for this one.

Keep your eye on the Dollar Index as this one will follow it.

………………………………………………………………………………………………..

6) Dollar/SGD :

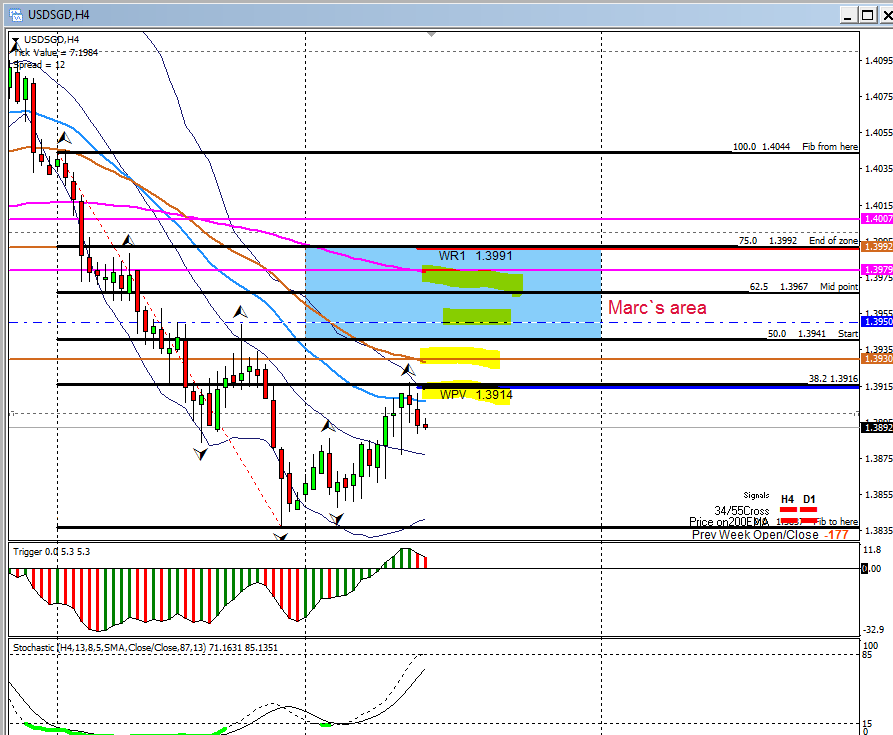

You MUST keep your eye on Trump and $USA volatility (and FOMC). I am tempted to short if it pulls back to 1.3950 and I prefer a long at 1.3500

Wednesdays notes :

This one pulled back in the early part of the week and currently we hitting the weekly main pivot at 1.3914 at the 38.2 fib.

Keep an eye on this level but also on the 55 EMA at 1.3930, Marc`s level at 1.3950 and the 200 EMA at 1.3979 level for possible short set ups.

………………………………………………………………………………………………..

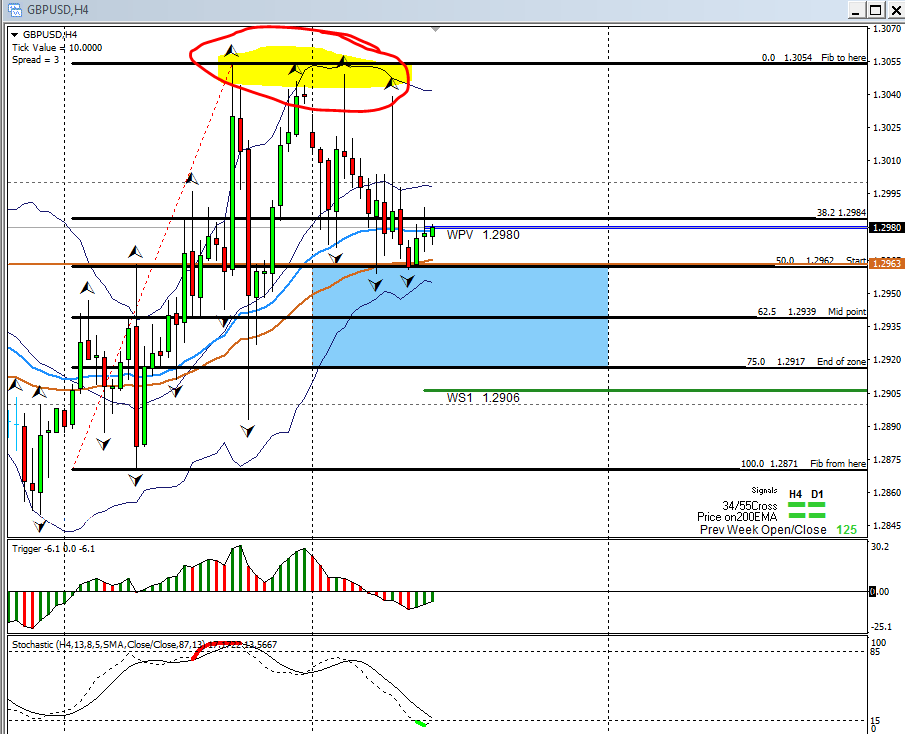

7) GBP/Dollar :

Yes it finally broke 1.3000 which is technically a very big area and normally a buy “signal” BUT you will have seen last week’s 100 pip spike down which took less than 20 pips and a LOT of stops so be very careful.

Brexit, elections and market makers ensure this will continue to be a wild and often erratic journey.

Wednesdays notes :

Once again…..naughty little one this. As Marc have mentioned……the 1.3000 was key. but once again price got to last week’s high at 1.3054 and spike down immediately and we right back 90 pips and sitting on the 4 hour 55 EMA and 50% fib.

While this 55 EMA holds, possible longs can set up…..but be careful with this wild horse at the moment.

………………………………………………………………………………………………..

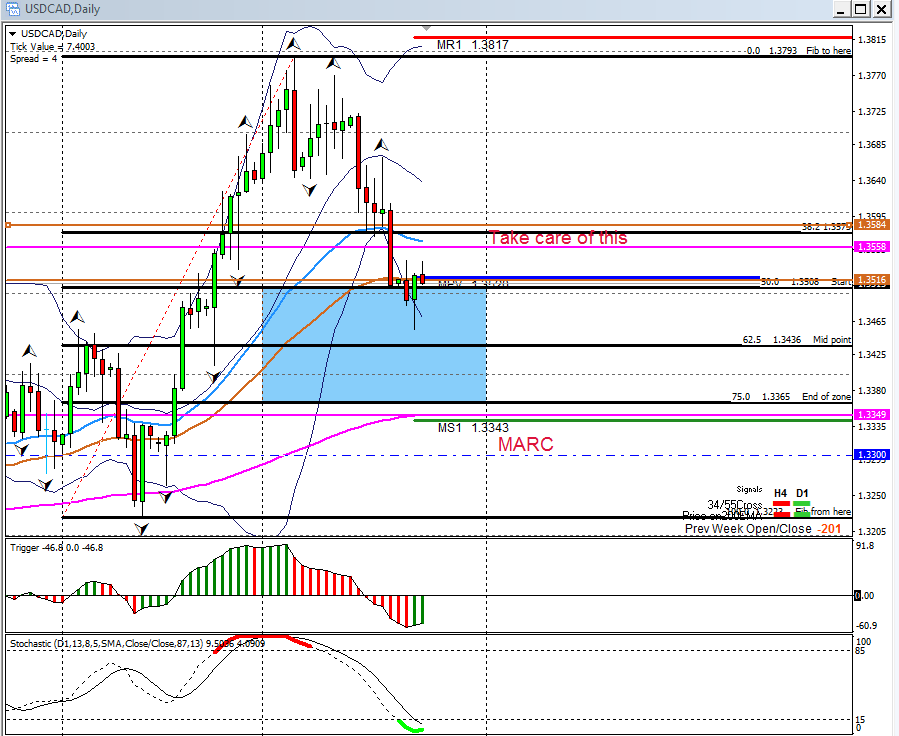

8) Dollar/CAD:

Oil broke up and therefore the $USA fell against the Cad. OPEC meet this week so oil could have a wild ride too. I am interested to long the Cad and 1.3300 will again be my favoured area.

Wednesdays notes :

We still a long way from Marc`s level at 1.3300. Currently on the 4 hour chart we can see that price is sitting on the monthly main pivot and daily 55 EMA at 1.3516 so we might get a long opportunity from here but take note of the 200 and 55 EMA`s at 1.3516 and 1.3584 as it can be a roadblock.

Probably better for price to break that to the upside first before we look for longs.

If we break to the downside….re look at the 200 EMA and MS1 pivot point at 1.3343 for support and then a long position again.

For more up to the minute updates do not forget to drop by the forum in Pierre’s corner.

Well that is that for the mid week update…………Now let me go see if I can find some cake and tea !!!

Regards

Pierre du Plessis