A suprise by the RBA followed by the FOMC and ECB meetings were the main talking points from a busy news week. The market seems to be at that point where it is sensitive to all data releases as people attempt to extrapolate what the releases mean for future rates – I’ll touch upon the main things to watch out for and the big releases in the week ahead. Ultimately, there are so many variables and unknowns that no one really knows – you’ve got to play what’s in front of you and be guided by the perceived probabilities.

Last week

The big news last week was the FOMC meeting. Rates were hiked by 25bps and a shift in the language and narrative. They dropped the line about anticipating that further hikes would be required. This could signal that they are potentially at peak rates. Bullard, although no longer a voting member, who is usually unwaveringly hawkish, also commented that he thinks that rates are now high enough.

If rates are at peak level, the next thing to look at is the duration time spent at this level. The market is pricing in cuts for the September meeting after pausing for two meetings. There are a lot of data and variables between now and then, but the market is again in opposition to the Fed who pushed back on the potential for cuts in September.

He said:

“We on the committee have a view that inflation is going to come down not so quickly, it will take some time” and “in that world, if that forecast is broadly right, it would not be appropriate to cut rates”

Fedwatch and the Market say . . . going down in September.

The Fed meeting was quickly followed by another hot jobs number with NFP coming in above expectation, unemployment ticking down.

There was also a consumer credit figure released. Although the headline figure was strong coming in at 26.5B vs 17.3B expected, digging a bit deeper it shows that this uptick was fuelled by one of the largest increases in credit card balance. There are a couple of ways to look at this.

- Everything is fine and people feel more comfortable taking on debt due to high employment and stability.

- The use of credit cards is to replace the spending power that has been lost to the increases in interest rates.

I’m currently favouring the latter scenario. The chart below shows credit card balances (blue) vs percentage of lenders tightening credit standards (orange). The green zones are recessions.

Although the data set isn’t very large, the last two recessions have both seen new highs in credit card balances. Also, widespread tightening of lending standards isn’t conducive to sustainable widespread increases in balances.

Other rate decisions were also made last week. The RBA unexpectedly increased rates by 25bps after pausing.

Governor Lowe defended the increases saying “We have seen further evidence that the Australian labour market is still very tight, that services price inflation is proving to be uncomfortably persistent abroad, and that asset prices — including the exchange rate and housing prices — are responding to changes in the interest rate outlook”. What does this mean about the future path? Lowe said that there is no set path and “It will continue to pay close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market. These are important releases to watch ahead of the next meeting.

The ECB also increased rates – there were discussions around either a 25 or 50bps hike. The 25bps was the desired path. Although initially dovish compared to the potential 50bps hike – comments by Lagarde suggested that more hikes were still on the cards, but it did note caution saying that variables like lags were still not fully understood. The next logical step is to have at least one more 25bps hike – as the inflation battle is far from over as noted in Lagarde’s speech. The smaller hike signals that the ECB is in the final stages of it’s hiking cycles – the market will be much more sensitive to data signalling inflation is slowing as this will lead to a quicker pause by the ECB.

The week ahead:

GBP rate decision lands on Thursday with an expectation of another 25bps hike. With CPI staying above 10% since September 2022; the BoE are on course to hike to try and bring inflation under control. GDP for the UK is also released the following day. So far the UK has dodged a technical recession which has somewhat freed the BoE to maintain the course of hikes. The accompanying statement should give an indication on what to watch in the weeks ahead and the potential BoE path.

In the US, CPI is released on Wednesday. This could give an indication on who is right – the Fed or the Market. If inflation remains high, this gives weight to the Fed’s argument that inflation is sticky and rate cuts are not appropriate. If inflation shows a drop, this could play into the markets perceived path of cuts starting in September.

Something else which could play a part in this is a yellow release on Monday – the Loan Officer Survey. Following on from banking stress again seen last week, will there be further tightening of credit standards? This potentially act as a proxy for rate cuts, especially following the large credit increases seen last week – a credit card has a limit, often these are turned into loans. If the loan lending isn’t available the only thing to do (without defaulting) is to cut back spending to finance. This could be the very start of that.

The NZD inflation expectations are one of the last releases of the week. The next Kiwi rate decision is May 24th, and with the RBNZ maintaining a hawkish path – these expectations could play a part in the next rate decision.

Supporting Factors:

DXY

The DXY is attempting to push through the support zone around 101. The major psychological level of 100 is next up where the dollar could find support. The weekly 200ema is at the 99.20 support zone and may offer more chance of support than the 100zone – especially if data releases increase rate cut chances and pushes the dollar through the 100zone.

EXY: Currently in between levels, with resistance above at 111.60 and support below at 109. However the EXY has struggled to break through the weekly 200ema which is the last ema which could offer resistance. A break above this and the 111.60 level could allow for a run up to 115.

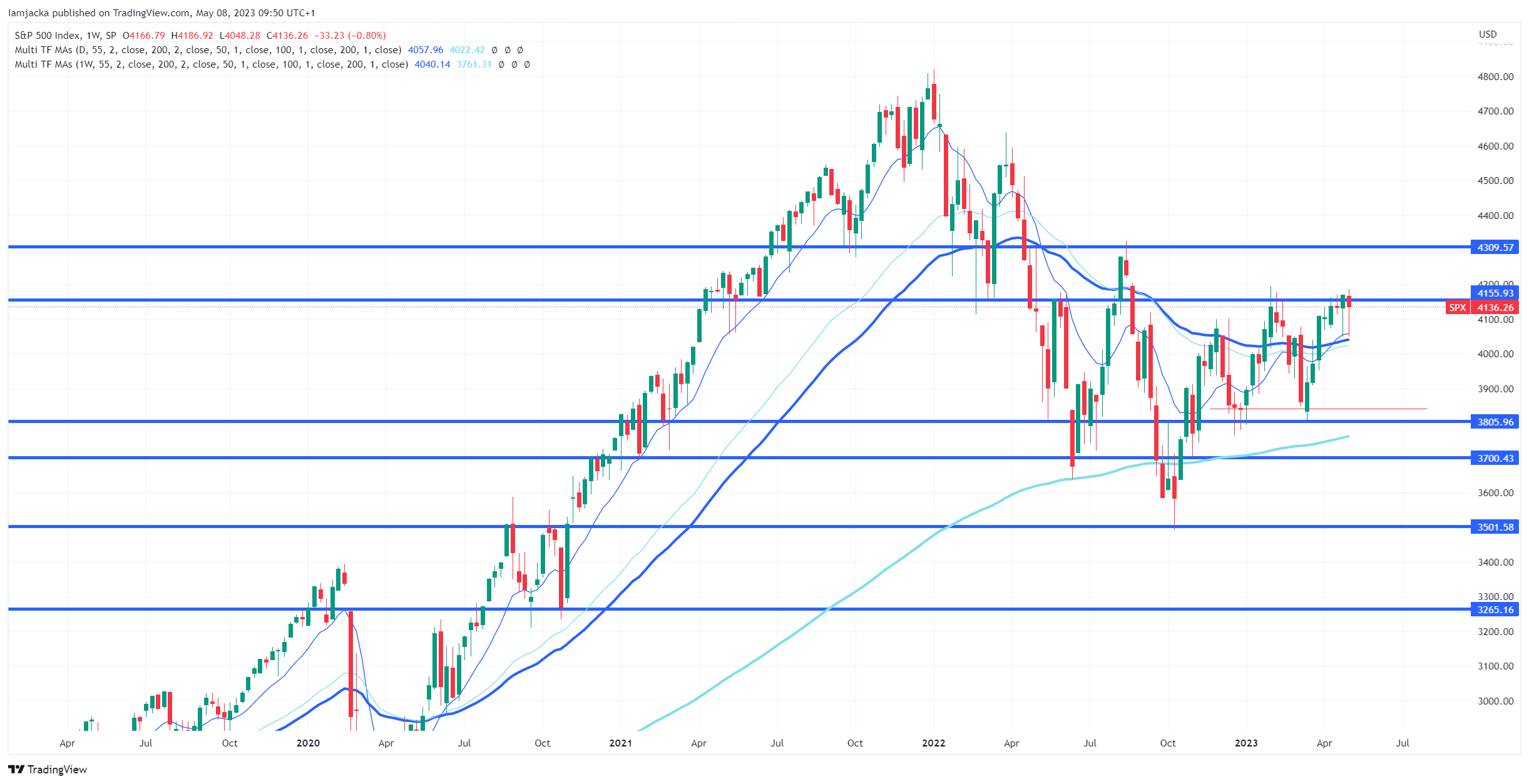

S&P

Due to the correlation with the DXY, the S&P is trying to push through the resistance level. The S&P is sitting above the emas with a rejection of the daily 55/200 and weekly 200ema last week following the perceived dovish FOMC meeting.

Oil: a fall in prices early last week down into reach of the support zone. Prices rallied back on Thursday and Friday. This was the third consecutive weekly decline in oil. There are a few levels of resistance which may hold back any rally without macro factors.

Copper

It has been in a tight range around the $4 mark and the EMA cluster. Last week saw a pretty indecisive market with new factors needed to break the stalemate.

Iron

There was a large drop in iron ore prices. The next area of support is found at 93.00. It also represents a clearing of the strong upside move in late 2022 when the China reopening story first materialised.

Kind regards,

James