Howzit ?

I hope you all healthy and wealthy this Monday evening 🙂

Looking at my charts then we have 8 potential pairs to keep an eye on for the week ahead…..

Lets have a look…..

Let’s have a look at some Earth and Sky set ups to keep an eye on….

……………………………………………………………………

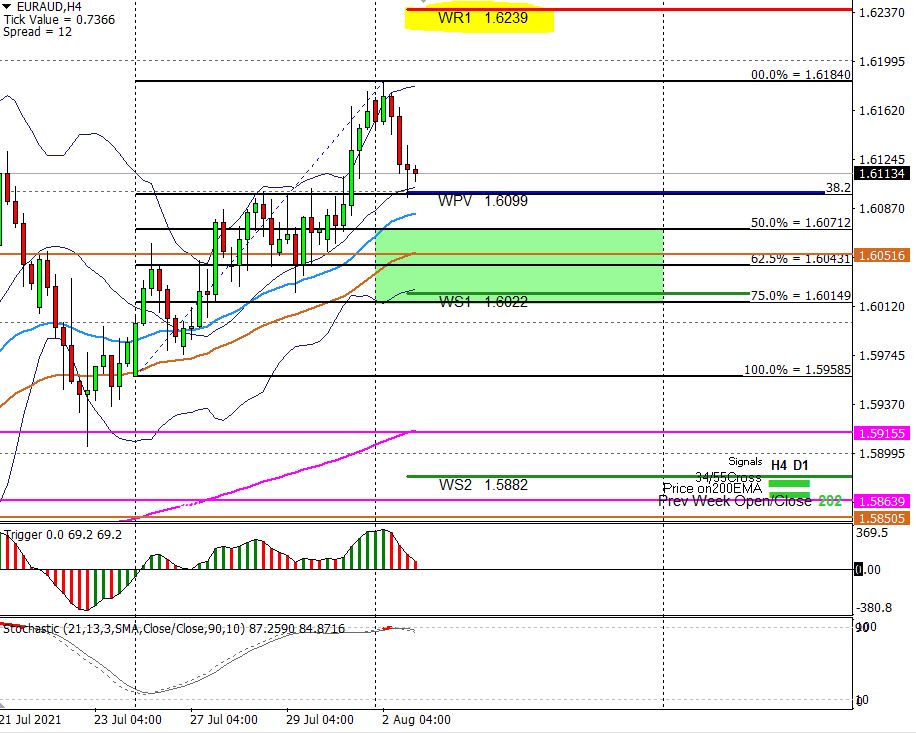

1) Euro/Aussie the 4 hour chart:

The direction indicator is long the 4 hour AND THE daily chart and we closed plus 202 pips higher than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 1.6071 and 1.6014 with areas to keep an eye on at 1.6051 and 1.6043 and 1.6022 areas again for possible longs.

Target: 1.6184 and 1.6200 and 1.6239 areas.

Counter shorts from the 1.6200 and 1.6239 areas.

Target: 1.6099 and 1.6071 1.4155 areas.

Notes:

First support road blog is at the 38.2 bib but I will prefer a deeper correction

……………………………………………………………………

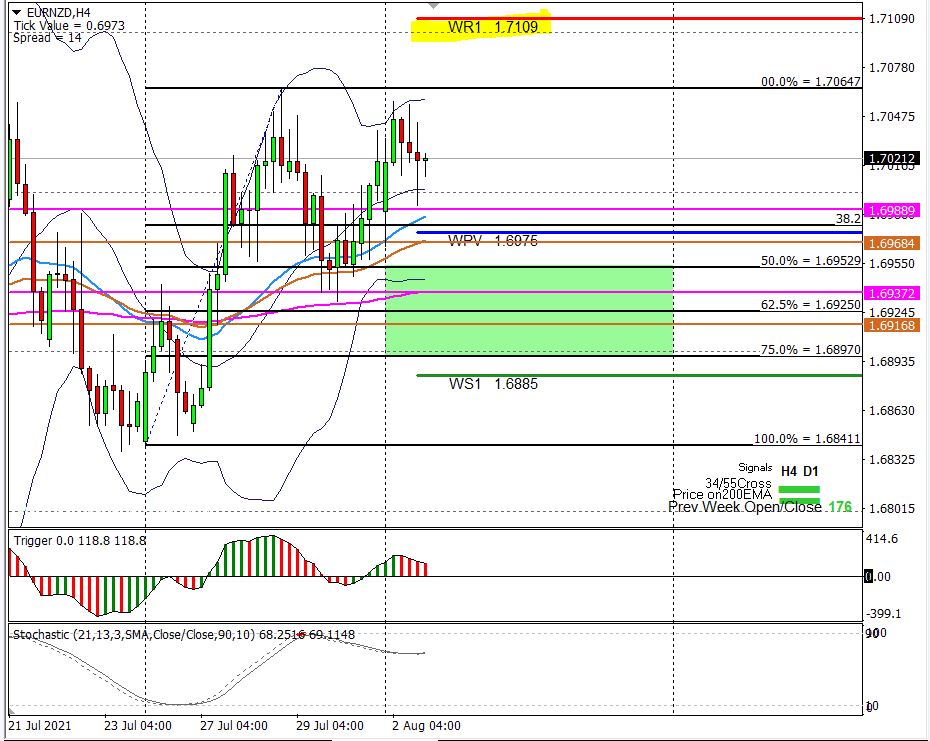

2) Euro/NZD the 4 hour chart:

The direction indicator is long the 4 hour AND THE daily chart and we closed plus 176 pips higher than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 1.6952 AND 1.6897 with areas to keep an eye on at 1.6952 and 1.6925 and 1.6916 areas again for possible longs.

Target: 1.7064 and 1.7109 areas.

Counter shorts from the 1.7109 areas.

Target: 1.6975 areas.

Notes:

First support road blog is at the 38.2 bib but I will prefer a deeper correction

……………………………………………………………………

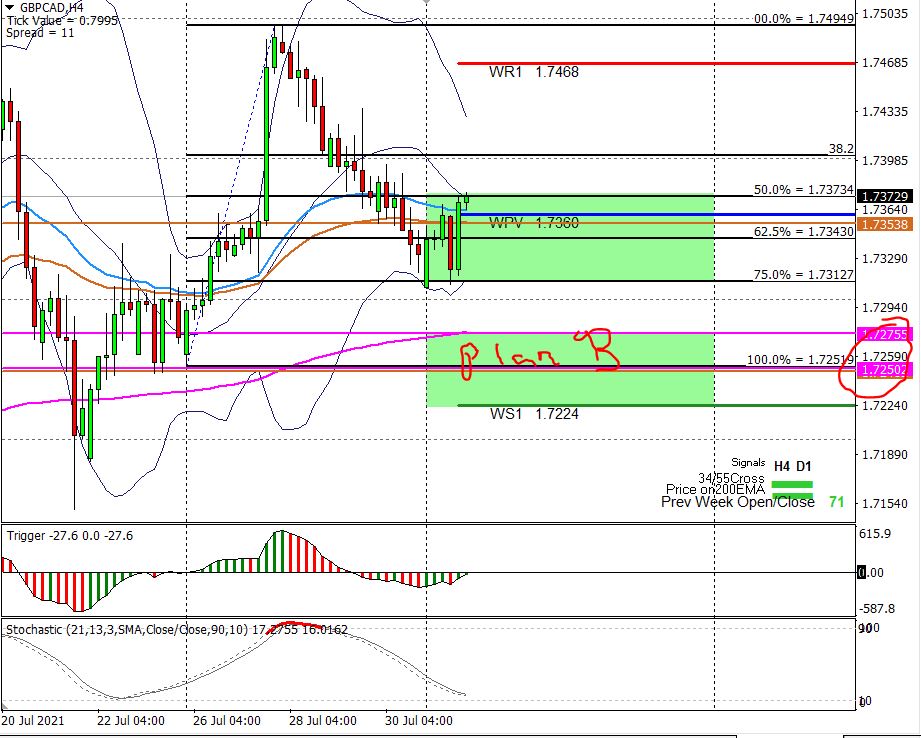

3) GBP/CAD the 4 hour chart:

The direction indicator is long the 4 hour AND THE daily chart and we closed plus 71 pips higher than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 1.7373 and 1.7312 with areas to keep an eye on at 1.7343 and 1.7312 areas again for possible longs.

Target: 1.7468 and 1.7494 areas.

Counter shorts from the 1.7468 and 1.7494 areas.

Target: 1.7360 area.

Notes:

If we break the 75% fib to the downside for some reason then be careful as we can go visit last week’s low at 1.7251 where I will re look for support to long from again…..

……………………………………………………………………

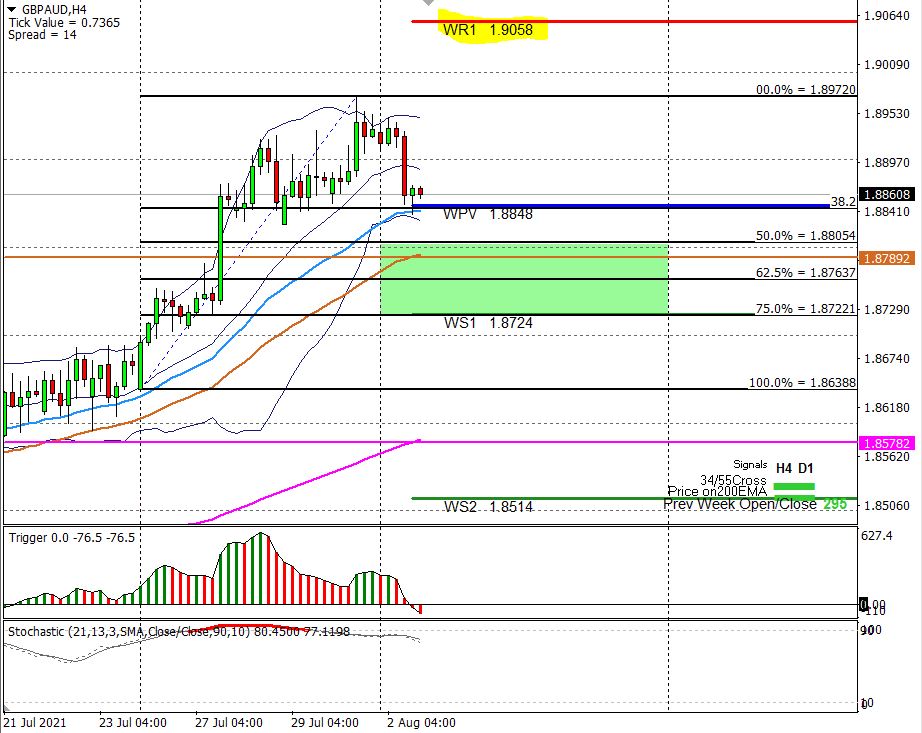

4) GBP/Aussie the 4 hour chart:

The direction indicator is long the 4 hour AND THE daily chart and we closed plus 295 pips higher than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 1.8805 and 1.8722 with areas to keep an eye on at 1.8805 and 1.8764 and 1.8722 areas again for possible longs.

Target: 1.8972 and 1.9058 areas.

Counter shorts from the 1.9000 and 1.9058 areas.

Target:1.8848 and 1.8805 area.

Notes:

First support road blog is at the 38.2 bib but I will prefer a deeper correction

…………………………………………………………………

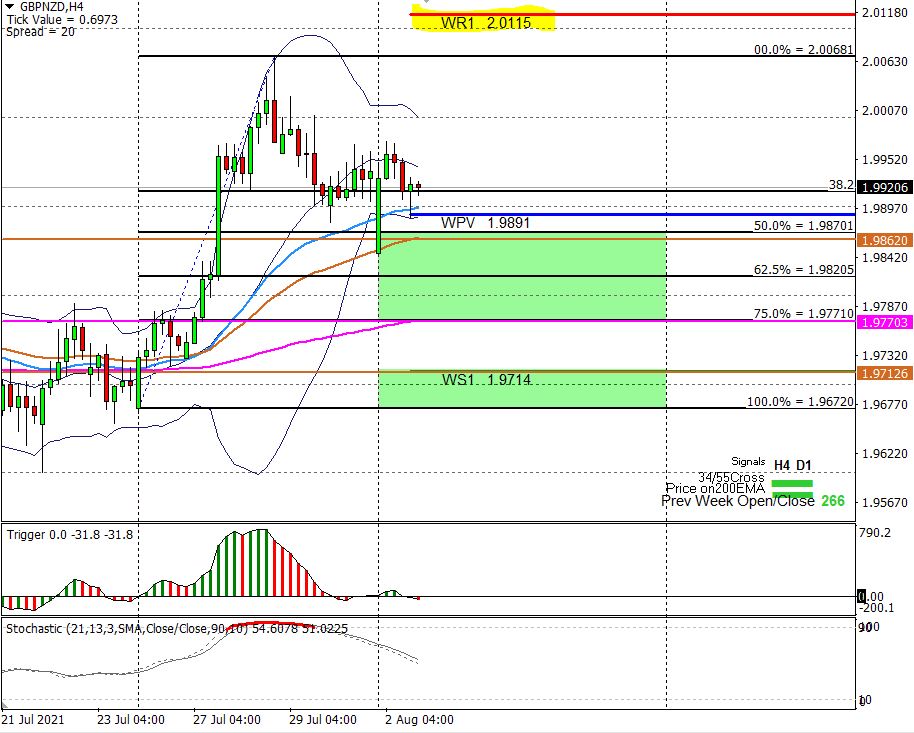

5) GBP/NZD the 4 hour chart:

The direction indicator is long the 4 hour AND THE daily chart and we closed plus 266 pips higher than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 1.9870 and 1.9771 with areas to keep an eye on at 1.9870 and 1.9820 and 1.9771 areas again for possible longs.

Target: 2.0068 and 2.0115 areas.

Counter shorts from the 2.0068 and 2.0115 areas.

Target: 1.9891 areas.

Notes:

First support road blog is at the 38.2 bib but I will prefer a deeper correction

If we break the 75% fib to the downside for some reason then be careful as we can go visit last week’s low at .19700 and 1.9672 where I will re look for support to long from again…..

……………………………………………………………………

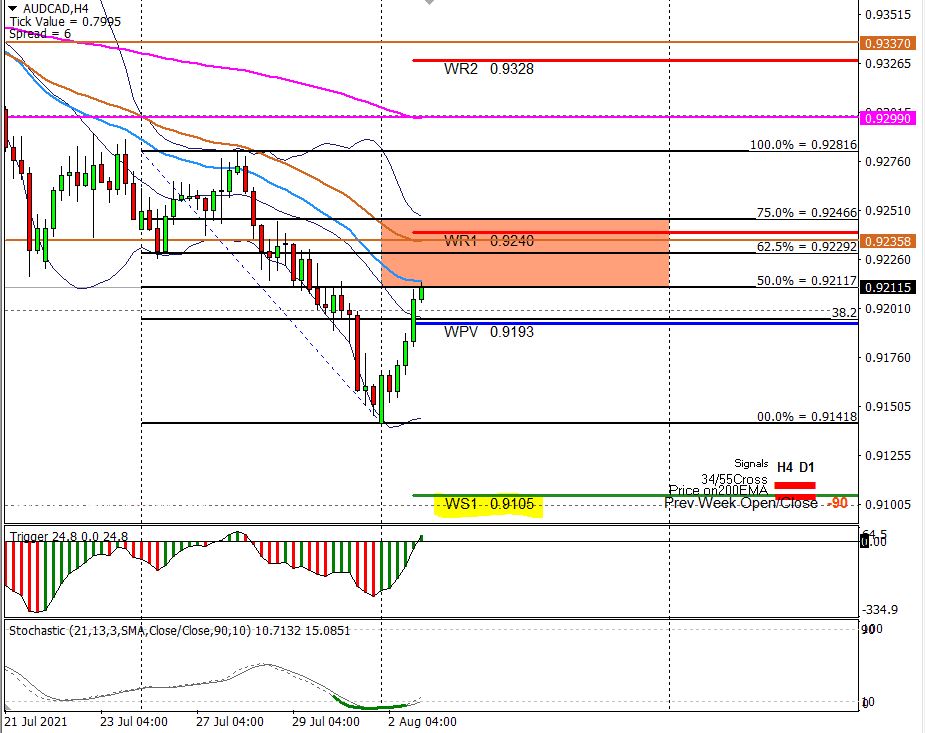

6) Aussie/CAD on the 4 hour chart:

The direction indicator is short on the 4 hour AND THE daily chart and we closed min 90 pips lower than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 0.9211 and 0.9246 with areas to keep an eye on at 0.9229 and 0.9240 areas again for possible shorts.

Target: 0.9105 levels

Counter longs from the WS pivot at 0.9105 areas.

Target: 0.9193 and 0.9211 areas.

Notes:

Keep an eye on the 55 EMA for that resistance we want in the short zone.

……………………………………………………………………

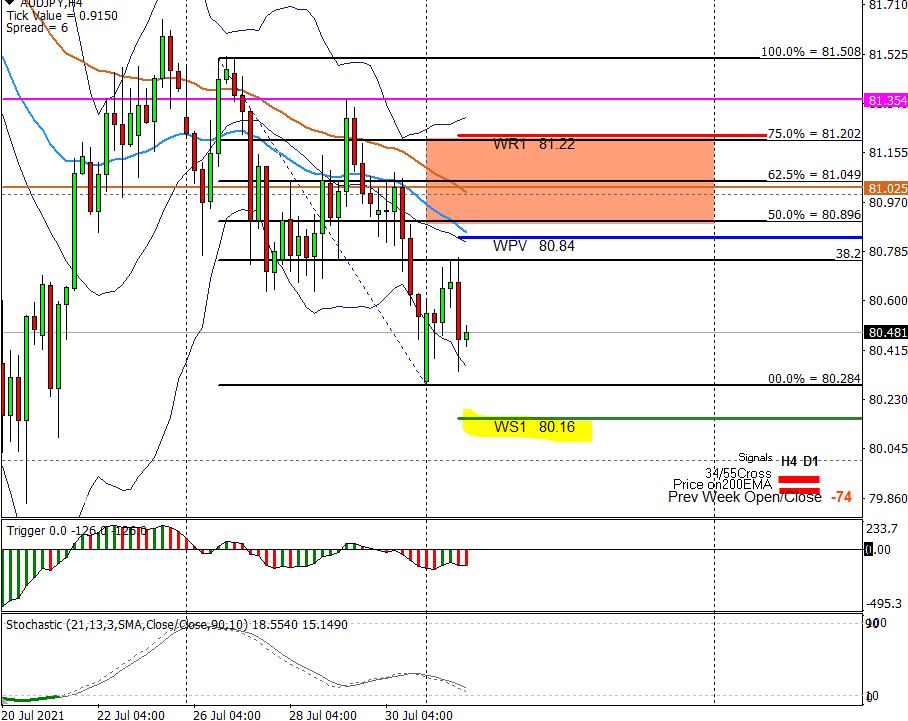

7) Aussie/JPY on the 4 hour chart:

The direction indicator is short on the 4 hour AND THE daily chart and we closed min 74 pips lower than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 80.89 and 81.20 with areas to keep an eye on at 80.89 and 81.00 and 81.22 areas again for possible shorts.

Target: 80.16 levels

Counter longs from the WS1 pivot at 80.16 areas.

Target: 80.84 and 80.89 areas.

Notes:

Keep an eye on the 55 EMA for that resistance we want in the short zone.

……………………………………………………………………

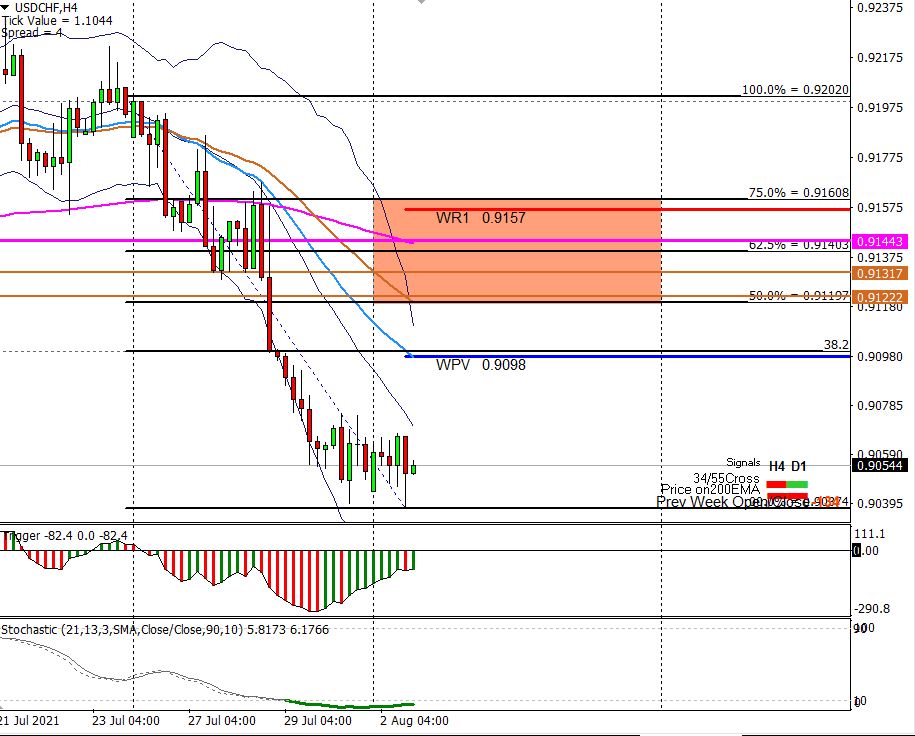

8) Dollar/CHF on the 4 hour chart:

The direction indicator is short on the 4 hour AND THE daily chart and we closed min 134 pips lower than last week`s opening so we did meet ALL of the requirements to fib the 4 hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 0.9119 and 0.9160 with areas to keep an eye on at 0.9122 and 0.9131 and 0.9144 areas again for possible shorts.

Target: 0.9037 and 0.8994 levels

Counter longs from the WS1 pivot at 0.8994 areas.

Target: 0.9098 and 0.9122 areas.

Notes:

If we make new lower lows without the correction follow price with the fib to get the adjusted short zone for the week.

……………………………………………………………………

Happy trading….

Look out for some catch up post this week in the forum.

Pierre

If you would like to learn how to trade like a professional check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below