Good morning everyone.

I hope you are all well this stunning Friday morning.

Not the best week when it comes to volume/momentum. Some pairs were very very slow to get to our levels of interest but no follow thru after that.

Did you notice the Bollinger bands on some of them?

They were closing up fast on some pairs and making tweezers and that is a sign that liquidity is drying up !!

I must be honest…….I find the markets a little harder after Mr Trump came on the scene. It’s like the market is tippytoeing – scared that it will wake someone up !!

However, there will always be trades out there……………

One pair that didn’t tippy-toe this week was the GBP/JPY pair. This one I called on Monday as we were at key resistance levels for a short setup. Price dropped like a stone and we got to last week’s low in no time giving us well over 200 pips with this move.

Later in the week we had another opportunity to short from the Earth and Sky zone. Price found the resistance at the weekly main pivot and psychological level and gave us some more pips !!

The naughty pairs for this week – the Aussie/Dollar and Aussie/JPY !!

Both of them this week didn’t respect the 200 EMA`S and sliced right thru them. My Aussie Dollar counter long from the support level at the WS2 pivot and 200 EMA turned into a loser this morning as my stop was triggered !! So not cool.

But as Marc always say: move on dot com !!!

……………………………………………………………………………….……..

Let`s have a look how we did for the week.

……………………………………………………………………………….……..

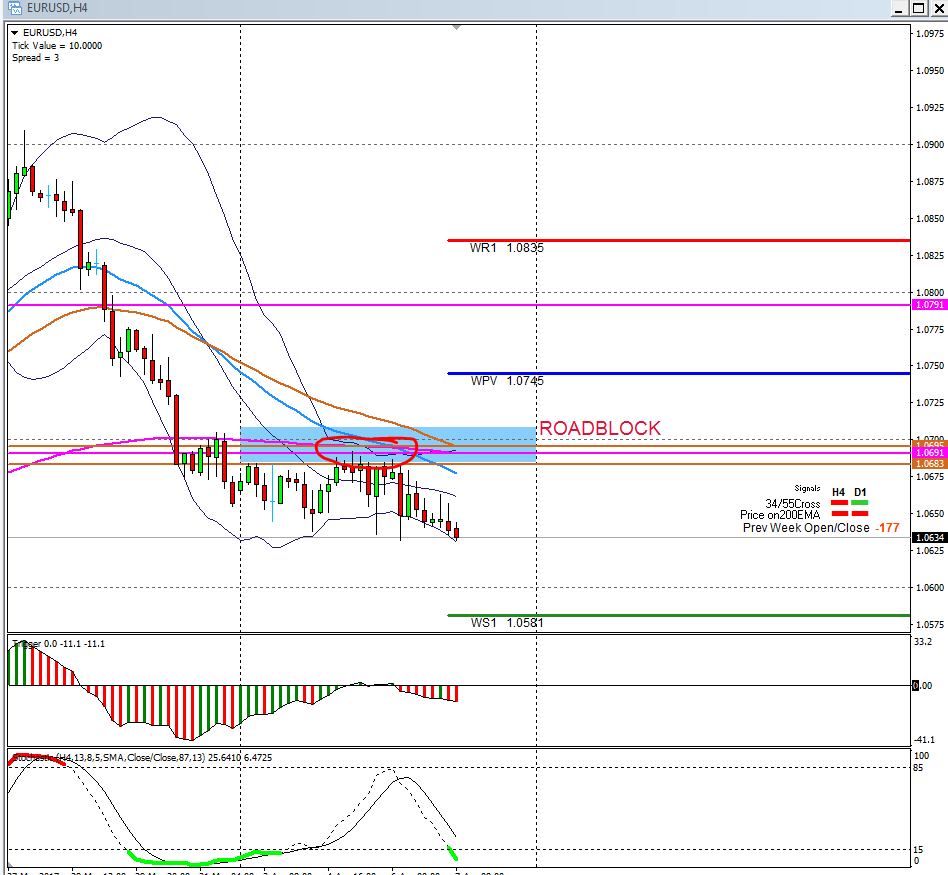

1) Euro/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 177 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy”

Notes:

We broke the 4 hour 200 EMA and the daily 55 EMA and new monthly main pivot to the downside. Three ways to play it this week

* Possible M2 short from the 1.0687/99 levels.

* If that breaks to the upside possible M2 long set ups from 1.0697 to the 55 EMA at 1.0731 and if that breaks to the upside to 1.0795 levels.

* Possible shorts from the daily 200 EMA at 1.0795.

Fridays notes:

Well looking back this morning we can see that that cluster of EMA`S between 1.0685 and 1.0704 kept price down. Problem is that volume/momentum was very very low this week and we only had a limited move of 50 odd pips on this pair.

While this roadblock holds my bias will be to look for shorts.

……………………………………………………………………………….……..

2) Euro/JPY on the 4 hour chart:

Difference between last week’s open/close: Min 117 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 119.01 and 119.73 levels

Potential area to look for reaction: At the 119.26 and 119.49 and 119.90 levels.

Potential Profit take areas: At the 118.00 and 117.43 levels.

MACDEE Divergence: No

Stochastic: Oversold.

Counter Trades:

Potential Counter Trades: At the 117.43 levels.

Potential Profit take areas: At the 118.07 and 118.67 and 119.26 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

We are highly oversold on this one so I am expecting a correction.

Fridays notes:

After my write up on Tuesday price made new lows so we had to follow it so that the zone can adjust. The new zone then started at 118.94.

Price broke the WS1 pivot to the downside and dropped all the way to the WS2 pivot at 117.43. Here we found support and price moved bullish.

Now this chart this morning is a typical example where a support level broke (WS1 pivot) and price found support at the WS2 pivot. Now once support breaks that turns into resistance……..so the bullish move from the WS2 pivot slammed right into the WS1 pivot and turned again.

…………………………………………………………………………………..…..

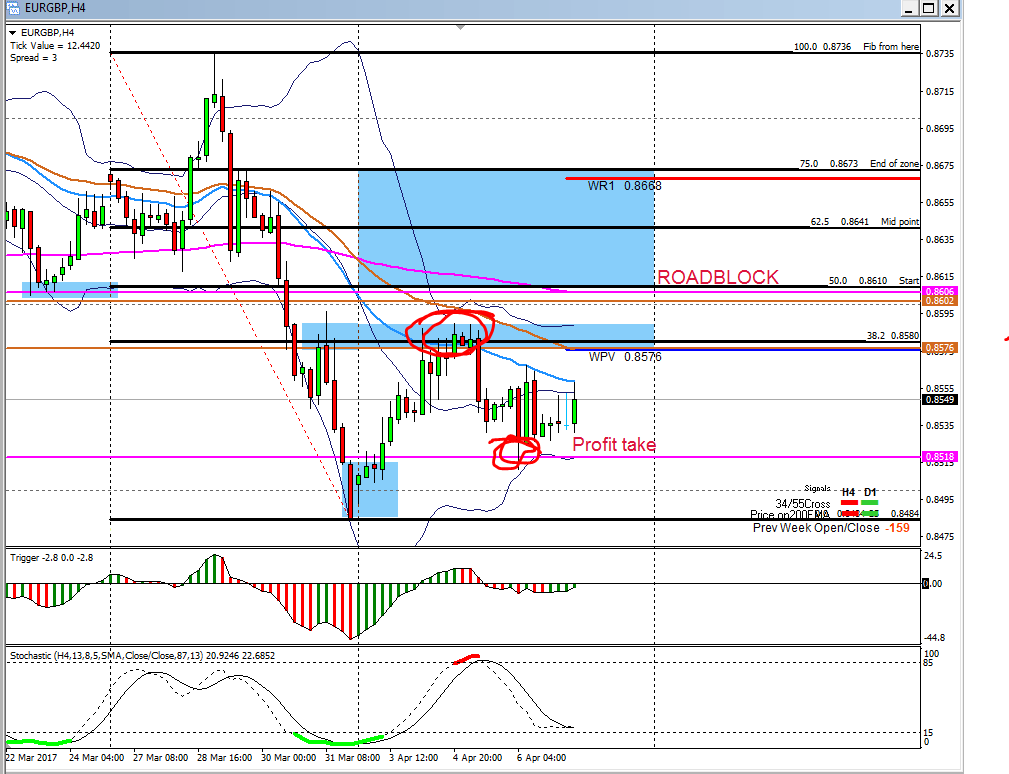

3) Euro/GBP on the 4 hour chart:

Difference between last week’s open/close: Min 159 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

LAST WEEK WE CLOSED MIN 8 PIPS LOWER THAN THE OPENING. The direction is mixed on the 4 hour but still long on the daily…..that is why I had to fib the daily chart.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.8610 and 0.8673 levels

Potential area to look for reaction: At the 0.8600 and0.8608 and 0.8618 levels.

Potential Profit take areas: At the0.8517 levels

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 0.8484 and 0.8417 levels.

Potential Profit take areas: At the 0.8576 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction Indi is mixed between the 4 hour and daily chart. I will fib this week the 4 hour however for a short zone while the EMA`S at 0.8618 holds as resistance.

We had the bounce I called yesterday from the 200 EMA at 0.8517.

Fridays notes:

This one had a nice correction but didn’t get to my 50% fib at 0.8610 where my main area was to short this pair. Looking back this morning we can see how the weekly main pivot and 55 EMA at the 38.2 fib gave a roadblock and limited the bullish move. Price dropped back to the daily 200 EMA at 0.8517 giving 60 odd pips if you took the short from this roadblock at 0.8576.

……………………………………………………………………………………….

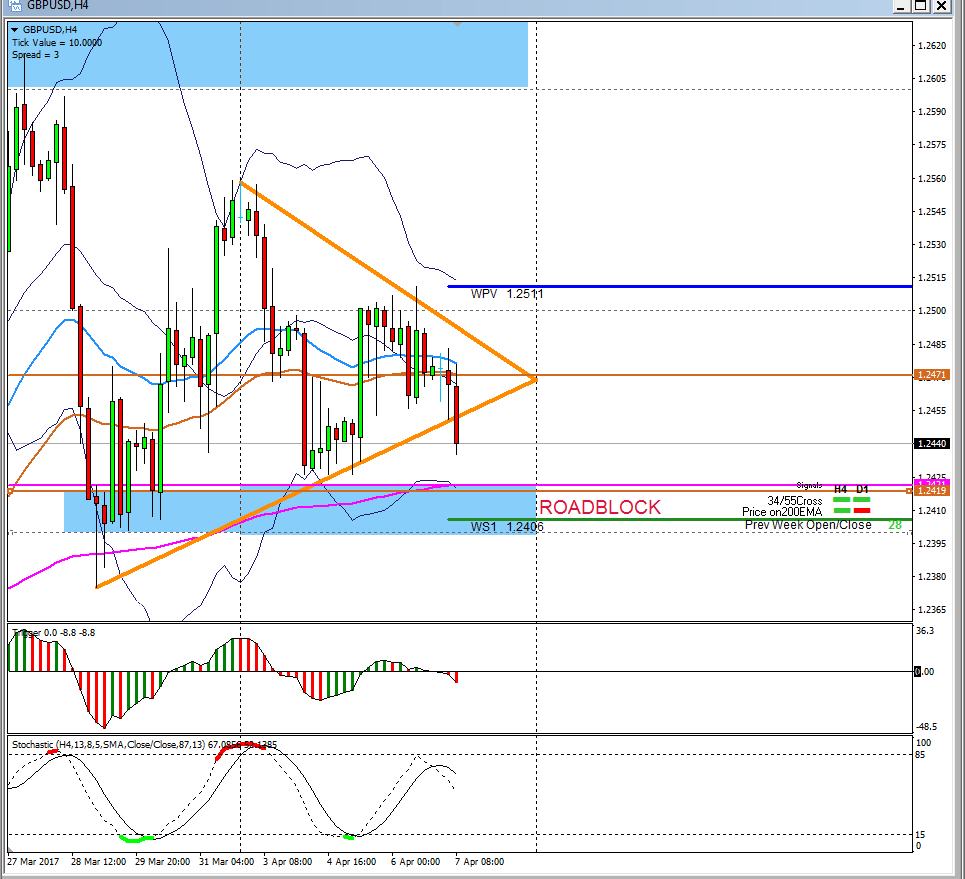

4) GBP/Dollar on the 4 hour chart:

Difference between last week’s open/close: Plus 28 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Notes:

Currently we dropping. I will re look for a possible long from the 200 and 55 EMA`S and WS1 pivot at 1.2406.

Fridays notes:

Price had a nice drop from Monday but didn’t get ALL THE WAY ( got within 13 pips) to our preferred area where we wanted to look for longs from the EMA`S at 1.2418 levels.

Yesterday I showed you in the webinar that we were ranging sideways and that it looked like we trapped in a triangle on the 4 hour chart.

By the looks of it we still trapped in a triangle and we need to wait for the break out.

……………………………………………………………………………………….

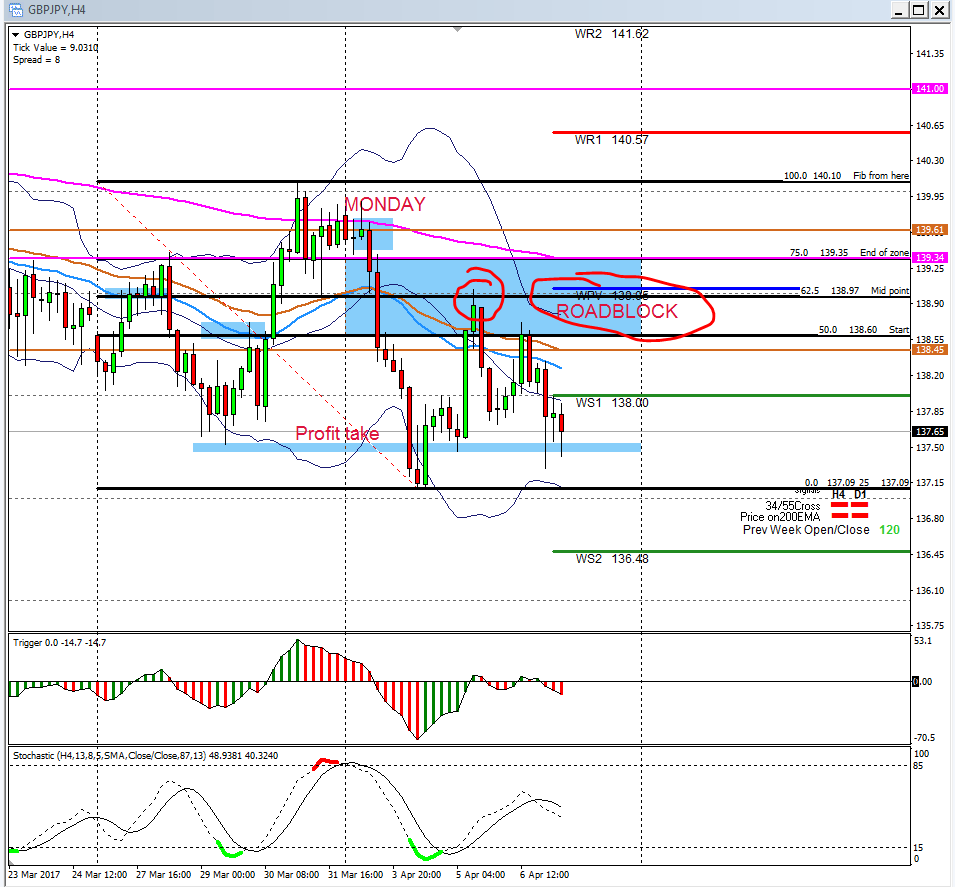

5) GBP/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 120 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 138.65 and 139.37 levels

Potential area to look for reaction: At the 138.90 and 139.00 and 139.63/79 levels.

Potential Profit take areas: At the 138.00 and 137.21 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 137.00 and 136.48 levels.

Potential Profit take areas: At the 138.00 and 138.90 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

This one triggered very nicely from my levels I called yesterday at the mother in law`s 200 EMA and 55 EMA at 139.63 and dropped already over 240 pips so a correction must surely be on the cards. But don’t call a bottom as we still can go to 137.00 and 136.48

Fridays notes:

This was the trade of the week.

On Monday we were just on the other side of the original 75% fib area at 139.46. Lust above that we had a 200 and 55 EMA as a roadblock where price found the resistance we needed. Price dropped from here reaching our main profit take at last week’s low at 137.52 giving us over 200 pips with this move.

Price made new lows so we had to follow it with our fib to get the adjusted zone for the week. The new trading zone now was between 138.60 and 139.40.

Price pulled back nicely to the zone and touched the psychological level and main weekly pivot in the zone where after it turned bearish again, giving another opportunity to short this pair. This move once again dropped over 150 pips.

……………………………………………………………………………………….

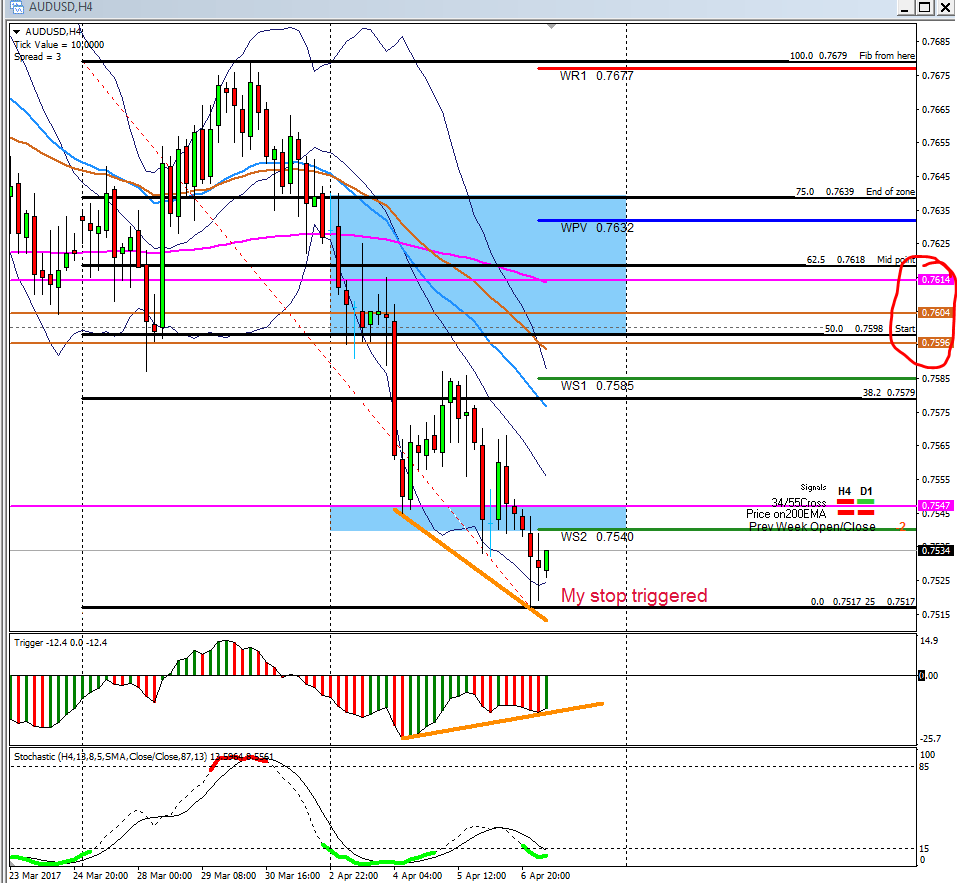

6) Aussie/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 2 pips.

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.7621 and 0.7650 levels

Potential area to look for reaction: At the 0.7612 and 0.7626 and 0.7534 levels.

Potential Profit take areas: At the 0.7585 and 0.7565 and 0.7540 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 0.7547 and 0.7540 levels.

Potential Profit take areas: At the 0.7585 and 0.7612 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction on the 4 hour is short….and long on the daily chart. We have two opportunities this week. One to look for shorts from the levels I called OR once we hit the daily 200 EMA and WS2 pivot point areas for support followed by confirmation to long this pair again.

Fridays notes:

Price had a big drop since Monday and we already over a 100 pips down. With the new lows we made we had to follow price with our fib to get the adjusted trading zone. The current zone is at 0.7598 and 0.7639 with loads of EMA`S in the zone.

We had a big support level at the WS2 pivot as we also have a daily 200 EMA here at 0.7540. I took a forward order from this level but my stop got hit this morning so not cool !!!

I will sit on my hands for now with the Aussies as we can see that the AussieJPY did the same this week.

……………………………………………………………………………………….

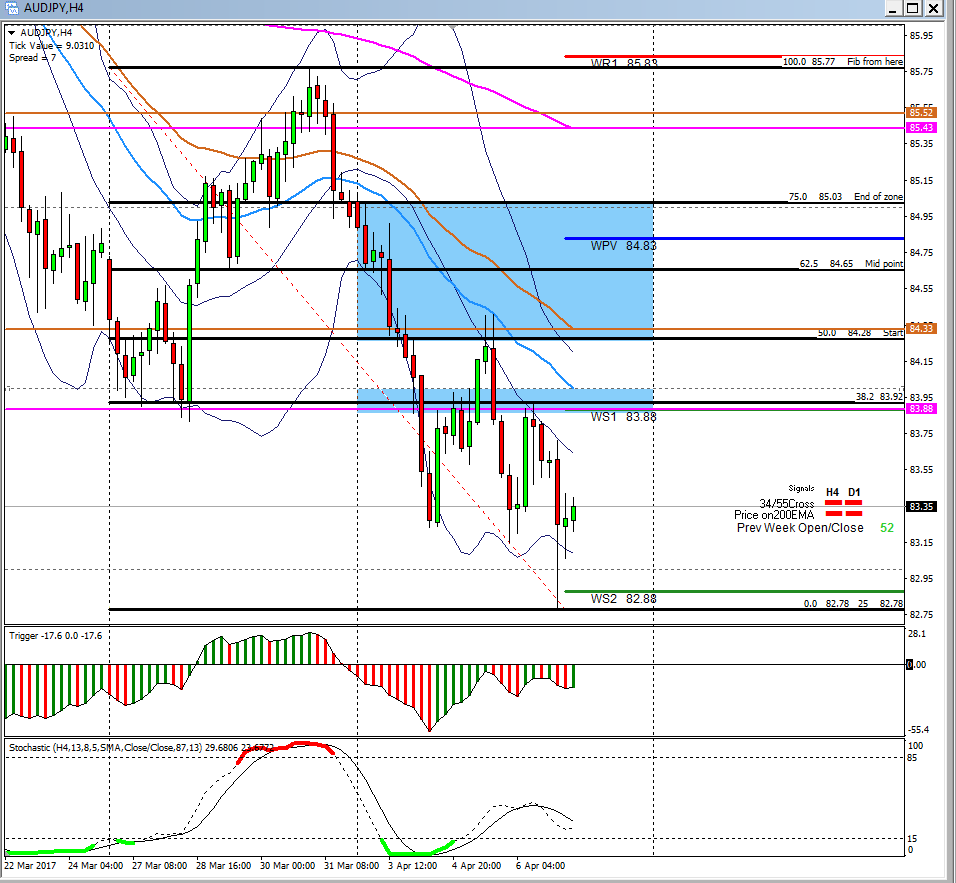

7) Aussie/JPY on the 4 hour chart:

Difference between last week’s open/close: Min 52 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 84.62 and 85.20 levels

Potential area to look for reaction: At the 84.83 and 85.00 levels.

Potential Profit take areas: At the 83.88 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 83.38 and 82.88 levels.

Potential Profit take areas: At the 83.88 and 84.34 and 84.83 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

We broke this morning the daily 200 EMA and WS1 pivot and last week’s low at 83.88 to the downside. So we might say that we have a possible M2 short set up on the cards from this level – However I will prefer a bigger pullback on this one.

Fridays notes:

This one was a naughty one for the week. Early in the week price broke that 200 EMA to the downside at the WS1 pivot at 83.88. I said to look for a possible M2 short set up on this one….price however broke back bullish once again breaking now the support level (200 EMA and WS1 pivot) to the upside but it didn’t get to our zone where we wanted to short starting at 84.51

Price turned bearish again and dropped right past the 200 EMA and WS1 pivot all the way to the WS2 pivot at 82.88 where it looks like its finding support again.

But a bit wild with that it does respect the EMA`S or pivots.

………………………………………………………………………………………

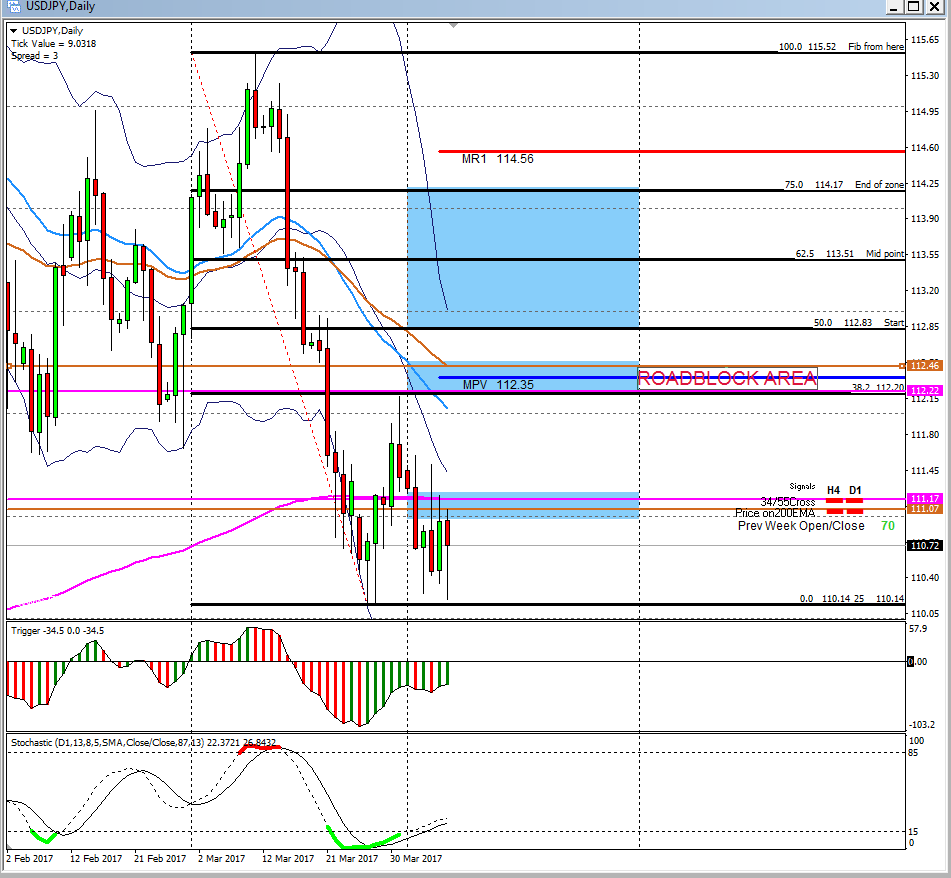

8) USD/JPY on the DAILY chart:

Difference between last week’s open/close: Plus 70 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 112.83 and 114.17 levels

Potential area to look for reaction: At the 112.53 and 112.65 and 112.83 levels.

Potential Profit take areas: At the 111..38 and 111.18 and 110.14 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 109.17 levels.

Potential Profit take areas: At the 111.18/38 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction Indi is showing to look for shorts on the 4 hour and daily chart. Last week we closed plus 70 pips higher than the opening so we can’t fib the 4 hour chart to get an Earth and Sky short zone. If we do fib the daily chart then we have a zone starting at 112.83.

Problem is we have loads of roadblocks before we get to this zone. We have a 200 EMA at 111.18 and a 55 EMA at 111.38 that can form a roadblock this week. Keep an eye on this – but if we break to the upside for some reason then I will re look at the 112.20/53/65/83 levels for reaction to short again.

Fridays notes:

That 4 hour and daily 200 EMA at 111.18 I mentioned on Tuesday turned out to be a big roadblock as price kept on bumping against it but couldn’t break it to the upside.

My area was to look for shorts at least from the 38.2 fib and main monthly pivot at 112.35 but we didn’t get there at all this week……Maybe next week !!

……………………………………………………………………………………….

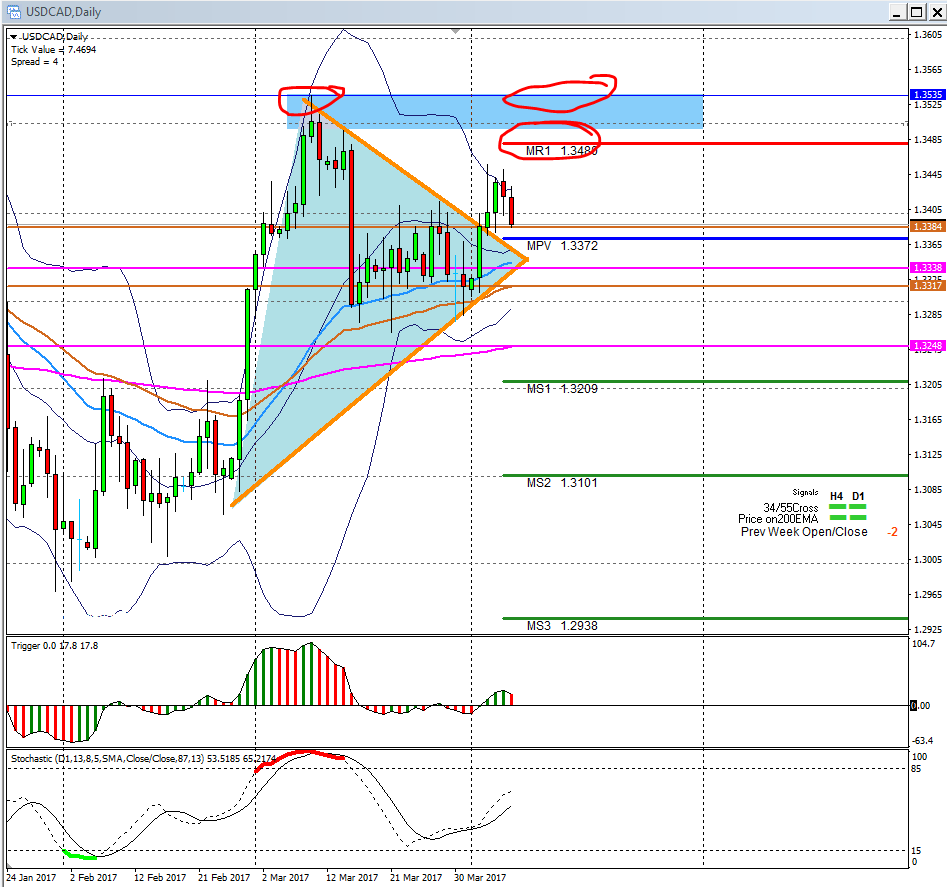

9) USD/CAD on the DAILY chart:

Difference between last week’s open/close: Min 2 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

Notes:

Looks like the triangle I showed you is breaking to the upside this morning. Possible M2 long set ups can be on the cards…..HOWEVER I am not so sure of that as we hitting now last weeks and the week be fore’s high area so we might run into resistance on this one.

If that for some reason breaks to the upside then I will re look for shorts at 1.3480 and 1.3500 where we have resistance waiting again.

Fridays notes:

The triangle broke to the upside, followed by a M2 long setup from the 1.3381 level. This move was also limited and only gave 60 odd pips.

My outlook is still to look for shorts from 1.3480 monthly pivot and last month’s high at 1.3555 levels.

……………………………………………………………………………………..

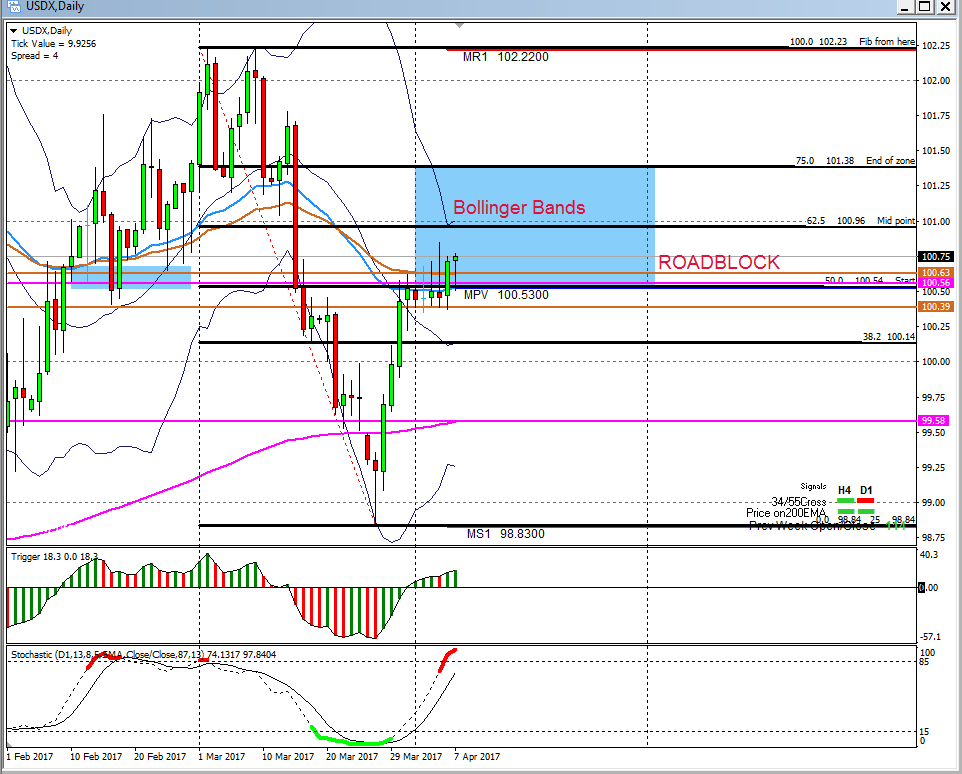

10) USD Index on the DAILY chart:

Difference between last week’s open/close: Plus 114 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is UNDER the 55 EMA (earth)

Direction: Mixed

Potential trading zone: Between the 100.53 and 101.38 levels.

Potential area to look for reaction: At the 100.55 and 100.63 levels.

Potential Profit take areas: At the 100.17 and 99.54 and 98.83 levels.

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 99.54 and 98.83 levels.

Potential Profit take areas: At the 100.53 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction indicator is all mixed up on the daily and 4 hour chart. However….If we fib the daily chart, then we have a zone this morning with price now hitting the 50% fib and key resistance levels as we have 2 EMA`S waiting here too. If we look to the left we can also see this is previous support/resistance level at100.55/63.

Fridays notes:

From Monday to today we were camping out at that monthly main pivot,200 and 55 EMA`S plus previous support/resistance at the 50% fib @ 100.53. This Index had a limited range of only 40 odd pips this week. If we have a look at the bollingerband we can see how they closing up fast making tweezers showing that momentum/volume is low. Maybe with today’s news it will give it a kick under the back side.

……………………………………………………………………………………..

Please remember we are NOT a “tipping service.” What we aim to teach you here at fxmentorpro is how to look for trade set ups using different methods, taking you’re trading to the next level.

Have a good one mates

Pierre 😛

`Learn from yesterday, Live for today and hope for tomorrow`

If you would like to learn how to trade like a professional check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below