The last meeting for both the Fed and ECB before the summer breaks were pretty much as expected and with no meeting next month, it’s all on the markets interpretation of the data. A break until the end of September will give the recent actions time to work through the system and be reflected in the data, but that won’t stop the market making predictions using every data point that is released between now and then.

Overall, the majority of the announcements happened as expected so lets recap.

Fed hiked by the expected 25bps

There are a lot of data releases between now and the next meeting, but there was certainly no indication that another hike in September was a done deal. Powell suggested that the September meeting action would be guided by the economy – this data led decision clearly puts a lot of focus on the data releases during August and September.

Thing of note from the announcements were

- Inflation is still too high – reiteration of 2% target

- The strength of the labour market

- Further hikes “may be appropriate”

What could this mean?

Although there is a lot of data between now and the next FOMC meeting, but as we are in a delicate balance, a high or low data point may be jumped on by the markets.

Initial clues may begin this week:

Tuesday:

ISM Manufacturing + Prices (both growth and inflation)

JOLTS (labour market)

Wednesday:

ADP Non-Farm Employment Change (Labour Market)

Thursday:

Unemployment Claims (Labour Market)

ISM Services PMI (Growth but also contains a little inflationary indication)

Friday:

Average Hourly Earnings (labour market)

Non-Farm Payroll (Labour market)

Unemployment Rate (Labour market)

There are certainly some items here which may move the market – however, employment and the labour market have been very resilient and not too rate sensitive – therefore a higher reading in these may not change. The ones I will be interested in are the items which have an inflation element such as the PMIs and the ISM Prices – but as ever NFP is a big market mover and can easily send price whipsawing up and down; it often comes with too much risk to hold through the announcement.

The ECB hiked by the expected 25bps

The ECB also hiked as expected. There have been times this year when Christine Lagarde has signalled that there will be a rate increase at the next meeting. This time, there was no pre-commitment to a hike in September but the door was fully open to hike, but equally to pause.

Lagarde and members have previously said that the risk of stopping too soon is bigger than hiking too much; however the recent data on economy painted a very poor picture with certain metrics down around the 2008 GFC levels.

Lagarde did say that inflation was coming down but remained elevated – does this indicate that unless there is a drop off in inflation, then there will be at least one more hike. . . and is the downturn in the economy to these levels the so called ‘hiking too much’ risk and ultimately is it one that Lagarde is willing to accept?

EUR Data this week:

Monday saw the release of the CPI Flash estimates. These are the most timely (but least accurate) of the CPI prints. CPI Flash and Core came in at 5.3% and 5.5% respectively.

Prelim Flash GDP, again the most timely but least accurate, showed an uptick in growth at 0.3% vs 0.2% expected and a previous (revised down) figure of -0.1%.

PMIs are all released this week and may give clues, especially in the breakdown figures, about where the risks and opportunities lie. Inflation again is the key variable, but at what point does economic pain become too much?

BoJ YCC tweak.

Although there as no change to the BoJ’s policy rate, there were the green shoots of change in a tweak to the YCC. The BoJ raised the ‘strict’ cap on yield from 0.5% to 1% on 10yr gov bonds.

Inflation also rose in Japan, which at 4% (core) is the highest since the early 1980’s. The BoJ would need to be sure that inflation was driven by the correct factors before making any policy tweaks, but all of the underlying conditions are there setting up for a policy shift in the future.

Elsewhere this week:

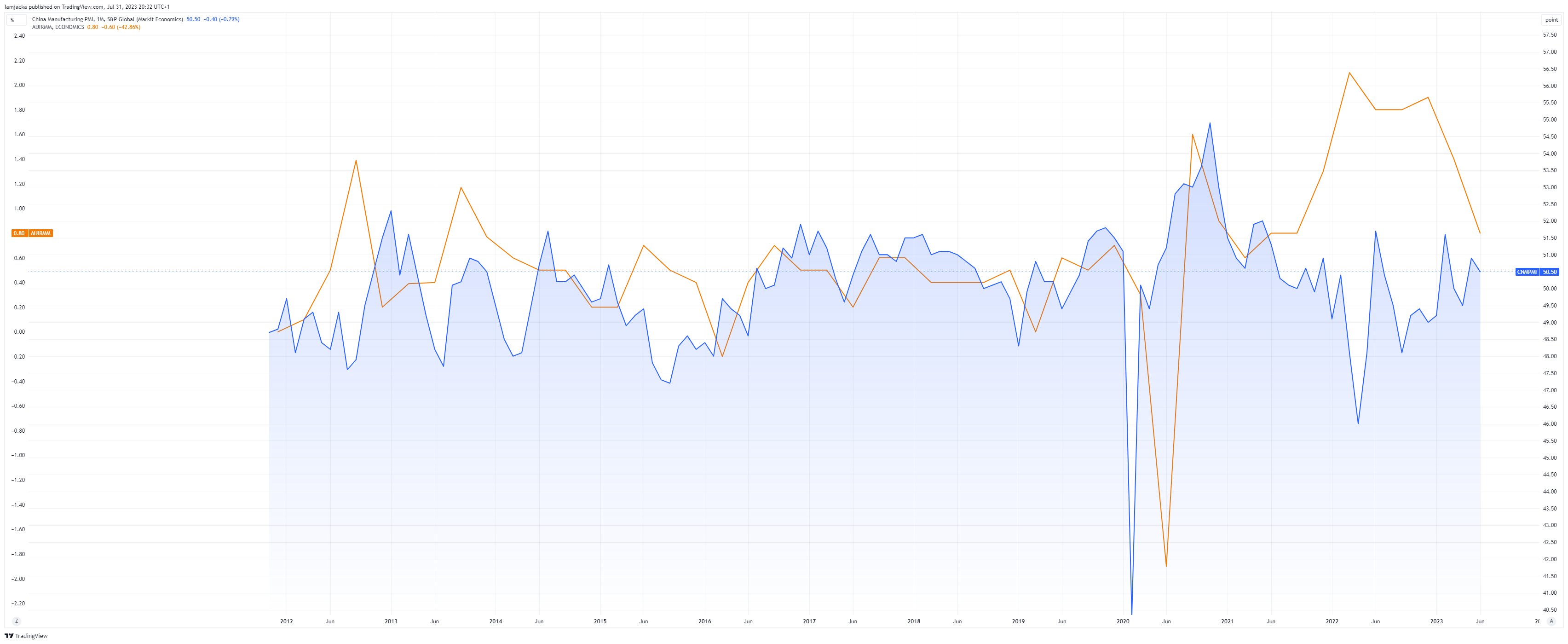

Australia – The RBA rate announcement is early Tuesday morning (UK Time) with an expectation of a 25bps hike. With a slight uptick in Chinese manufacturing which is somewhat correlated to Australian inflation (see below), as well as a very tight labour market with strong wage growth the consensus of 25bps is baked into price, but with inflation cooling pretty quickly, it could be a dovish hike – and a small chance of no hike which would cause a pretty big market reaction.

The Bank of England are due to meet and announce their rate on Thursday. Last time out they surprised the majority of the market with a 50bps hike. Since then data has shown that inflation has cooled, however that 50bps will not have had time to work through the system. We may still be a few weeks away from seeing the extent of the 50bps hike. There have been some comments made which suggest another 50bps hike is on the cards, but the majority seem to expect 25bps.

Wage growth is pretty strong in the UK and although inflation has cooled, it is still high compared to all of its peers.

The voting on rate decision was 7 in favour of a 50bps hike, vs 2 for a pause. With this overwhelming swing from 25bps, to 50bps last time it is very unlikely that the voting will be moving from 50bps to unchanged.

The DXY and the EXY

The DXY has recently broken to new lows and is continuing to form lower highs and lower lows. It has recently rejected a dip below 100, but with rates potentially at their peak it could give headwinds to any DXY strength. Weekly chart . . .

On a lower timeframe, the push down and subsequent rejection has brought price into a recent broken support, and the 61.8% fib retracement zone and the daily 55ema. If this is coupled with bearish news this week, we could see the DX falling to new lows and again retesting below 100.00. Daily chart . . .

EXY

The EXY (weekly show below) is pretty much the exact opposite. It is forming higher highs and higher lows. The recent push to new recent highs was met with a small pushback which has brought it it the daily 55ema.

Other things to keep an eye for this week is more details on a stimulus package coming out of China to help boost spending. With the aim on boosting ‘light industry’ consumer packaged goods, consumer durables, sports and leisure equipment, and light industrial machinery as well as pushing local governments to push forward with more events such as sport and music festivals. With this increased consumption, often comes more imports from New Zealand, and depending on the stimulus package, potentially Australia.

Link to our previous post

Kind regards,

James