I found it a bit difficult this morning to read some of the charts as we broke key EMA`s just to break it again to the other side making it difficult to get the trading zones for this week. Take note of my time frames and the notes I made for each of them.

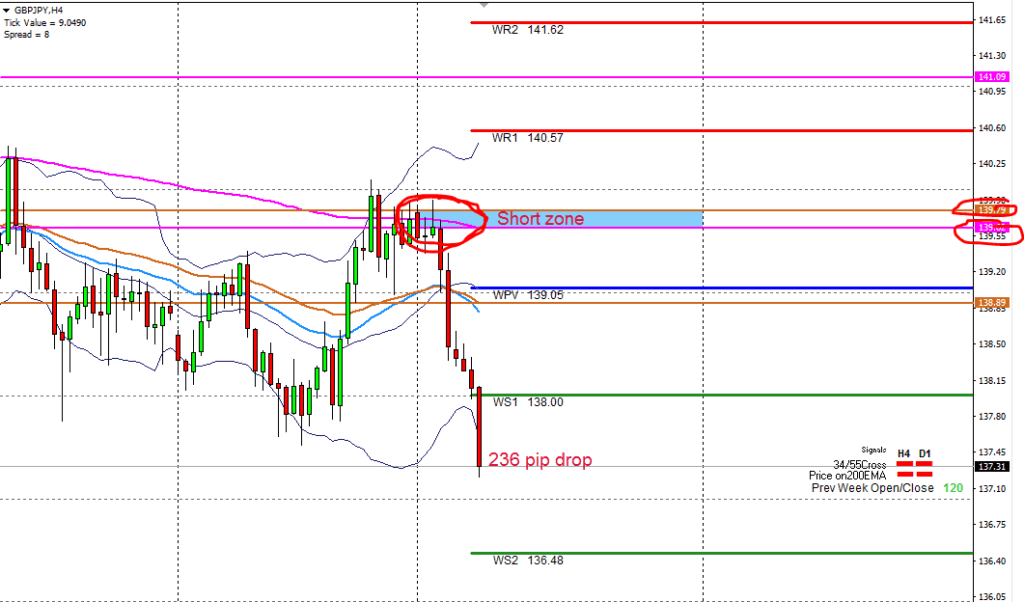

Yesterday the spaghetti indicator told us to keep an eye on the GBP currency as it was overbought – O boy did the GBP/JPY tanked from a key level. I called shorts from the mother in laws dining room table (The 4 hour 200 EMA and 55 EMA) at 139.63 and this one dropped like a stone – already well over 200 pips !!! But be careful now as we getting closer to possible support at the psychological level at 137.00

Yesterdays notes:

6) GBP JPY on the 4 hour chart:

Currently we hitting a key resistance level here at the 200 and 55 EMA at 139.71 and 139.93. MACD is rolling over and stochastic is overbought so a possible short set up might be on its way.

AND THEN THE MOVE……………..(Here we had two strong EMA`s as acting as a roadblock at previous support/resistance level if you look to the left of the chart giving us a good probability for the short set up)

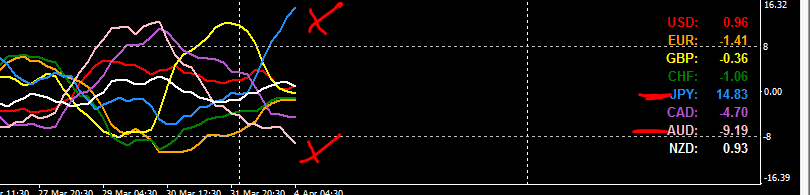

Looking at the spaghetti indicator again this morning we can see its telling us to keep an eye on the Aussie and the JPY currencies. Have a look at the charts and see if you can spot opportunities setting up for these currency pairs. Remember to look for multiple reasons like pivot points, EMA`S, previous support/resistance, psychological levels.

The More Reasons The Higher The Probability

Remember the more reasons the higher the probability that price will react at these levels !!

…………………………………………………………………………

Please register for Forex Mentor Pro Live Training on Thursday Apr 06, 2017 11:00 AM london (BST) time at:

https://attendee.gotowebinar.com/register/8554391061360629251

Live training session with Marc Walton. Pierre du Plessis & Judith Waker. The team will assess fundamentals, M2 Earth & Sky & the trigger system for pote ntial trades. Followed by a Q & A session

After registering, you will receive a confirmation email containing information about joining the webinar.

…………………………………………………………………………

1) `Red Flag News` that can make you lose your pants if you are not careful. 💡

You can use the following web site for `SCHEDULED NEWS` for the week @ http://www.dailyfx.com/calendar

Don`t take any trades just before `Red Flag News` If you are already in a trade, protect your entry. I don’t want to meet up with you at Little Beach, Maui, Hawaii. Did you know this is a nudist beach?

For reference if you don’t want to believe me, have a look at the 4th of April 2013 at all the JPY pairs what happened with price after `Red Flag News` came out. ALWAYS TRADE WITH A STOP!

Still don’t believe me? Then you must be new to Forex Trading

Have a look at what the Swiss did to the market on the 15th of January 2015!!

You would have lost the shirt on your back, your house, your car, your personality and your virginity for a 2nd time if you didn’t have a stop in place!!! 👿

…………………………………………………………………………

2) Where is the `Forum Hang out Spot` that everyone is talking about?

On the top of this main page, go to the ` Forum` Tab and click on it…….once in there, look for `Main forum and Current weeks trades` and click on it………Once in there look for `Pierre`s Earth and Sky Trading week `and click on it……..once in there, look for the Current week`s Thread Tab and click on it……easy as pips! 😉

………………………………………………………………

3) This week`s Analysis:

This is my current `Earth and Sky Trading Zones` – Please take note of the time frames I am looking at.

Sometimes I will refer to `The mother in law` in my video`s or in my write up. The mother in law represents the 200 EMA (the pink line) on that specific time frame.

If you new to the `Earth and Sky` please make sure to read the supporting notes for this system – Look for unit in the education area under Earth and Sky System.

Go to the `Education Tab` here in the main blog and look for the `Earth and Sky Trading System` where you will find helpful videos using this system.

Remember to have a look at some of the other methods we teach here at Forex Mentor Pro too.

………………………………………………………………………….

What’s the spaghetti indicator (RS All Indi) telling us?

The spaghetti indicator shows us that we need to keep our eyes on the Aussies and JPY currencies for now.

………………………………………………………………………………….……

Let’s have a look what’s cooking in the Forex Kitchen !!

The More Reasons The Higher The Probability

1) Euro/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 177 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy”

Notes:

We broke the 4 hour 200 EMA and the daily 55 EMA and new monthly main pivot to the downside. Three ways to play it this week

* Possible M2 short from the 1.0687/99 levels.

* If that breaks to the upside possible M2 long set ups from 1.0697 to the 55 EMA at 1.0731 and if that breaks to the upside to 1.0795 levels.

* Possible shorts from the daily 200 EMA at 1.0795.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/JPY and the Euro/GBP. Be careful; don’t take the same trades on these four pairs at the same time!

Also remember: This pair is `NEGATIVE CORRELATED` (moving in the opposite direction) as the Dollar/CHF pair. Be careful; DO NOT OVER EXPOSE YOUR ACCOUNT BY PLACING OPPOSITE TRADES ON THESE TWO PAIRS.

……………………………………………………………………………….……..

3) Euro/JPY on the 4 hour chart:

Difference between last week’s open/close: Min 117 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 119.01 and 119.73 levels

Potential area to look for reaction: At the 119.26 and 119.49 and 119.90 levels.

Potential Profit take areas: At the 118.00 and 117.43 levels.

MACDEE Divergence: No

Stochastic: Oversold.

Counter Trades:

Potential Counter Trades: At the 117.43 levels.

Potential Profit take areas: At the 118.07 and 118.67 and 119.26 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

We are highly oversold on this one so I am expecting a correction.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/USD and the Euro/GBP. Be careful; don’t take the same trades on these four pairs at the same time!

…………………………………………………………………………………..…..

4) Euro/GBP on the 4 hour chart:

Difference between last week’s open/close: Min 159 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

LAST WEEK WE CLOSED MIN 8 PIPS LOWER THAN THE OPENING. The direction is mixed on the 4 hour but still long on the daily…..that is why I had to fib the daily chart.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.8610 and 0.8673 levels

Potential area to look for reaction: At the 0.8600 and0.8608 and 0.8618 levels.

Potential Profit take areas: At the0.8517 levels

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 0.8484 and 0.8417 levels.

Potential Profit take areas: At the 0.8576 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction Indi is mixed between the 4 hour and daily chart. I will fib this week the 4 hour however for a short zone while the EMA`S at 0.8618 holds as resistance.

We had the bounce I called yesterday from the 200 EMA at 0.8517.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Euro Index, Euro/Dollar and the Euro/JPY. Be careful; don’t take the same trades on these four pairs at the same time

……………………………………………………………………………………….

5) GBP/Dollar on the 4 hour chart:

Difference between last week’s open/close: Plus 28 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Notes:

Currently we dropping. I will re look for a possible long from the 200 and 55 EMA`S and WS1 pivot at 1.2406.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the GBP/JPY pair. Be careful; don’t take the same trades on both pairs at the same time!

……………………………………………………………………………………….

6) GBP/JPY on the 4 hour chart:

Difference between last week’s open/close: Plus 120 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 138.65 and 139.37 levels

Potential area to look for reaction: At the 138.90 and 139.00 and 139.63/79 levels.

Potential Profit take areas: At the 138.00 and 137.21 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 137.00 and 136.48 levels.

Potential Profit take areas: At the 138.00 and 138.90 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

This one triggered very nicely from my levels I called yesterday at the mother in law`s 200 EMA and 55 EMA at 139.63 and dropped already over 240 pips so a correction must surely be on the cards. But don’t call a bottom as we still can go to 137.00 and 136.48

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the GBP/Dollar pair. Be careful; don’t take the same trades on both pairs at the same time!

……………………………………………………………………………………….

7) Aussie/Dollar on the 4 hour chart:

Difference between last week’s open/close: Min 2 pips.

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 0.7621 and 0.7650 levels

Potential area to look for reaction: At the 0.7612 and 0.7626 and 0.7534 levels.

Potential Profit take areas: At the 0.7585 and 0.7565 and 0.7540 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 0.7547 and 0.7540 levels.

Potential Profit take areas: At the 0.7585 and 0.7612 levels

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction on the 4 hour is short….and long on the daily chart. We have two opportunities this week. One to look for shorts from the levels I called OR once we hit the daily 200 EMA and WS2 pivot point areas for support followed by confirmation to long this pair again.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the AUD/JPY pair. Be careful; don’t take the same trades on both pairs at the same time!

……………………………………………………………………………………….

8) Aussie/JPY on the 4 hour chart:

Difference between last week’s open/close: Min 52 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 84.62 and 85.20 levels

Potential area to look for reaction: At the 84.83 and 85.00 levels.

Potential Profit take areas: At the 83.88 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 83.38 and 82.88 levels.

Potential Profit take areas: At the 83.88 and 84.34 and 84.83 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

We broke this morning the daily 200 EMA and WS1 pivot and last week’s low at 83.88 to the downside. So we might say that we have a possible M2 short set up on the cards from this level – However I will prefer a bigger pullback on this one.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the AUD/USD pair. Be careful; don’t take the same trades on both pairs at the same time!

………………………………………………………………………………………

9) USD/JPY on the DAILY chart:

Difference between last week’s open/close: Plus 70 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is under the 200 EMA

34 EMA (sky) is under the 55 EMA (earth)

Direction: Short

Potential trading zone: Between the 112.83 and 114.17 levels

Potential area to look for reaction: At the 112.53 and 112.65 and 112.83 levels.

Potential Profit take areas: At the 111..38 and 111.18 and 110.14 levels

MACDEE Divergence: No

Stochastic: Oversold

Counter Trades:

Potential Counter Trades: At the 109.17 levels.

Potential Profit take areas: At the 111.18/38 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction Indi is showing to look for shorts on the 4 hour and daily chart. Last week we closed plus 70 pips higher than the opening so we can’t fib the 4 hour chart to get an Earth and Sky short zone. If we do fib the daily chart then we have a zone starting at 112.83.

Problem is we have loads of roadblocks before we get to this zone. We have a 200 EMA at 111.18 and a 55 EMA at 111.38 that can form a roadblock this week. Keep an eye on this – but if we break to the upside for some reason then I will re look at the 112.20/53/65/83 levels for reaction to short again.

……………………………………………………………………………………….

10) USD/CAD on the DAILY chart:

Difference between last week’s open/close: Min 2 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

Notes:

Looks like the triangle I showed you is breaking to the upside this morning. Possible M2 long set ups can be on the cards…..HOWEVER I am not so sure of that as we hitting now last weeks and the week be fore’s high area so we might run into resistance on this one.

If that for some reason breaks to the upside then I will re look for shorts at 1.3480 and 1.3500 where we have resistance waiting again.

Correlation: This pair is POSITIVE CORRELATED (moving in the same direction) as the Dollar Index. Be careful; don’t take the same trades on both pairs at the same time!

……………………………………………………………………………………..

11) USD Index on the DAILY chart:

Difference between last week’s open/close: Plus 114 pips

GAP TRADING:

Did we open with a gap this week? No

Did the gap close? N/A

If the gap didn’t close, pop over to the education tab – Look under Marc`s name for his “Gap Trading Strategy” and how to trade it.

Earth and Sky Trading Zone for the week:

Remember, if price don’t give us the pull back but instead make new lows/highs follow price with your fib to get the “adjusted” Earth and Sky Trading Zones for the week.

Price is above the 200 EMA

34 EMA (sky) is UNDER the 55 EMA (earth)

Direction: Mixed

Potential trading zone: Between the 100.53 and 101.38 levels.

Potential area to look for reaction: At the 100.55 and 100.63 levels.

Potential Profit take areas: At the 100.17 and 99.54 and 98.83 levels.

MACDEE Divergence: No

Stochastic: No man’s land

Counter Trades:

Potential Counter Trades: At the 99.54 and 98.83 levels.

Potential Profit take areas: At the 100.53 levels.

Warning: Counter trades are always more riskier than trading with the main trend so change your lot size accordingly if you want to counter trade !!!

Notes:

The direction indicator is all mixed up on the daily and 4 hour chart. However….If we fib the daily chart, then we have a zone this morning with price now hitting the 50% fib and key resistance levels as we have 2 EMA`S waiting here too. If we look to the left we can also see this is previous support/resistance level at100.55/63.

Correlation: Remember that the Dollar Index is negative correlated with the Euro Index (They move in opposite direction) so only take one trade at a time as you will double your risk if you took trades on both index`s.

This pair is also POSITIVE CORRELATED (moving in the same direction) as the Dollar/CAD. Be careful; don’t take the same trades on both pairs at the same time!

……………………………………………………………………………………..

Please remember we are NOT a “tipping service.” What we aim to teach you here at fxmentorpro is how to look for trade set ups using different methods, taking you’re trading to the next level.

Have a good one mates

Pierre 😛

`Learn from yesterday, Live for today and hope for tomorrow`

Remember to make the video clip bigger to see the levels more clearly!

If you would like to learn how to trade like a professional check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below