Teenager in the house!

Good morning everyone.

How you all doing this stunning Monday morning?

Well let me just warn you beforehand……If you have any jokes regarding the rugby game between the Springboks and Ireland I will have to send you to the naughty corner!!

However…You will NOT BE alone as one of our senior members (Crosswind) already got his marching orders early this morning 🙂

OK with that out of the way, looking at the charts this morning it looks a little like a teenager’s bedroom.

It’s messy and I cant find anything worth looking at this morning!

I will have to attend Fotis’ webinar this morning and then will have a meeting with Judith afterwords. Once we are done I will drop some notes for you in the forum to keep you up to speed with what we looking to trade this week. Once we have made sense of whats going on that is – so look out for it !!

This Weeks Live Training Session Webinar:

TRY to get to the live training sessions, we are able to explain our plans in much greater detail and those who can attend have a better chance of having a profitable week. If you can’t make it then make sure to check out the recording and the notes. Some of the trades that we showed in the last session fired and gave pips once more so don’t miss out !

Please register for this week’s Forex Mentor Pro Live Training on Tuesday the 14th of November 2017 – at 11:00 AM BST (London Time) at:

https://attendee.gotowebinar.com/register/5224026420853822722

Live training session with Marc Walton & Judith Waker. ( Sorry mates I can’t make tomorrow – I need to be in Cape Town for some business but as you know…..you in good hands) 🙂

The team will assess fundamentals, M2 Earth & Sky & the trigger system for potential trades. Followed by a Q & A session

After registering, you will receive a confirmation email containing information about joining the webinar.

……………………………………………………………….

The Spaghetti Indicator:

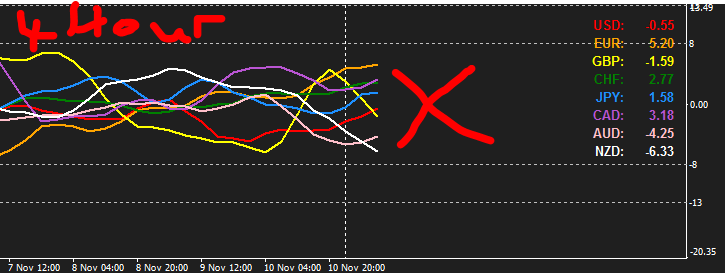

The 4 hour chart :

The Spaghetti Indi is flat on ALL the currencies this morning.

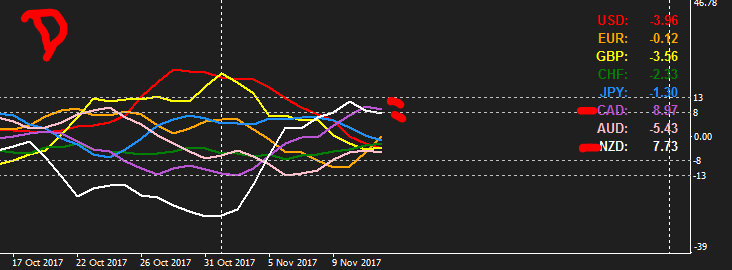

The Daily chart :

The Spaghetti Indi is overbought on the CAD and NZD currencies this morning and very flat on the rest.

So let’s keep an eye on them for possible trade set ups from areas of interest (multiple reasons levels areas)

- If you want to add the overbought and oversold areas to this Indi…..right click on the RS all Indi……then go to the RS All properties…….here we go to the levels tab…..then add the 8 and 13 and min 8 and min 13 line and click on OK.

- Remember then to save a new template.

……………………………………………………………….

……………………………………………………………….

Lets have a look at some notes:

……………………………………………………………….

1) Euro Dollar on the 4 hour chart:

Notes:

The directoion indicator is mixed on the daily and short on the 4 hour chart…however last week we closed plus 50 pips higher than the opening so we cant fib the 4 hour to get a short zone.

We however have a roadblock area between 1.1700 and 1.1718 where we have a WR1 pivot and a 4 hour 200 EMA and a daily 55 EMA that can give resistance where we can have short set ups to follow.

……………………………………………………………….

2) Euro JPY on the DAILY chart:

Notes:

Sitting on my hands with this pair. The direction indi is long on the daily and short on the 4 hour chart……and last week we only closed min 1 pip lower than the opening so we formed a doji on the weekly chart. We already at last months low area so we cant fib last month to get a long zone……..

My plan for this one is to wait and see.

I have 3 areas where we can find support where after I will look for a long set up. The first one is at the MS1 pivot at 131.00 and the second one at 130.00 and then lastly the 129.62 level.

……………………………………………………………….

3) Euro GBP on the 4 hour chart :

Notes:

The direction indicator is short on the 4 hour chart and mixed on the daily chart……plus we closed only 6 pips higher than the opening……..so we cant really fib it.

We are however at a key reistance area on this one. We have a short area between 0.8886 and 0.8921 so I will be looking for trades to set up here.

I will keep an eye on the 4 hour 200 EMA at 0.8886 and the daily 55 EMA at 0.8901 and the WR1 pivot at 0.8921 for possible entry points.

……………………………………………………………….

4) GBP Dollar on the 4 hour chart:

Notes:

We opend with a GAP this morning…..and with this move we broke a 200 EMA and a daily plus 4 hour 55 EMA`S to the downside……this is signigifant and we need to take note if it.

Also looks like we trapped in a triangle on this one too – so add the above then we have a time bomb on our hands.

So for now I will be sitting on the side line.

……………………………………………………………….

5) GBP JPY on the WEEKLY chart:

Notes:

Sitting on my hands with this pair. If we look at the weekly chart we spot MACD divergence plus we sitting at a cluster of EMA`S too plus stochastic is rolling over PLUS we trapped in a triangle on this pair……so all warning signs to be careful.

………………………………………………………………

6) Aussie Dollar on the 4 hour chart:

Currently I have an Earth and Sky short zone between 0.7665 and 0.7683 areas to keep an eye on 0.7670 and 0.7678 resistance areas where after I will re look to short this pair again.

Possible counter longs at 0.7617 and 0.7586

Notes:

If the WR1 pivot at 0.7690 breaks to the upside for some reason be carefull as we migh fly to the upside and go visit the WR2 pivot at 0.7732 where we also have a daily 200 EMA waiting where I will then start to re look for short set ups.

………………………………………………………………

7) Aussie JPY on the DAILY chart:

Notes:

The direction Indi shows we short on the 4 hour and mixed on the daily chart. You can fib the 4 hour chart but I am expecting a bigger bullish move up that will break the earth and sky short zone to the upside……….

So my plan for this pair this week is to stick to the daily chart. I will look for resistance between 87.29 and 88.00 where after I will look for short set ups

Otherwise I will look for support between 86.34 and 86.14 and 86.00 where we have the daily 200 EMA, a MS1 pivot and a psychological level.

………………………………………………………………

8) Dollar JPY on the DAILY chart:

The direction Indi is all mixed up on the 4 hour and long on the daily. We also closed min 43 pips lower than the opening of last week so we can’t find the 4 hour to get a long zone. So we had to fib the daily chart.

Currently I have an Earth and Sky long zone between 113.19 and 112.44 with areas to keep an eye on the 113.03 and 112.68 support areas where after I will look to long this pair.

Possible counter shorts at 114.71 and 114.84 resistance levels.

Notes:

If the 55 EMA support at 112.68 breaks to the downside…..be careful as we might drop to the mother in law dining room table (daily 200 EMA) at 111.66 where I will re look for support to go long.

………………………………………………………………

9) Dollar CAD on the DAILY chart:

Notes:

The direction indicator is mixed on the 4 hour and mixed on the daily chart plus we closed min 68 pips lower than the opening so its really totally mixed up !!

Looking at the daily chart then my only plan I can put together is to look for shorts at the daily 200 EMA at 1.2823 and last month’s high area at 1.2900

Otherwise I will re look to long from 1.2649 and 1.2626 and the 1.2577 areas ( 200 EMA, 55 EMA and the MS1 pivot areas )

………………………………………………………………

10) Dollar Index on the DAILY chart :

Notes:

The direction indicator is long on the 4 hour chart and mixed on the daily chart and last week we closed min 41 pips lower than the opening so it’s really totally mixed up !!

Looking at the daily chart then my only plan I can put together is to look for shorts between 95.30 and 95.53 areas as we have some roadblocks here (200 EMA and MR1 pivot) that can give resistance.

Otherwise if we break to the downside I will re look to long from 94.00 and 93.90 again where we had the inverse head and shoulder neckline and some EMA`S that can give support again.

………………………………………………………………

I will be back tomorrow with a comprehensive Earth and Sky analysis plus a video clip for you !!

Regards

Pierre

If you would like to learn how to trade like a professional AND receive detailed daily analysis BEFORE the event then check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below