Last week saw fundamental changes with the US dollar. We can see the rollercoaster of a ride last week by taking a look at the EURUSD.

On Tuesday the JOLTS figures were released. This was as expected, but there was a large downward revision to the previous release. This began to signal some potential underlying weakness in the labour market.

Then somewhat blindsiding the market, there was a downgrade to the US Credit rating by Fitch. Although this has happened in the past, it was somewhat unexpected (but also pretty logical). This had a big impact outside of forex, but the effects could be seen in dollar strength.

Paradoxically, this caused the dollar to temporarily gain strength, why?

So, there is a huge pot of money with very little risk appetite. AAA rated bonds were perfect for these – there were no better rated instruments from a credit rating point of view. So this pot of money made up of low risk appetite was happy knowing that they’ve told their investors “we only have the lowest risk – but with this low risk you get a slightly lower yield – but it’s AAA rated”. Then along comes Fitch and says “nope, due to the bickering about the debt ceiling and all the political turmoil we think there is a bit more risk involved so we are downgrading you to AA+”

The US treasury called it arbitrary, and to some extent it is, but in practice it means that

- The big pot of money sitting is now no longer invested in the lowest risk asset which mean it has to be moved

- The argument that it’s low risk but slightly less yielding is dead. People don’t want more risk for the same yield so people will want to move it.

So what are the steps for this big pot of money and how does it impact the forex market? Well you sell the bonds – in effect – swap the bonds for US dollars so you can reallocate it somewhere else. This demand for dollars artificially strengthened the US market.

In the middle of this, there was also the ADP employment news – this did legitimately boost dollar strength as the negative JOLTs was cautiously countered by strong ADP.

Thursday saw the ISM Services which missed expectation – although still in expansion territory it missed expectation and may be pointing to a slowdown. Breaking this down there was a slight drop in new order and business activity, but there was the biggest drop in employment. From 53.1 to 50.7. This is just above contraction territory and contraction in relation to jobs means unemployment.

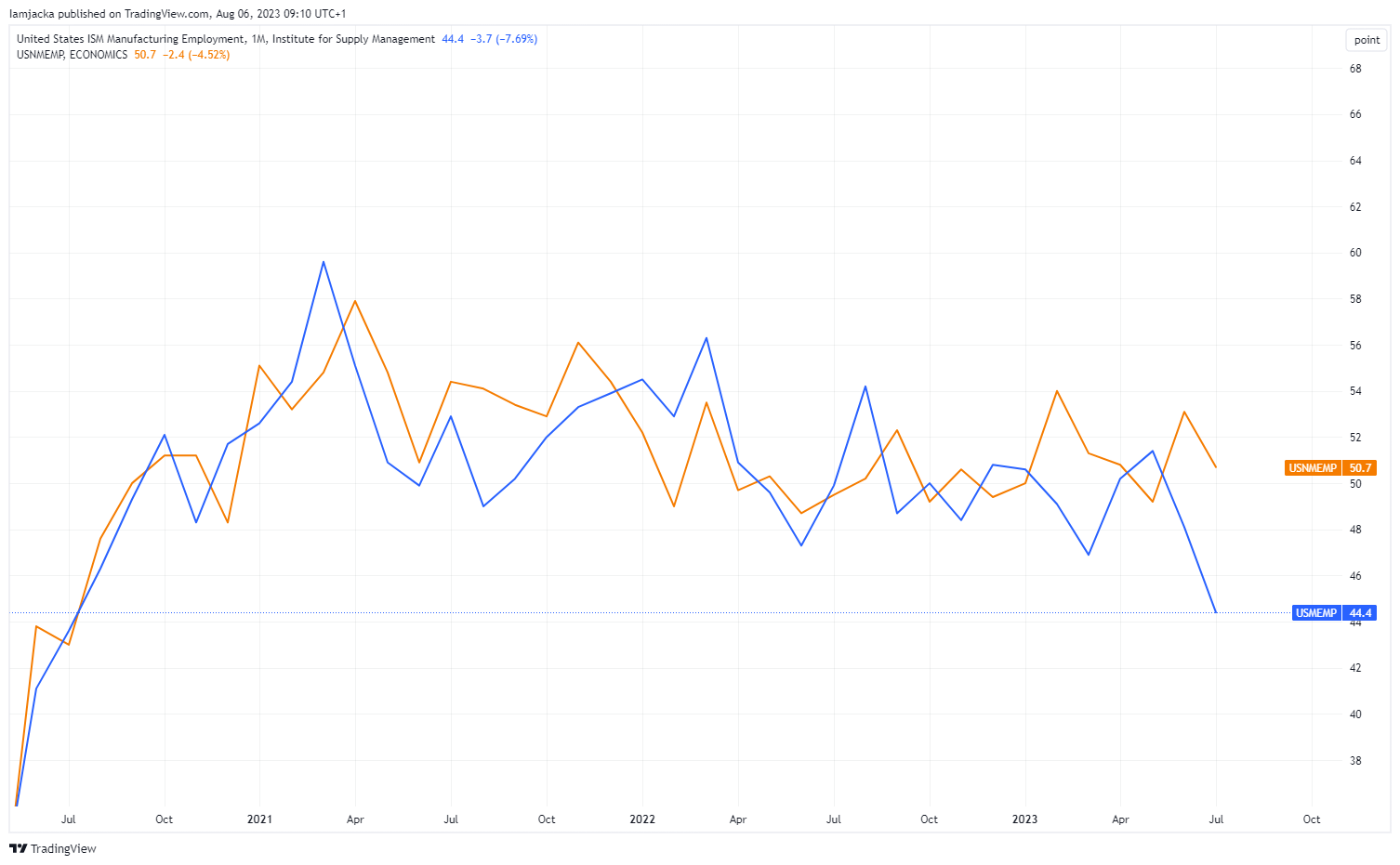

The picture is worse when combined with the manufacturing jobs number.

The manufacturing ISM numbers are the lowest since July 2020 when employment numbers were coming off the COVID lows.

Historically, +/-20k isn’t anything to write home about for NFP but let’s look at it in context to the past 12months.

Notice anything? This is the first month where not only has there not been a significant beating of expectation, it significantly underperformed which rounded off the week with a dollar sell off and setting up next week with a very bearish tone.

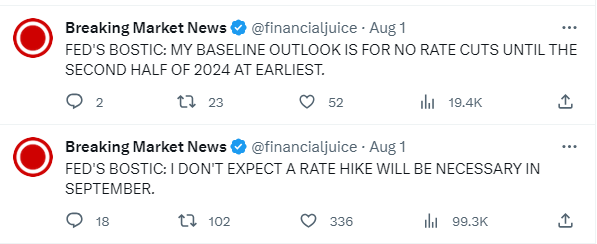

There were also some bearish comments coming from fed members throughout the week which further weighed on the dollar. Although you can sometimes get blinded by every piece of news and comment that’s made, I think it is good to look at the overall tone and sentiment at the end of the week. Bostic started the week particularly bearish:

Source: Forexfactory

Elsewhere, there were two central bank meetings.

The RBA unexpectedly held rates unchanged and the comments from Gov. Lowe implied that the tightening is bringing inflation back down to target within their timescales but he left the door open to further hikes if inflation tick up. This firmly puts all eyes on the next inflation figure coming out of Australia.

The next inflation measures are

- Wage Price Index (Aug 15)

- CPI (Aug 30)

- Commodity Prices (1 Sept)

There is a big gap between now and then, so I would expect the technical levels to be key and to drive the market until we get a clearer picture following the inflation figures.

In the UK the BoE raised rates in line with expectations. Looking at the voting – it was more of a bullish shift, potentially pointing to signs that there could be at least one more rate hike in the pipeline. All meetings this year have seen a vote split of 7 in favour of a hike, 0 in favour of a cut and 2 in for holding rates. The release showed that either Dinghera or Tenreyro switched from holding rates to voting for a hike. There were also 2 votes for a 50bps hike with the remaining hikers voting for 25bps. At a time when the BoE could be nearing peak rates, a hawkish shift leaves the door wide open for additional hikes to come.

Overall the week showed a bearish leaning for both the USD and AUD, and a tentatively bullish leaning for the GBP – at least sentiment wise but that doesn’t always translate into price, which is why the technicals are important.

Next week:

The biggest news of the week should be the CPI and PPI release on Thursday and Friday. Further signs that inflation is slowing, should see more weakness in the dollar. The DXY supports the idea of starting the week on a bearish note.

The weekly shows a rejection of the 78% fib level which coincided with the 103 level and just below a cluster of moving averages. Moving towards the 101 support level I think a weak number for the CPI will see a break towards the recent lows and the 200EMA.

Inflation figures for the NZD may cause some action in the NZD pairs, and growth data from the UK may give more clues following the hawkish bank votes. The argument that the recent negative GDP reading was due to bank holidays and the coronation of the King will be put to the test with an expectation of 0.2% MoM growth. If GDP meets or beats expectations, I would expect to see the GBP strengthen on the potential of more hikes.

Tuesday has some yellow news which may be significant –

Source: forexfactory

Seeing positive moves in these, especially coupled with the bearish dollar may put the USDJPY under pressure however BoJ protection of the tweaked YCC may come into play.

Have a good week everyone!

James