Another eventful week fundamentally…. there was: ‘Red-hot’ US Jobs data out on Friday as well a US debt ceiling deal. The strong dollar of course, putting pressure on gold and many other asset classes. Surprisingly enough, not Bitcoin.

This week I thought I’d give you guys a breakdown of Forex seasonality.

Forex seasonality refers to the recurring patterns or trends in the foreign exchange market that tend to occur at specific times of the year. These patterns are often influenced by factors such as economic cycles, geopolitical events, and market participant behaviour etc.

‘Traditional’ seasonality trends include

Month-based Seasonality: Certain months tend to exhibit consistent patterns in forex markets. For example:

-January Effect: Historically, January has seen strength in currencies like the U.S. dollar and Japanese yen as investors return from holidays and engage in portfolio rebalancing.

-Summer Lull: During the summer months, trading volumes may decrease, leading to lower volatility and potentially slower price movements.

Quarterly Seasonality: Some seasonal trends occur on a quarterly basis:-

-End of Quarter Flows: Institutional investors, such as hedge funds and mutual funds, often engage in portfolio rebalancing at the end of each quarter. This can lead to increased volatility and potential currency movements.

Economic Calendar Events: Forex seasonality can also be influenced by specific economic events that occur annually:

-Central Bank Meetings: Monetary policy decisions and interest rate announcements by central banks tend to have a significant impact on currency values. These events often occur at regular intervals and can create short-term trends.

-Holiday Periods: During holidays, market participation may decrease, leading to lower liquidity and potentially more volatile price movements.

Annual Patterns: Certain annual events can impact forex markets:

-Tax Seasons: Tax-related activities can influence currency flows, especially in countries with significant foreign investments or cross-border trade.

-Year-End Repatriation: At the end of the fiscal year, multinational corporations may repatriate funds, which can impact currency exchange rates.

Just a basic example, there are many many more online.;

What are some Forex seasonality resources available to you?

-Forex Research Reports: Many financial institutions, banks, and forex brokers publish regular research reports that include analysis of seasonal patterns in the forex market. These reports often provide historical data, charts, and commentary on seasonal trends. Examples include reports from major banks like JPMorgan, Barclays, and Deutsche Bank.

-Economic Calendars: Economic calendar websites, such as Forex Factory and Investing.com, provide a schedule of upcoming economic events and announcements. These calendars often highlight events that are known to have a seasonal impact on currencies, such as central bank meetings and important economic data releases.

-Forex Analytics Websites: Websites like DailyFX, FXStreet, and BabyPips offer educational resources, market analysis, and trading tools. They often include articles, forums, and blog posts discussing seasonal trends and patterns in the forex market.

-Trading Platforms and Tools: Some forex trading platforms and charting software offer built-in features and tools to analyse seasonality. These tools may provide historical data, charts, and indicators specifically designed to identify seasonal patterns.

-Academic Research: Academic studies and papers can offer valuable insights into forex seasonality. Platforms like Google Scholar or research databases like JSTOR and SSRN can help you find relevant research articles on the topic.

Let’s look at some other key charts.

DXY chart:

Price moved away from that big 100-102 zone. Also managed to break above the 200 on Friday.

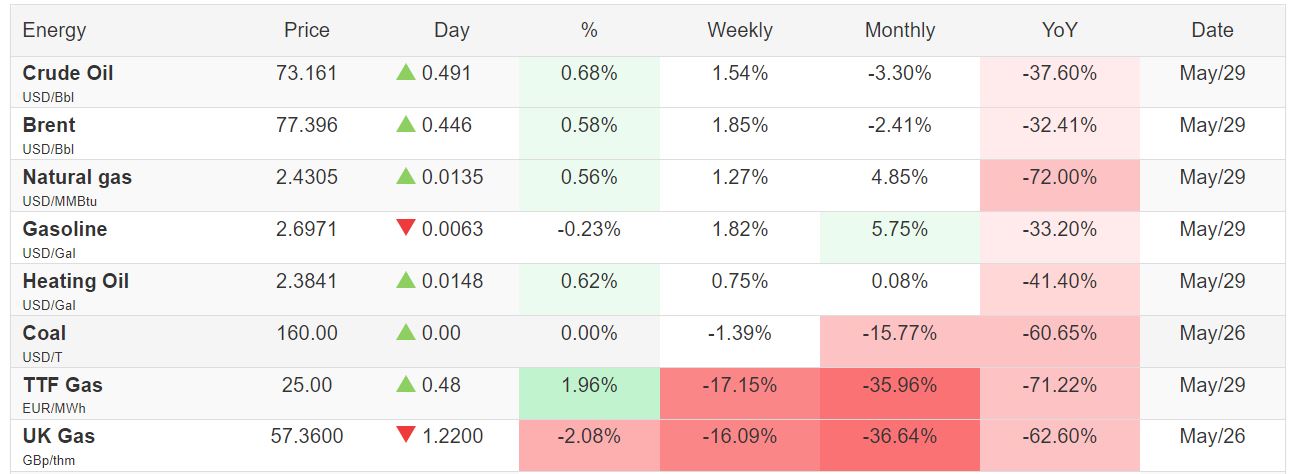

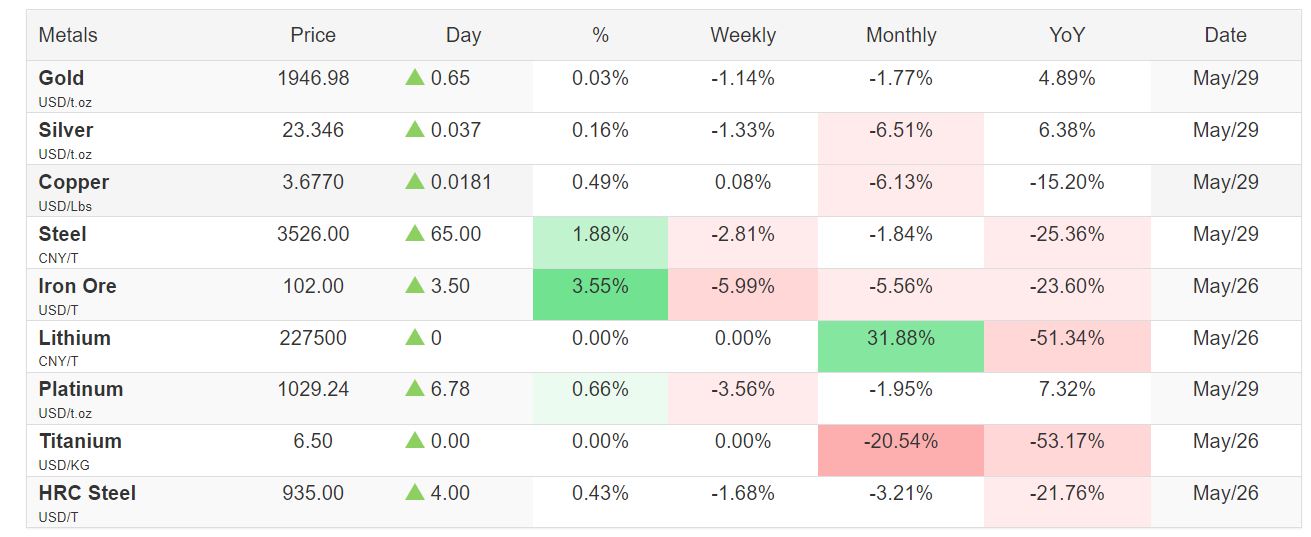

Energy & Metal Prices;

Gold;

Big retracement from the previous all time high. Pressure on Friday due to a stronger dollar.

Oil;

Still at a big area.

Bitcoin;

31000 is a big area. A break above could mean an extended move up. Interestingly it didn’t ‘really’ sell off on Friday.

+++++++++++++++++++++++++++++

You can also follow us on Twitter https://twitter.com/marcwalton

+++++++++++++++++++++++++++++

Red flag news:

Interest rate news from Canada on Wednesday!

++++++++

MAJORS

EUR/USD: Long from 1.0700 BUT I need to see Bullish signs. *See video.

USD/CHF: Short from 0.9300

GBP/USD: Long from 1.2300 *Same theory as the EUR/USD.

AUD/USD: 0.6800 is key *See video.

NZD/USD: Short from 0.6200

USD/CAD: Looking to long from 1.300 (A-grade). If it breaks below 1.3360, I’d look for shorts.

USD/JPY: Long from 136.60

CROSSES

EUR/GBP: Short from 0.86500

EUR/AUD: Long from 1.5800

EUR/CAD: If it breaks below 1.4300, I’d look to short.

AUD/CAD: 0.9100 for a short.

GBP/CAD: Looking to short if it breaks below 1.6700

GBP/CHF: Short from 1.130

AUD/NZD: Long from 1.085

NZD/JPY: 84.40 is my line in the sand. *See video.

As always, remember correlation! -Especially when taking more than one JPY trade!

M3 -Shorter timeframes.

I do my analysis on daily and weekly charts first and make a note of the MAJOR areas of support and resistance. Then copy them onto Pierre’s Earth and sky template. Then I make a note of the weekly & monthly pivots points and add them to the charts. You will see lots of opportunities line up during the week. The important thing then is to select a bias for the next few days and do NOT take trades if the price is too near a trend line or pivot. Ideally, you want to buy when the price is near a major support and or pivot point line and has the potential to make at least 40 pips. Vice versa for a short.

New members, please note: If I am looking to take a trade long, for example, 1.5000, I place my order 10 pips above & 10 pips below for a short. This is because price often does not quite reach a major line and you need to allow for spreads.

We are NOT a “tipping service” our aim is to teach you how to trade for yourself.

Watch the video below for more detailed explanations of this week’s analysis and trade plan (click the 4 arrows bottom right to view full-screen):

Regards

Thinus