Weekly Analysis: DXY to breakout or continue down?

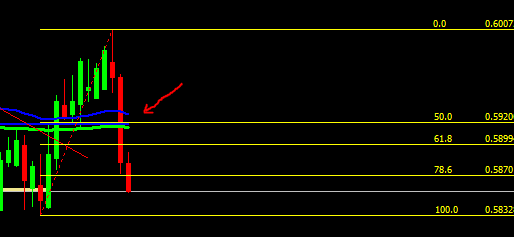

There was a lot of volatility last week; however, we couldn’t trade everything because there was Big news almost every single day. Guessing the news is gambling. A perfect example would be the NZDUSD M2 Long. Technically, this looked good for a long time, but you had the NZD GDP on Wednesday night after FOMC. It tanked because New Zealand’s real GDP contracted by 0.9% in Q2 2025 compared to the previous quarter—significantly deeper than the 0.3% forecast by the RBNZ and consensus expectations of a 0.3–0.4% decline. This marks the third contraction within the past five quarters, continuing a pattern of economic fragility following late-2024 recession.

It has breached the 78.6% fib level, so now it looks attractive for short for the week ahead. I suspect more downside as they are expected to cut earlier than the forecast, which is dovish for the currency.

One more tip is to not jump in right at the open, even if the setup looks attractive. Sometimes it pulls deeper during the night, and the danger of you being in a losing trade at the start of the week. If it is a significant level, don’t worry, you will get a chance during the day.

The DXY has rebounded doing a double bottom for this year, and it is coming into a trendline and Daily 55. To me it is still in a downtrend; however, watch closely, if it breaks that trendline, then we are $ Bullish again.

I recorded the video on Saturday morning. Check to see if Marc Chandler has updated his analysis for next week https://www.marctomarket.com/

The Forex Week Ahead+++++++++++++++++++++++

The week ahead seems fairly reasonable. On Tuesday, all the Manufacturing PMIs are due out so wait until that is clear for EUR and GBP in the morning. Wednesday AUD CPI. CHF Bank rate on Thursday along with US goods data and GDP figures, will be released later in the afternoon. This will likely cause volatility. On Friday Japan CPI, CAD GDP and Core PCE for the US. This week should be more easier to navigate along and make a plan.

++++++++++++++++++

The live training session: Here is a link to register for this week’s live training session. It takes place on Tuesday, 23rd September at 11.00am London time (BST/GMT+1)

https://us02web.zoom.us/webinar/register/WN_dj-ozXnJQwmoNvnrmfG27Q

Then we can have a more detailed, up-to-the-minute look at what’s happening and potential trades for the rest of the week.

MAJORS

I am looking for “A” grade trades from weekly & daily charts that I can place the orders and then just walk away. A “B” grade is of interest, but not an A yet.

As ever, I always look for multiple reasons in a trade. The more you have the higher the probability.

EUR/USD: Watch 1.16500 for a long on the 4HR. I wouldn’t want to long or to short in the current area, as I don’t have 5 reasons.

USD/CHF: One to consider for a short at the daily 55 and trendline, only two reasons so not an A grade.

Do not take the Euro/$ & Chf at the same time. They are correlated so it’s the same “bet.”

GBP/USD: Same thing watch the 4HR, it seems attractive around 1.3470, waiting for a reversal.

AUD/USD:I prefer the counter trend trade at 0.6670.

NZDUSD: Broke the EMAs now looks good for a short at 0.5910

USD/CAD: Needs to have a clear break above the EMAs on a daily to Long or break below the neckline for a short. Both look attractive.

There is also an inverse Head and shoulder on the 4HR , needs a daily candle break to then long, possibly 1:2 risk reward.

USDYEN: Needs a break above 149 for a long. Been consolidating between EMAs for too long.

Some are A grades, where I will place forward orders; some pairs have “areas of interest.” I have a lot of similar crosses, so be very careful with the correlation.

Cross Pairs

EURGBP: 0.8640 for a long worked last week, I would long there again.

NZDCAD: looks attractive for a short at 0.8160, same as NZDUSD.

AUDCAD: attractive for a long in the current area but I will watch this on monday in London or NY session for a reversal.

EURAUD: waiting for a confirmation to short. watch the video

GBPAUD: Waiting for an extra confirmation to short, Daily 200 in the way.

GBPNZD: 2.27500 long worked last week but missed it, will look there again.

GBPCAD: The trend is now bearish, will look to short at 1.8650

I have quite a few other “possibles” that I will monitor during the week. I also have some crypto and stock ideas that I share in the previous post and video..

As always, remember correlation!

New members, please note: If I am looking to take a trade long, for example, 1.5000, I place my order 10 pips above & 10 pips below for a short. This is because price often does not quite reach a major line and you need to allow for spreads.

We are NOT a “tipping service”; we aim to teach you how to trade for yourself.

Watch the video below for more detailed explanations of this week’s analysis and trade plan.

To find out more about our crypto journey, check out the mini-course, and if you want to get involved in what I believe is the next boom, scroll to the bottom of this page to find out more: CLICK HERE

You can watch the full video below, you can read the transcript or view the full screen by clicking the buttons below the video:

Ashley